AI for plan-to-results (P2R): Scope, integration, use cases, challenges and future outlook

Listen to the article

Plan-to-results is a critical component of financial operations, encompassing functions such as strategic planning, budgeting, forecasting, and performance management. Efficient execution of these processes ensures that corporate strategies translate into actionable plans and measurable outcomes. However, traditional plan-to-results frameworks often face challenges like outdated forecasts, manual variance analysis, and disconnected data systems, which can impede timely decision-making and overall financial performance. As financial operations become more complex, these challenges intensify, necessitating more robust and dynamic solutions.

AI is rapidly transforming plan-to-results by automating workflows, reducing manual effort, and enhancing data integration. A recent Gartner survey revealed that 58% of finance organizations already leverage AI to improve forecasting accuracy and streamline budgeting processes, while 80% of CFOs plan to increase investments in AI over the next few years. These figures underscore AI’s growing role as a cornerstone of modern financial strategies, helping organizations update forecasts in real-time, perform variance analysis automatically, and maintain a unified data source for better decision-making.

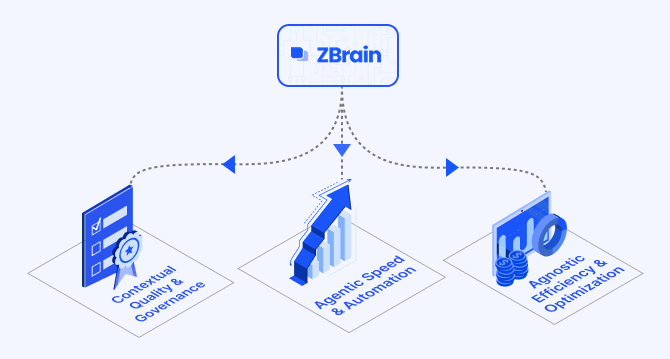

As AI adoption accelerates, platforms like ZBrain play a pivotal role in integrating AI into plan-to-results workflows. By automating forecasting, optimizing budgeting processes, and streamlining variance analysis, ZBrain enables organizations to enhance operational efficiency and financial performance. Beyond automation, ZBrain assesses AI readiness within financial operations, identifies opportunities for process optimization, and delivers tailored AI solutions to improve accuracy and speed.

This article explores how AI is transforming the plan-to-results process in financial operations, driving efficiency, and improving strategic outcomes. It also highlights how platforms like ZBrain empower businesses to harness AI-driven automation for faster, error-free planning and superior financial performance in an increasingly competitive landscape.

- What is plan-to-results, and why is it important?

- Understanding the stages of the plan-to-results process

- Transforming plan-to-results: How AI solves traditional challenges

- Approaches to integrating AI into plan-to-results

- AI applications transforming plan-to-results

- Why ZBrain is the ideal platform for plan-to-results operations

- Benefits of implementing AI in plan-to-results operations

- Measuring the ROI of AI in plan-to-results

- Challenges and considerations in adopting AI for plan-to-results operations

- Best practices for implementing AI in plan-to-results

- The future of AI in plan-to-results

- Transform plan-to-results operations with ZBrain

What is plan-to-results, and why is it important?

Plan-to-results (P2R) is a structured framework that connects strategic planning with operational execution and real-time performance measurement. It ensures that organizations—whether in finance, supply chain, project management, or enterprise performance management (EPM)—align their long-term goals with day-to-day actions. By continuously comparing planned objectives with actual outcomes, P2R helps businesses identify gaps, reallocate resources effectively, and maintain focus on long-term targets.

Key components of P2R include:

-

Goal setting and strategic alignment:

P2R begins with defining clear, strategic objectives that cascade throughout the organization. This ensures that every department shares a common roadmap, aligning high-level goals with operational plans. -

Resource forecasting and execution alignment:

By forecasting resources and aligning execution plans, organizations can prevent bottlenecks and adjust to changing market conditions swiftly. This proactive approach optimizes resource utilization and mitigates potential risks. -

Performance tracking and feedback loops:

Real-time performance measurement and regular checkpoints allow teams to monitor progress against goals. Feedback loops facilitate continuous refinement of plans, ensuring data-driven decisions and ongoing process improvements. -

Transparency and accountability:

A well-implemented P2R framework promotes clear communication of objectives and responsibilities. This transparency builds trust across the organization and ensures that all stakeholders remain accountable to the plan.

Plan-to-results is important because it aligns organizational objectives with execution, optimizes resource utilization and mitigates risks, drives data-driven decisions and continuous improvement, and enhances transparency and accountability. By incorporating AI-driven automation, organizations can transform their planning processes into agile, responsive systems that deliver superior financial outcomes.

Understanding the stages of the plan-to-results process

The plan-to-results (P2R) cycle serves as a comprehensive, closed-loop management framework designed to guide organizations from planning to continuous improvement, ensuring strategic goals are effectively executed. Evaluating the P2R cycle through a finance lens reveals its critical role in achieving operational alignment, improving performance, and delivering sustained value.

1. Strategic planning and preparation

Effectiveness in finance: In the financial domain, the planning stage serves as the cornerstone for aligning organizational resources and setting expectations for revenue generation, cost management, and profitability. The financial planning process involves creating forecasts, setting budgets, and establishing financial goals. Key considerations include:

-

Budget creation and resource allocation: Financial strategies often include defining department budgets, controlling expenditures, and ensuring funds are allocated based on priority and expected return on investment. This stage directly impacts the financial health of an organization and lays the foundation for how finance teams operate and manage resources throughout the year.

-

Risk management: Identifying potential financial risks (e.g., market volatility, regulatory changes, or cash flow disruptions) ensures proactive planning and risk mitigation, which is critical for financial stability and compliance.

-

Stakeholder alignment: Ensuring that financial targets and assumptions are aligned across the organization, from board members to department heads, is crucial in promoting a cohesive strategy. The finance function must work closely with other departments to ensure that revenue projections, cost expectations, and cash flow assumptions are realistic and agreed upon.

Contribution to operational alignment: Strategic financial planning enables all departments to operate within clearly defined financial parameters. For instance, sales and marketing can align their activities with budget constraints, and production can manage costs based on realistic expenditure forecasts. Clear financial goals also help ensure alignment in corporate decision-making across the organization.

2. Execution (Implementation) of plans

Effectiveness in finance: During the execution stage, financial planning transitions from theory to action. Here, finance plays a critical role in monitoring actual performance against budgeted targets. This phase includes:

-

Resource management and tracking: The finance function is responsible for ensuring that funds are available as needed for operational activities, tracking expenditures, and managing cash flow. For instance, cash flow forecasting helps businesses ensure they can meet short-term obligations while maintaining liquidity.

-

Financial controls and compliance: Ensuring the organization adheres to financial regulations, internal controls, and budgeting constraints during execution is vital. It also includes managing the financial operations (e.g., accounts payable and receivable, payroll) while maintaining control over spending.

-

Communication and collaboration: Finance teams work closely with other functions (e.g., marketing, operations, and HR) to monitor how actual financial performance compares to the plan. Communication of budget deviations and operational impact is critical.

Contribution to performance improvement: The execution phase allows finance to intervene and adjust the budget when necessary. If costs begin to exceed forecasts or revenues fall short, the finance team can assess the situation and recommend corrective actions (e.g., cost-cutting measures, reallocation of funds, or additional investments in key growth areas).

Contribution to operational alignment: The finance function’s ongoing support ensures operational alignment. By providing real-time financial insights and updates on budget performance, finance teams help other departments understand their financial limitations and opportunities. This ongoing alignment facilitates smooth day-to-day operations as teams adjust activities according to available resources.

3. Monitoring and control

Effectiveness in finance: The monitoring and control stage is crucial for tracking financial performance against strategic objectives. This stage ensures that variances are quickly identified and corrective actions are implemented. Key components in the financial context include:

-

Real-time performance tracking: Financial performance is continually monitored using KPIs (e.g., profitability, liquidity, return on investment) to compare actual figures against planned budgets. Dashboards and reporting tools can help finance teams track these metrics and make adjustments when deviations occur.

-

Variance analysis: Finance teams regularly perform variance analysis to assess whether costs, revenues, and profits align with the budget. Significant variances can prompt deeper analysis and adjustments to strategies or operational processes.

-

Corrective actions: In cases where discrepancies arise, finance teams recommend corrective actions such as reallocating resources, reducing costs, or taking proactive measures to improve cash flow. For instance, if a company exceeds its operating expenses, the finance team may suggest renegotiating contracts or delaying non-essential investments.

Contribution to continuous value delivery: The control function ensures that financial goals remain on track throughout the year. This vigilance in monitoring prevents wasteful spending and optimizes the use of resources, thereby safeguarding financial value. Effective monitoring is also essential for avoiding financial crises or compliance issues.

Contribution to operational alignment: Continuous monitoring enables finance teams to provide timely information on the organization’s financial state, ensuring that all departments stay aligned with the budget. For instance, if unexpected financial issues arise, finance can alert other departments, such as sales or production, to adjust their activities accordingly.

4. Evaluation and reporting

Effectiveness in finance: At this stage, the finance function plays a critical role in providing formal assessments of the organization’s financial performance, comparing actual results with planned budgets. This involves:

-

Performance measurement: Finance evaluates how well the organization has achieved its financial goals, such as profitability, revenue growth, and cost control. Performance reports often include income statements, balance sheets, and cash flow statements that provide insights into financial health.

-

Root cause analysis: When discrepancies between plan and actual performance arise, finance conducts root cause analysis to identify why certain financial targets were missed. For instance, low revenue may be due to poor sales performance or external factors like market downturns, and finance must assess these variables.

-

Stakeholder communication: Financial reports are shared with internal stakeholders (management, board members) and, in some cases, external stakeholders (investors, regulators). Clear, transparent reporting builds trust and informs future decision-making.

Contribution to operational alignment: Evaluating financial performance ensures that the company meets its objectives and, if not, provides actionable insights to recalibrate operations. For example, if a product line underperforms financially, finance can work with marketing and production to adjust pricing strategies or shift resources.

5. Continuous improvement (Adaptation and feedback)

Effectiveness in finance: Continuous improvement is a cornerstone of long-term financial health. The financial team leverages insights gained during the evaluation phase to improve future plans and operations. Key aspects include:

-

Refining financial strategies: Based on lessons learned, finance may adjust budgeting methods, improve forecasting techniques, or incorporate new financial tools to enhance the accuracy of future financial plans.

-

Optimizing financial processes: Finance teams continually refine processes such as cost management, capital allocation, and financial reporting to improve efficiency and reduce costs. This can also involve embracing technology such as automation or AI for routine financial tasks.

-

Institutionalizing learning: As financial challenges and opportunities arise, finance teams use feedback to strengthen governance frameworks, enhance risk management practices, and embed financial best practices across the organization.

Contribution to performance improvement: By institutionalizing financial improvements and ensuring that lessons learned inform future strategies, finance contributes to ongoing performance enhancement. This learning cycle ensures that the financial operations become more agile and adaptable to changing conditions, fostering a culture of continuous value creation.

Contribution to operational alignment: Continuous improvement in the financial domain also helps align operations with strategic goals. As financial tools, techniques, and processes evolve, they provide departments with better forecasting, real-time data, and insights, helping them make more informed decisions that align with financial objectives.

The plan-to-results cycle plays an integral role in organizations’ financial management by ensuring that each stage contributes to operational alignment, performance improvement, and continuous value delivery. By providing a structured approach to planning, execution, monitoring, evaluation, and improvement, P2R enhances financial oversight and decision-making.

-

For small organizations, the P2R cycle provides a streamlined, clear structure to ensure that limited resources are used effectively. The emphasis on monitoring and control can help smaller organizations avoid costly missteps.

-

For larger organizations, the P2R cycle scales well, particularly in managing complex financial processes, tracking multiple revenue streams, and adjusting strategies across diverse business units.

In both contexts, effective execution and continuous adaptation foster financial agility, enabling businesses to meet their financial goals while driving growth and stability.

Transforming plan-to-results: How AI solves traditional challenges

The plan-to-result (P2R) framework ensures organizations move seamlessly from strategic planning to execution, monitoring, evaluation, and continuous improvement. However, traditional P2R approaches often suffer from inefficiencies due to manual workflows, siloed data, and slow decision-making. AI-driven automation, predictive analytics, and real-time monitoring transform each stage by enhancing accuracy, agility, and strategic alignment.

Below is a structured breakdown of how AI optimizes the P2R process:

|

Stage |

Step |

Challenge |

Impact of traditional methods |

How AI helps overcome the challenge |

|---|---|---|---|---|

|

Strategic planning and preparation |

Set objectives and goals |

Static goal-setting |

Lacks adaptability to market changes. |

AI-driven forecasting analyzes real-time trends to refine goals dynamically. |

|

|

Conduct analysis |

Manual data collection |

Slow and lead to incomplete insights. |

AI automates data aggregation and applies predictive analytics for deeper insights. |

|

|

Allocate resources |

Inefficient planning |

Leads to budget misallocation. |

AI-powered optimization models dynamically allocate personnel, budgets, and technology. |

|

|

Ensure stakeholder alignment |

Delayed reporting |

Causes misalignment between teams. |

AI-driven dashboards provide real-time insights, ensuring better cross-functional collaboration. |

|

Execution (Implementation) of plans |

Translate plans into actionable workflows |

Rigid manual workflows |

Slow to adjust and adapt. |

AI-powered workflow automation dynamically adapts based on progress and dependencies. |

|

|

Assign responsibilities and timelines |

Inefficient workload distribution |

Creates bottlenecks and delays. |

AI optimizes task allocation based on expertise and availability. |

|

|

Manage resources and track progress |

Static tracking |

Leads to resource shortages or underutilization. |

AI continuously monitors resource availability and dynamically reallocates as needed. |

|

|

Maintain operational alignment |

Siloed execution |

Causes inconsistencies across teams. |

AI-powered coordination tools synchronize execution across departments. |

|

Monitoring and control |

Establish tracking mechanisms |

Delayed monitoring |

Relies on outdated manual reports. |

AI-driven dashboards provide real-time KPI visibility. |

|

|

Collect real-time data |

Fragmented systems |

Hinder visibility and decision-making. |

AI integrates data from multiple sources for proactive issue detection. |

|

|

Identify variances |

Reactive variance analysis |

Delayed identification of budget overruns, schedule slips, and quality issues. |

AI-powered anomaly detection highlights deviations early, preventing cost overruns. |

|

|

Apply corrective actions |

Manual issue resolution |

Leads to delays and inefficiencies. |

AI suggests and automates corrective actions dynamically. |

|

Evaluation and reporting |

Compare plan vs. actual |

Manual performance reviews |

Leads to inaccurate assessments. |

AI-driven analytics provide real-time performance tracking. |

|

|

Root cause analysis |

Focus on symptoms not causes |

Prevents long-term improvements. |

AI applies machine learning to detect root causes of inefficiencies. |

|

|

Report findings |

Inconsistent reporting |

Leads to misalignment and poor decision-making. |

AI automates report generation with dynamic dashboards. |

|

|

Document lessons learned |

Knowledge loss |

Due to unstructured documentation. |

AI-powered knowledge management systems capture and categorize insights. |

|

Continuous improvement (Adaptation and feedback) |

Refine strategies and plans |

Traditional strategies |

Become outdated quickly. |

AI dynamically updates forecasts and strategic models. |

|

|

Optimize processes |

Slow manual improvements |

Reactive rather than proactive. |

AI suggests refinements using real-time feedback loops. |

|

|

Institutionalize learning |

Poor knowledge sharing |

Best practices are not effectively distributed. |

AI-driven knowledge-sharing platforms ensure continuous learning. |

|

|

Iterative approach |

Rigid planning cycles |

Lack of adaptability to real-time insights. |

AI fosters an agile, data-driven approach for ongoing optimization. |

Streamline your operational workflows with ZBrain AI agents designed to address enterprise challenges.

Approaches to integrating AI into plan-to-results

AI is fundamentally reshaping how organizations move from strategic planning to operational execution by enabling real-time performance measurement and continuous improvement. By embedding AI into a plan-to-results (P2R) framework, companies can align their long-term objectives with day-to-day actions and dynamically bridge the gap between planning and execution. Here are the key approaches to integrating AI within a P2R process:

Custom in-house AI development

Developing a tailored AI solution allows organizations to design systems that seamlessly connect strategic goals with operational performance. These bespoke tools automate resource forecasting, execution alignment, and performance tracking—turning plans into measurable results.

-

Strategic customization: AI models can be built to support unique P2R requirements, such as aligning budget forecasts with operational milestones or modeling dynamic resource allocation.

-

Full control and compliance: Custom solutions ensure complete oversight of data flows, helping to maintain regulatory compliance and secure sensitive operational data.

-

Scalability: As organizational needs evolve, these AI systems can adapt to support new performance indicators and evolving business processes.

By forecasting resource needs and aligning execution with strategic plans, custom AI solutions drive clarity and measurable performance improvements.

AI point solutions

AI point solutions offer specialized tools designed to address specific elements within the P2R cycle. These off-the-shelf applications target distinct processes—such as execution alignment or real-time performance tracking—to quickly convert strategic plans into actionable outcomes.

-

Rapid deployment: Ready-to-use AI tools can be integrated with existing systems to deliver insights and performance adjustments rapidly.

-

Cost-effectiveness: These targeted solutions provide high-impact functionality without the time and expense of developing a fully customized system.

-

Ease of integration: Seamlessly connecting with ERP, CRM, and other management systems, point solutions help ensure that every step of the planning-to-results journey is data-driven.

For example, an AI-based performance analytics tool can quickly pinpoint deviations from the plan, enabling immediate corrective actions and keeping operations aligned with strategic objectives.

Comprehensive AI platforms

Comprehensive AI platforms like ZBrain integrate multiple functionalities to cover the full spectrum of P2R—from initial goal setting and resource forecasting to execution tracking and outcome analysis. These platforms consolidate diverse data streams into a unified system that enhances visibility and drives continuous improvement.

-

Centralized data management: Bringing together data from planning, execution, and performance measurement, these platforms provide a holistic view of organizational performance.

-

End-to-end automation: By automating key processes such as budget revisions, resource allocation, and performance reviews, comprehensive platforms reduce manual intervention and streamline operations.

-

Adaptive scalability: As business conditions change, these platforms can adjust in real-time to support global expansion and evolving industry standards.

With integrated dashboards and predictive analytics, comprehensive platforms enable organizations to continuously compare planned objectives against actual outcomes and refine strategies on the fly.

Continuous monitoring and strategy refinement

At the heart of P2R lies a commitment to ongoing improvement. AI enables continuous monitoring by providing real-time data analytics, predictive insights, and robust feedback loops, ensuring that every operational adjustment is data-driven.

-

Real-time adjustments: AI tools continuously track performance metrics, enabling organizations to respond quickly to any deviations from their strategic plans.

-

Predictive analytics: Advanced models forecast potential gaps between planned and actual performance, supporting proactive decision-making.

-

Feedback loops: Regular feedback from performance data and stakeholder inputs ensures that strategic plans are constantly refined, making future planning even more precise.

By embedding continuous monitoring into the P2R framework, organizations can maintain agility, optimize resource utilization, and ensure that strategic goals are achieved consistently.

Integrating AI into a plan-to-results framework not only streamlines planning and execution but also creates a resilient, data-driven environment where strategic objectives are continuously aligned with operational realities. This synergy between planning, execution, and performance measurement is essential for long-term success in today’s dynamic business landscape.

AI applications transforming plan-to-results

Artificial Intelligence (AI) is revolutionizing plan-to-results processes by automating tasks, enhancing decision-making, and optimizing resource allocation. Below is a breakdown of AI applications across critical financial planning and strategy stages, along with how ZBrain AI agents can enhance these processes.

Strategic planning and preparation

Strategic planning and preparation form the foundation of effective financial management, encompassing budget creation, risk assessment, and stakeholder alignment. Integrating Artificial Intelligence (AI) into these processes enhances accuracy, efficiency, and strategic decision-making.

AI applications:

- Budget creation and resource allocation: AI automates budget forecasting and resource distribution, improving accuracy and efficiency.

- Risk management: AI identifies potential financial risks through predictive analytics, enabling proactive mitigation strategies.

- Stakeholder alignment: AI facilitates data-driven insights to align financial targets across the organization.

How ZBrain enhances strategic planning and preparation:

| Use case | Description | How ZBrain helps |

|---|---|---|

| AI-driven budgeting | Automates budget analysis and resource allocation. | ZBrain AI agents, like the Variance Analysis Agent, can help automate tasks to streamline financial planning, improve accuracy, and optimize resource allocation. |

| Predictive risk analytics | Identifies potential financial risks through data analysis. | ZBrain AI agents, like the Cash Position Tracking Agent, can analyze financial data to predict risks, enabling proactive mitigation strategies. |

| Financial performance monitoring | Tracks financial performance metrics to ensure alignment with strategic goals. | ZBrain’s Financial Insights AI Agent automates the analysis of complex performance data, providing standardized reports and insights. |

Execution (Implementation) of plans

Integrating AI into the execution phase of financial strategies significantly enhances operational efficiency and decision-making.

AI applications:

- Resource management and tracking: AI monitors expenditures and manages cash flow in real-time.

- Financial controls and compliance: AI ensures adherence to financial regulations and internal controls.

- Communication and collaboration: AI facilitates seamless communication between finance teams and other departments.

How ZBrain enhances the execution of plans

| Use case | Description | How ZBrain helps |

|---|---|---|

| Automated cash flow management | Monitors and optimizes cash flow in real-time. | ZBrain’s Cash Flow Monitoring Agent analyzes financial transactions to provide real-time cash flow insights, aiding in maintaining liquidity. |

| Compliance automation | Ensures financial operations adhere to regulations and internal policies. | ZBrain’s Compliance Risk Assessment Agent monitors compliance requirements and flags potential issues, reducing legal risks and administrative overhead. |

| Financial communication enhancement | Improves collaboration between finance and other departments through data insights. | ZBrain AI agents can facilitate data sharing and reporting, enhancing inter-departmental communication and decision-making. |

Monitoring and control

Integrating AI into monitoring and control enables real-time tracking, automated variance analysis, and proactive adjustments to align performance with strategic goals.

AI applications:

- Real-time performance tracking: AI continuously monitors financial KPIs against budgets.

- Variance analysis: AI identifies discrepancies between actual and planned financial performance.

- Corrective actions: AI suggests adjustments to address financial variances.

How ZBrain enhances monitoring and control

| Use case | Description | How ZBrain helps |

|---|---|---|

| Financial performance monitoring | Continuously tracks financial metrics and compares them against budgets. | ZBrain’s Financial Insights AI Agent automates the analysis of performance data, providing real-time insights. |

| Automated variance analysis | Identifies and analyzes variances between actual and planned financial outcomes. | ZBrain’s Variance Analysis Agent performs variance analysis, highlighting discrepancies and potential causes for timely intervention. |

| Proactive financial adjustments | Recommends corrective actions to align financial performance with strategic goals. | ZBrain AI agents can suggest actionable insights to address financial variances, aiding decision-making. |

Evaluation and reporting

Leveraging AI in evaluation and reporting automates financial measurements, root cause analysis, and stakeholder communication for data-driven refinements.

AI applications:

- Performance measurement: AI assesses the achievement of financial goals.

- Root cause analysis: AI investigates reasons behind financial discrepancies.

- Stakeholder communication: AI generates reports for internal and external stakeholders.

How ZBrain enhances evaluation and reporting:

| Use case | Description | How ZBrain helps |

|---|---|---|

| Automated financial reporting | Generates accurate financial reports for stakeholders. | ZBrain AI agents can automate the creation of financial statements, ensuring accuracy and compliance. |

| AI-driven root cause analysis | Investigates underlying causes of financial performance issues. | ZBrain AI agents can analyze data to identify root causes of discrepancies, facilitating targeted corrective actions. |

| Stakeholder communication automation | Streamlines the dissemination of financial information to relevant parties. | ZBrain AI agents can prepare and distribute financial reports, ensuring timely and transparent communication. |

Continuous improvement (Adaptation and feedback)

Embedding AI into continuous improvement processes empowers organizations to optimize strategies and operations by dynamically adapting based on actionable insights.

AI applications:

- Refining financial strategies: AI uses insights to enhance financial planning.

- Optimizing financial processes: AI improves efficiency in financial operations.

- Institutionalizing learning: AI incorporates lessons learned into organizational practices.

How ZBrain enhances continuous improvement

| Use case | Description | How ZBrain helps |

|---|---|---|

| AI-driven financial strategy optimization | Enhances financial planning based on data insights. | ZBrain AI agents can analyze past performance to recommend improvements in financial strategies. |

| Process efficiency enhancement | Streamlines financial operations to improve efficiency. | ZBrain AI agents can automate routine tasks, reducing manual errors and increasing productivity. |

| Knowledge management automation | Captures and disseminates lessons learned for organizational growth. | ZBrain AI agents can document insights and best practices, facilitating continuous learning and adaptation. |

By integrating ZBrain AI agents into these stages, financial institutions can achieve greater efficiency, accuracy, and strategic alignment in their financial planning and execution processes.

Why ZBrain is the ideal platform for plan-to-results operations

ZBrain’s AI-driven platform transforms strategic planning into measurable operational outcomes by seamlessly linking goal setting, resource forecasting, execution alignment, and real-time performance tracking. Its robust capabilities enable organizations to continuously compare planned objectives with actual results, refine resource allocation, and drive continuous improvement across functions.

AI readiness assessment for P2R

ZBrain’s AI readiness framework, ZBrain XPLR, evaluates your organization’s current capabilities and readiness to integrate AI within a P2R process. This assessment identifies gaps between strategic plans and operational execution, providing actionable insights to ensure a smooth implementation that maximizes ROI through enhanced performance tracking.

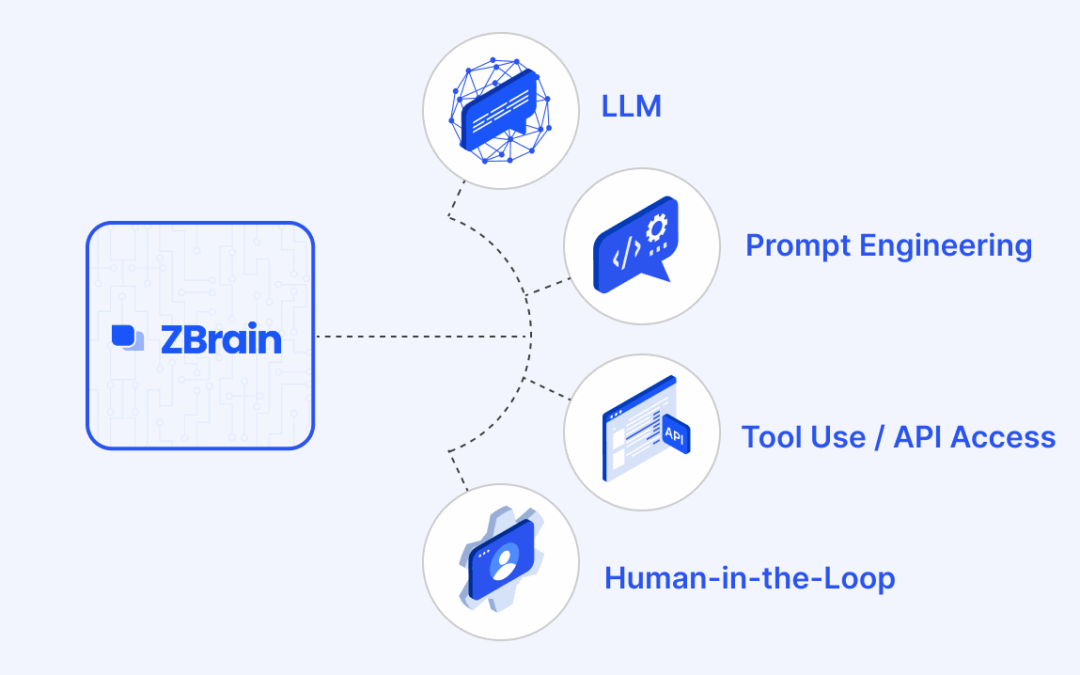

Low-code development for rapid P2R deployment

With ZBrain Builder’s intuitive low-code interface, business users can quickly create and deploy customized AI solutions aligned with P2R objectives. This empowers teams to develop tools for resource forecasting, budget alignment, and performance measurement without needing deep technical expertise, ensuring that day-to-day operations are directly linked to strategic goals.

Proprietary data utilization for actionable insights

ZBrain leverages your organization’s proprietary data to develop AI models tailored to every stage of the P2R cycle. By incorporating internal insights into forecasting, execution, and performance analysis, ZBrain delivers highly relevant, data-driven recommendations that perfectly sync your strategic plans and operational results.

Enterprise-ready integration

Engineered for scalability and robust security, ZBrain integrates seamlessly with existing systems and workflows. This enterprise-ready design supports large-scale operations by ensuring that planning, execution, and performance tracking processes are unified across the organization with minimal disruption.

End-to-end P2R support

ZBrain provides comprehensive support throughout the entire P2R lifecycle—from initial development and deployment to ongoing optimization. This end-to-end approach ensures that every phase, including goal setting, resource allocation, and performance measurement, contributes to a continuous loop of improvement and measurable outcomes.

Flexible data ingestion for real-time decision making

With flexible data ingestion capabilities, ZBrain Builder integrates real-time data from multiple sources. This ensures that strategic planning is constantly informed by up-to-date insights, enabling organizations to compare planned objectives against actual performance and adjust strategies on the fly.

Intelligent agent creation for automated execution

ZBrain Builder’s intelligent agents automate key P2R tasks such as resource allocation, budget forecasting, and performance tracking. By reducing manual effort and minimizing errors, these agents help ensure that strategic plans are executed precisely, driving consistent alignment between goals and outcomes.

By automating core processes and integrating real-time insights into every phase of planning and execution, ZBrain empowers organizations to bridge the gap between strategy and results—making it the ideal platform for a robust plan-to-results framework.

Streamline your operational workflows with ZBrain AI agents designed to address enterprise challenges.

Benefits of implementing AI in plan-to-results operations

Integrating AI into finance transforms strategic planning into actionable results by linking long-term financial goals with operational execution and real-time performance measurement. Here’s how AI empowers finance functions within a plan-to-results (P2R) framework:

For organizations

-

Cost efficiency: AI automates core financial tasks—such as budgeting, forecasting, and expense management—reducing manual intervention and lowering operational costs. This efficiency directly translates planned budgets into measurable savings.

-

Enhanced decision-making: By delivering real-time, data-driven insights, AI enables finance teams to forecast cash flows, optimize resource allocation, and adjust strategies on the fly. This continuous feedback loop helps align strategic objectives with actual performance.

-

Improved compliance: Automated financial controls and audit processes ensure adherence to regulatory standards and internal policies, reducing non-compliance risk and ensuring that strategic plans are executed within established guidelines.

-

Data integration: Seamless integration with ERP, CRM, and accounting systems consolidates diverse financial data streams. This unified view supports accurate forecasting and ensures that up-to-date, reliable data consistently back strategic initiatives.

-

Operational efficiency: AI optimizes end-to-end financial processes—from cash management to investment analysis—accelerating decision-making and ensuring that day-to-day operations align with broader strategic goals.

For finance teams

-

Increased productivity: Automating routine tasks like reconciliations, report generation, and data entry frees finance professionals to focus on high-value strategic analysis and predictive modeling, enhancing the overall planning-to-results cycle.

-

Skill enhancement: Exposure to advanced analytics and AI-driven forecasting tools empowers finance teams to engage in deeper scenario planning and risk assessment, bridging the gap between strategic planning and execution.

-

Improved job satisfaction: By reducing repetitive work, AI allows finance professionals to concentrate on strategic initiatives that drive business growth, fostering a more engaging and fulfilling work environment.

For stakeholders

-

Transparent performance tracking: Real-time monitoring of financial outcomes builds trust among investors, regulators, and internal stakeholders by clearly linking planned objectives with actual results.

-

Proactive risk management: Predictive analytics and continuous monitoring enable early detection of financial risks, allowing organizations to adjust strategies promptly and safeguard long-term financial health.

By embedding AI into a plan-to-results framework, organizations can transform finance planning and strategy into a dynamic, continuously refined process—ensuring that strategic financial goals are not only set but also achieved through data-driven, measurable actions.

Measuring the ROI of AI in plan-to-results

Implementing AI in finance operations enhances decision-making, streamlines processes, and improves financial management. ZBrain’s AI solutions automate key finance functions—such as financial reporting, variance analysis, risk management, liquidity optimization, and budgeting—while supporting data-driven decisions. Businesses can assess these solutions’ impact by evaluating cost savings, process optimization, and improved forecast accuracy. Below are examples of how ZBrain’s AI applications drive ROI in finance planning and strategy.

ZBrain implementation for plan-to-results processes: Key ROI indicators

AI-driven improvements in plan-to-results processes using ZBrain can lead to measurable ROI by reducing manual effort, increasing accuracy, and enabling proactive decision-making. Here’s a breakdown of ROI for key finance use cases:

Automated financial reporting

Use case: Automating the generation of financial reports—such as income statements, balance sheets, and cash flow statements—by consolidating data from multiple sources.

ROI metrics:

-

Reduced report generation time

-

Lower operational costs through automation

-

Improved reporting accuracy and compliance

Example: ZBrain AI agents can automatically compile comprehensive financial reports, freeing up finance teams for strategic analysis while reducing manual errors.

Variance analysis and forecasting

Use case: Automating variance analysis and financial forecasting by continuously comparing budgeted versus actual performance and providing actionable insights.

ROI metrics:

-

Increased forecast accuracy

-

Reduced time spent on manual variance analysis

-

Cost savings from optimized resource allocation

Example: ZBrain AI agents can analyze financial data in real time, flagging discrepancies and enabling finance teams to adjust forecasts and strategies quickly.

Risk management and fraud detection

Use case: Leveraging AI to detect anomalies, identify potential fraud, and ensure regulatory compliance in financial transactions.

ROI metrics:

-

Reduced incidence of fraud

-

Lower risk of regulatory violations

-

Enhanced financial process security

Example: ZBrain AI agents can monitor transactions continuously, detecting irregularities and mitigating risks before they escalate into significant financial losses.

Liquidity and cash flow optimization

Use case: Optimizing liquidity planning by assessing cash reserves, forecasting cash flow gaps, and aligning funding strategies with operational needs.

ROI metrics:

-

Improved cash flow forecasting

-

Reduced liquidity shortfalls

-

Enhanced decision-making speed for cash management

Example: ZBrain AI agents provide real-time insights into cash positions, enabling finance teams to manage liquidity and allocate resources more efficiently and proactively.

Budgeting and dynamic planning

Use case: Automating the budgeting process and continuously aligning financial plans with real-time data from various systems.

ROI metrics:

-

Increased budgeting accuracy

-

Reduced manual intervention and errors

-

Cost savings and improved resource planning

Example: ZBrain’s genAI agents streamline the budgeting cycle by integrating real-time and historical data, aligning planned outcomes with actual results, and significantly reducing manual revisions.

Integrating ZBrain into your finance operations can transform strategic planning into tangible results. The plan-to-results process ensures every phase—from goal setting and data integration to execution and continuous monitoring—is linked to measurable financial outcomes, driving long-term success and robust ROI.

Challenges and considerations in adopting AI for plan-to-results operations

While integrating AI into plan-to-results processes can drive significant improvements—from cost savings and operational efficiency to enhanced decision-making—organizations face several real-life challenges that must be addressed for successful adoption. Below are common pain points and how ZBrain’s AI solutions, within a plan-to-results (P2R) framework, tackle these issues:

|

Aspect |

Challenge |

How ZBrain addresses this challenge |

|---|---|---|

|

Data integration |

Integrating data from various financial systems (ERP, CRM, accounting software) is complex and can lead to fragmented insights. |

ZBrain Builder seamlessly ingests data from multiple sources, ensuring real-time, consistent financial data flow for accurate, unified analysis. |

|

Legacy system compatibility |

Many finance departments rely on outdated systems that may not support modern AI integration, hindering process improvement. |

ZBrain XPLR conducts AI readiness assessments to evaluate legacy systems and design tailored integration strategies, ensuring a smooth transition into AI-driven processes. |

|

High initial investment |

Implementing AI solutions can be costly upfront, which is a significant concern for smaller finance teams or organizations with tight budgets. |

ZBrain offers phased implementation options that allow organizations to evaluate ROI step-by-step and manage costs effectively, reducing financial risk during adoption. |

|

Data security risks |

Financial data is highly sensitive, and breaches or unauthorized access can lead to significant losses and reputational damage. |

ZBrain employs robust security protocols—including role-based access and continuous monitoring—to protect sensitive financial data throughout the plan-to-results lifecycle. |

|

Data privacy compliance |

Adhering to complex financial regulations and data privacy standards (e.g., GDPR, SOC 2) can be challenging and costly. |

ZBrain ensures compliance with global standards ISO 27001:2022, SOC 2 Type II by embedding regulatory checks and automated compliance monitoring into its AI solutions. |

|

Lack of skilled personnel |

Finance teams often face a shortage of AI expertise, slowing implementation and limiting the effective use of AI tools. |

ZBrain Builder’s low-code platform empowers finance professionals to deploy AI solutions without deep technical expertise, accelerating adoption and easing the learning curve. |

|

User adoption resistance |

Finance teams may resist AI adoption due to fears of complexity, disruption, or job displacement, impacting overall system utilization. |

ZBrain’s Builder’s intuitive interface and customizable modules simplify AI integration, promote user confidence, and foster a culture of continuous improvement and collaboration. |

|

Inaccurate or incomplete data |

Poor data quality can lead to faulty insights, misaligned budgeting, and suboptimal financial decisions that derail strategic planning. |

ZBrain Builder incorporates data normalization and validation tools to ensure high-quality, reliable data is used, leading to more accurate, actionable financial insights. |

|

Scalability issues |

Scaling AI solutions across multiple finance functions or geographic regions can be challenging without a flexible, adaptable system. |

ZBrain’s cloud-native architecture and modular design support scalable AI deployment, enabling gradual expansion and consistent performance across all plan-to-results operations. |

By addressing these real-life challenges with a plan-to-results approach, ZBrain’s AI solutions enable finance departments to transition smoothly to AI-driven operations, ensuring that strategic financial objectives are achieved through measurable, continuous improvements.

Best practices for implementing AI in plan-to-results

Implementing AI in plan-to-results operations transforms strategic planning into measurable outcomes by linking long-term financial objectives with day-to-day execution. Adopting AI successfully in finance requires careful planning, robust execution, and collaboration across finance teams. Below are key best practices for leveraging AI for the plan-to-results (P2R) processes that transform strategic plans into measurable, actionable outcomes.

Assess process readiness for AI integration

-

Map existing workflows: Conduct a comprehensive review of current finance operations—such as budgeting, financial reporting, variance analysis, and risk management—to identify bottlenecks and areas ripe for automation.

-

Evaluate data quality and infrastructure: Ensure access to accurate, structured financial data and a robust IT environment that supports AI tools, enabling real-time tracking and performance measurement.

-

Gauge organizational readiness: Engage key stakeholders—CFOs, finance managers, and IT leaders—early in the process to align expectations and address concerns regarding AI adoption.

Leverage the right AI technologies

-

Predictive analytics for revenue and risk: Use machine learning to anticipate cash flow trends, identify potential financial risks, and optimize resource allocation based on historical and real-time data.

-

Natural Language Processing (NLP) for reporting: Automate the extraction and synthesis of financial data from reports, invoices, and contracts to streamline the creation of financial statements and compliance documents.

-

AI-driven process automation: Deploy AI analytics tools to enhance decision-making in budgeting, cost management, and financial forecasting, ensuring a direct link between strategic plans and operational results.

Engage stakeholders and manage change effectively

-

Communicate the strategic vision: Clearly articulate the benefits of AI in finance—such as improved reporting accuracy, faster decision-making, and enhanced risk mitigation—while addressing potential concerns about system changes and job roles.

-

Invest in training and upskilling: Equip finance teams with the skills necessary to leverage AI tools effectively, ensuring they can interpret AI-generated insights and integrate them into everyday financial decision-making.

-

Pilot and phased rollouts: Begin with targeted AI applications (e.g., automating variance analysis or streamlining financial reporting) to demonstrate value and refine processes before scaling across the entire finance function.

Ensure scalability and flexibility

-

Select scalable AI solutions: Choose AI platforms that can grow with your organization, handling increasing volumes of financial data and more complex analytical tasks as your business evolves.

-

Continuous improvement: Regularly evaluate AI models and update them based on new data, stakeholder feedback, and changing business needs, ensuring that your financial planning remains agile and aligned with strategic goals.

-

Seamless integration: Ensure AI tools integrate smoothly with existing financial systems (ERP, accounting software, data warehouses), facilitating a unified, plan-to-results approach that bridges strategic planning with real-time performance monitoring.

By following these best practices, organizations can effectively leverage AI to transform finance planning and strategy, ensuring that every phase—from initial planning and data integration to execution and continuous improvement—is aligned with achieving measurable, long-term financial success.

The future of AI in plan-to-results

The future of plan-to-results operations in finance is set to be transformed by advanced AI-driven automation, predictive analytics, and emerging technologies such as generative AI, blockchain, and cloud-based integration. These innovations within a plan-to-results (P2R) framework enable finance teams to turn strategic plans into measurable, actionable outcomes while addressing real-world pain points. Key trends shaping this future include:

AI and blockchain integration in finance

-

Trend: AI combined with blockchain improves data integrity and transparency in financial transactions.

-

Real-life challenge: Finance departments often face issues with data discrepancies, fraud, and audit inefficiencies.

-

P2R impact: Blockchain creates immutable records while AI continuously validates financial data in real-time, ensuring that strategic targets align with actual outcomes.

AI-driven financial forecasting and operational efficiency

-

Trend: Advanced AI models analyze historical data, market conditions, and real-time metrics to optimize budgeting, forecasting, and risk management.

-

Real-life challenge: Traditional forecasting methods are labor-intensive and prone to errors, often causing misalignment between planned and actual performance.

-

P2R impact: AI-enabled forecasting creates a dynamic feedback loop, allowing finance teams to adjust strategies promptly and optimize resource allocation.

Generative AI for personalized financial insights

-

Trend: Generative AI produces tailored financial reports and actionable insights by processing large volumes of data.

-

Real-life challenge: Manual data analysis can overlook critical patterns, leading to suboptimal decision-making.

-

P2R impact: With continuously updated, data-driven insights, finance professionals can quickly bridge the gap between strategic plans and day-to-day operations.

Cloud-based integration and scalability

-

Trend: Cloud computing supports scalable AI deployments, integrating diverse financial systems for unified data analysis.

-

Real-life challenge: Legacy systems often create data silos, limiting comprehensive financial analysis and responsiveness.

-

P2R impact: Cloud-based AI solutions ensure seamless data flow and scalability, aligning operational execution with strategic financial objectives.

Ethical AI and data security in finance

-

Trend: Responsible AI practices, including bias mitigation and robust data security, are becoming essential as finance operations grow more data-centric.

-

Real-life challenge: Data breaches and opaque decision-making processes can erode trust and lead to compliance risks.

-

P2R impact: Transparent, ethical AI frameworks ensure that every step—from data collection to operational decisions—is secure and compliant, reinforcing the link between strategy and real-world performance.

By embracing these trends within a plan-to-results framework, finance teams can continuously compare planned objectives with actual performance, adjust strategies in real-time, and drive long-term financial success. Platforms like ZBrain are at the forefront, enabling organizations to implement these advanced technologies and transform their finance operations into agile, data-driven, and sustainable processes.

Transform plan-to-results operations with ZBrain

ZBrain empowers organizations to bridge the gap between planning and execution, transforming strategic plans into tangible, measurable outcomes. By identifying automation opportunities and optimizing operational workflows, ZBrain delivers real-time, data-driven insights that drive efficiency across the entire plan-to-results cycle.

ZBrain XPLR evaluates your current operational workflows, pinpointing areas where AI can enhance efficiency and accuracy. This ensures that your plans are executed effectively and outcomes align with business objectives.

With ZBrain Builder’s low-code platform, teams can quickly design and deploy custom solutions that automate critical tasks—such as resource allocation, process monitoring, and performance analysis—streamlining the conversion of strategic intent into real-world results.

Additionally, ZBrain agents play a pivotal role by automating key processes and providing real-time alerts and actionable insights. These intelligent agents monitor operational performance, detect anomalies, and trigger immediate responses, ensuring that every step in the plan-to-results process is both agile and measurable.

By seamlessly integrating with existing systems, offering scalability, and ensuring robust security, ZBrain transforms operational workflows, enhances resource utilization, and drives continuous improvement—providing organizations with a decisive competitive edge in today’s dynamic market.

Endnote

The integration of AI into plan-to-results operations is transforming how organizations align strategic planning with execution to optimize business performance. By automating key processes such as financial forecasting, resource allocation, and operational tracking, AI enhances efficiency, improves decision-making, and ensures seamless execution of business strategies. As AI evolves, its ability to provide real-time insights and adapt to changing conditions strengthens agility and responsiveness. Embracing AI-driven solutions within the P2R framework fosters continuous innovation, enabling organizations to refine strategies, enhance performance measurement, and achieve long-term success.

Ready to optimize your plan-to-results operations with AI? Leverage ZBrain’s intelligent automation to align strategic planning with execution, enhance forecasting accuracy, and streamline performance tracking—driving efficiency, agility, and sustainable business growth.

Listen to the article

Author’s Bio

An early adopter of emerging technologies, Akash leads innovation in AI, driving transformative solutions that enhance business operations. With his entrepreneurial spirit, technical acumen and passion for AI, Akash continues to explore new horizons, empowering businesses with solutions that enable seamless automation, intelligent decision-making, and next-generation digital experiences.

- What is plan-to-results, and why is it important?

- Understanding the stages of the plan-to-results process

- Transforming plan-to-results: How AI solves traditional challenges

- Approaches to integrating AI into plan-to-results

- AI applications transforming plan-to-results

- Why ZBrain is the ideal platform for plan-to-results operations

- Benefits of implementing AI in plan-to-results operations

- Measuring the ROI of AI in plan-to-results

- Challenges and considerations in adopting AI for plan-to-results operations

- Best practices for implementing AI in plan-to-results

- The future of AI in plan-to-results

- Transform plan-to-results operations with ZBrain

What is ZBrain, and how can it optimize plan-to-results processes with AI?

ZBrain is an AI enablement platform that facilitates the seamless integration of artificial intelligence into business operations, aligning with the plan-to-results (P2R) framework to enhance financial performance.

Here’s how ZBrain supports the plan-to-results process:

-

AI readiness assessment with ZBrain XPLR: ZBrain XPLR evaluates an organization’s preparedness for AI adoption, identifying opportunities to integrate AI into financial processes. This assessment aids in aligning AI initiatives with financial goals, ensuring that AI applications contribute effectively to financial planning and performance.

-

Seamless data ingestion and integration: ZBrain Builder integrates with various financial systems, ensuring smooth data flow. By combining structured and unstructured data, businesses can create accurate, real-time financial models, leading to improved budgeting, forecasting, and compliance decisions.

-

Low-code development environment: ZBrain Builder’s intuitive, low-code interface empowers financial teams to rapidly design, build, and deploy AI-driven solutions with minimal coding expertise. This accelerates the automation of financial processes, from budgeting and forecasting to financial reporting and compliance monitoring.

-

Cloud and model flexibility: Supporting various AI models and integrating seamlessly with cloud platforms such as AWS, Azure, and GCP, ZBrain provides the flexibility to select optimal infrastructure for cost-effective, scalable financial solutions.

-

Enhanced compliance and governance: ZBrain’s AI capabilities facilitate continuous monitoring and ensure adherence to financial regulations and internal policies. By identifying potential risks in financial transactions, budgeting, and reporting, ZBrain strengthens operational governance and audit readiness.

By offering a comprehensive suite of AI tools, ZBrain enables organizations to automate, optimize, and innovate their financial processes, leading to enhanced financial performance, improved decision-making, and a clear focus on achieving long-term financial objectives.

How does ZBrain ensure the security and privacy of sensitive data in the plan-to-results process?

ZBrain safeguards sensitive financial data throughout the plan-to-results (P2R) process by implementing robust security measures:

-

Private cloud deployments: ZBrain agents can operate within a private cloud environment, ensuring that critical financial data remains securely stored within your organization’s infrastructure.

-

Robust security features:

-

Access controls: Granular role-based access controls restrict data access to authorized personnel only, protecting sensitive financial information.

-

Compliance and Governance: ZBrain adheres to industry standards ISO 27001:2022 and SOC 2 Type II, ensuring that financial data handling complies with confidentiality, integrity, and accountability requirements.

-

This comprehensive approach ensures that sensitive financial data is protected throughout its lifecycle, from strategic planning and budgeting to performance analysis and reporting.

Can ZBrain AI agents be integrated with the existing plan-to-results (P2R) framework?

Yes, ZBrain AI agents are designed to integrate with your current plan-to-results (P2R) framework seamlessly. The platform supports various data formats and standards, ensuring smooth interoperability with legacy financial, ERP, and reporting systems.

This integration enables organizations to:

-

Leverage existing Infrastructure: Enhance current P2R processes without the need for a complete overhaul of legacy systems.

-

Enrich data and workflows: Connect ZBrain AI agents with existing tools to automate financial planning, budgeting, forecasting, and reporting workflows, improving data accessibility and efficiency.

-

Drive AI-driven insights: Utilize AI capabilities to optimize financial strategies, monitor performance, and enhance decision-making while maintaining compatibility with existing technologies.

By enabling seamless integration, ZBrain ensures that organizations can modernize their P2R processes without disrupting existing systems, improving overall operational efficiency.

What kind of AI agents can be built on ZBrain Builder for the plan-to-results processes?

ZBrain Builder empowers organizations to develop AI agents for plan-to-results processes for finance operations that integrate strategic planning, operational execution, and real-time performance measurement under the plan-to-results (P2R) framework. These agents optimize key functions—including financial reporting, cash flow management, resource forecasting, compliance, and risk management—by continuously comparing planned outcomes with actual performance. This alignment enables rapid adjustments, data-driven decision-making, and enhanced transparency and accountability, ultimately transforming finance revenue management into a dynamic, resilient system that drives long-term financial success.

How does ZBrain cater to diverse plan-to-results process needs across business operations?

ZBrain’s flexibility enables it to meet a wide range of plan-to-results process needs across business operations. Organizations can automate critical tasks by developing tailored AI agents—from setting strategic goals and forecasting resources to aligning execution and tracking performance. This seamless integration not only streamlines operations such as contract management and compliance monitoring but also enhances overall efficiency, accuracy, and data-driven decision-making. Ultimately, ZBrain bridges the gap between strategic planning and operational execution, driving continuous improvement and long-term success.

How can we measure the ROI of ZBrain in our plan-to-results processes?

Measuring ROI from ZBrain in a plan-to-results framework involves tracking KPIs that bridge strategic planning with operational execution.

-

Reduced manual effort:

Automate billing, contract management, and revenue recognition tasks to accelerate processing, minimize errors, and improve accuracy. -

Faster revenue realization:

Optimize contract workflows and ensure timely invoicing to enhance cash flow and accelerate revenue recognition. -

Improved accuracy and compliance:

Implement automated validation processes to ensure precise billing and adherence to regulatory standards. -

Enhanced operational efficiency:

Leverage streamlined workflows and real-time data updates to lower operational costs while aligning execution with strategic goals.

Monitor these KPIs to measure how ZBrain enhances efficiency, reduces errors, and refines the overall plan-to-results process.

How can I get started with ZBrain for my plan-to-results processes?

To begin using ZBrain for optimizing your plan-to-results processes, contact us at hello@zbrain.ai or fill out the inquiry form on our website. Our team will contact you to explore how our platform can integrate with your existing plan-to-process framework and streamline the workflows.

Insights

A guide to intranet search engine

Effective intranet search is a cornerstone of the modern digital workplace, enabling employees to find trusted information quickly and work with greater confidence.

Enterprise knowledge management guide

Enterprise knowledge management enables organizations to capture, organize, and activate knowledge across systems, teams, and workflows—ensuring the right information reaches the right people at the right time.

Company knowledge base: Why it matters and how it is evolving

A centralized company knowledge base is no longer a “nice-to-have” – it’s essential infrastructure. A knowledge base serves as a single source of truth: a unified repository where documentation, FAQs, manuals, project notes, institutional knowledge, and expert insights can reside and be easily accessed.

How agentic AI and intelligent ITSM are redefining IT operations management

Agentic AI marks the next major evolution in enterprise automation, moving beyond systems that merely respond to commands toward AI that can perceive, reason, act and improve autonomously.

What is an enterprise search engine? A guide to AI-powered information access

An enterprise search engine is a specialized software that enables users to securely search and retrieve information from across an organization’s internal data sources and systems.

A comprehensive guide to AgentOps: Scope, core practices, key challenges, trends, and ZBrain implementation

AgentOps (agent operations) is the emerging discipline that defines how organizations build, observe and manage the lifecycle of autonomous AI agents.

Adaptive RAG in ZBrain: Architecting intelligent, context-aware retrieval for enterprise AI

Adaptive Retrieval-Augmented Generation refers to a class of techniques and systems that dynamically decide whether or not to retrieve external information for a given query.

How ZBrain breaks the trade-offs in the AI iron triangle

ZBrain’s architecture directly challenges the conventional AI trade-off model—the notion that enhancing one aspect inevitably compromises another.

ZBrain Builder’s AI adaptive stack: Built to evolve intelligent systems with accuracy and scale

ZBrain Builder’s AI adaptive stack provides the foundation for a modular, intelligent infrastructure that empowers enterprises to evolve, integrate, and scale AI with confidence.