Transforming Credit Scoring Using AI

Problem

Challenges in Traditional Credit Scoring Practices

Credit scoring is a critical aspect of the finance and banking industry, determining the creditworthiness of individuals and businesses. However, traditional credit scoring methods involve extensive manual processes and rely on historical data, which can be time-consuming and may not capture the full financial picture. ZBrain presents an advanced solution using AI and ML to make this challenging task simpler and more efficient.

Solution

I. How ZBrain Innovates Credit Scoring

ZBrain transforms the credit scoring process by integrating artificial intelligence and machine learning, delivering precise credit scores that enable financial organizations to evaluate creditworthiness swiftly and with greater accuracy. Here’s a comparison of the traditional credit scoring process versus the ZBrain Flow approach:

| Steps | Without ZBrain Flow | Time Without ZBrain Flow | With ZBrain Flow |

|---|---|---|---|

| Data collection and preprocessing | Manual | ~7 hours | Automated by ZBrain Flow |

| Credit analysis | Manual | ~6 hours | Automated by ZBrain Flow |

| Scoring model development | Manual | ~6 hours | Automated by ZBrain Flow |

| Report generation | Manual | ~3 hours | Automated by ZBrain Flow |

| Total | ~22 hours | ~3 hours |

II. Key Data Inputs

To achieve optimal credit scoring results, ZBrain requires access to the following data sources:

| Information Source | Description | Recency |

|---|---|---|

| Customer’s financial statements | Individual or business financial records | Current fiscal year |

| Credit bureau reports | Credit history and outstanding debts | Last 2 years |

| Bank statements | Transaction history and account balances | Current month |

| Tax returns | Income and tax records | Last 2 years |

| Employment and income verification | Employment history and income details | Last 6 months |

| Public records | Legal records, bankruptcies, and liens | Last 5 years |

III. ZBrain Flow: How It Works?

Step 1: Data Collection and Exploratory Data Analysis

ZBrain begins the process by automatically collecting data from various sources, including financial statements, credit bureau reports, bank statements, tax returns, employment verification, and public records. This integral data collection approach ensures a comprehensive view of the individual’s or business’s financial status. After data collection, ZBrain initiates preprocessing and exploratory data analysis (EDA) to rectify missing values and inconsistencies, understand the data’s underlying structure, unveil patterns, and extract valuable insights.

Step 2: Embedding Generation

During this phase, textual data is converted into numerical representations through embedding methods. These embeddings excel at capturing the semantic nuances and connections among diverse data points, thus streamlining retrieval and analysis.

Step 3: Query Execution and Credit Scoring Analysis

Upon receiving the query, ZBrain fetches the relevant data based on the specifications. This data and the query are then passed on to the OpenAI LLM for further analysis. ZBrain leverages AI algorithms to generate a credit score that accurately reflects creditworthiness, considering various data points and current financial indicators. The LLM understands the data, dynamically generating a comprehensive and coherent report.

Step 4: Parsing the Generated Report

After generating the report using LLM, ZBrain parses this output to eliminate irrelevant information, ensuring the report is accurate and focused. The parsed data is then thoughtfully structured to adhere to the desired format, sections, and report guidelines.

Result

Improved Credit Scoring Efficiency

ZBrain offers a unique approach to credit scoring in the finance and banking industry. By automating data collection, preprocessing, and report generation, ZBrain has dramatically cut down the time and effort for credit scoring. What was once a labor-intensive 22-hour manual process is now an efficient, streamlined, automated process that only takes 3 hours. This facilitated process empowers financial institutions to assess creditworthiness more swiftly and accurately, leading to better lending decisions and a more efficient credit management system. Leverage ZBrain to unlock unparalleled efficiency and optimize credit operations.

Example Report

Prompt:

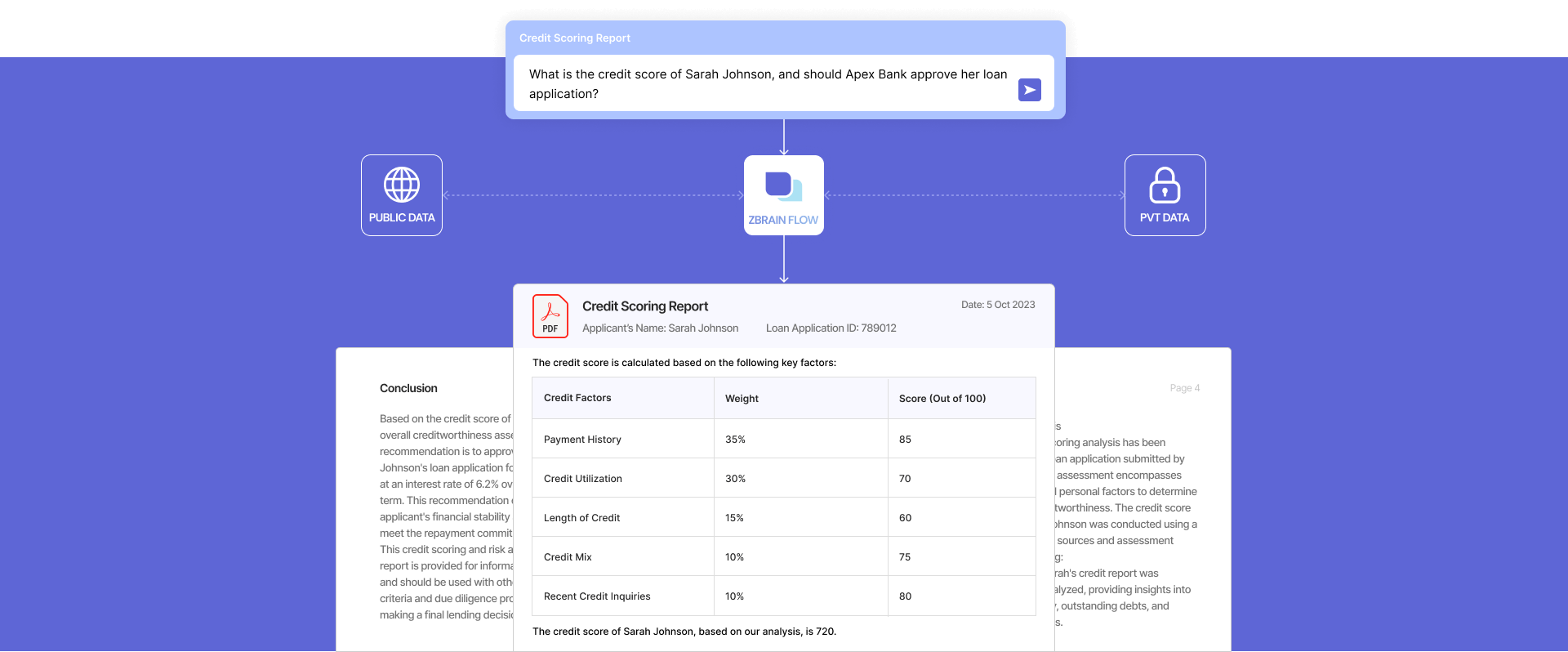

What is the credit score of Sarah Johnson, and should Apex Bank approve her loan application?

Credit Score Analysis

A thorough credit scoring analysis has been conducted for the loan application submitted by Sarah Johnson. The assessment encompasses various financial and personal factors to determine the applicant’s creditworthiness. The credit score analysis for Sarah Johnson was conducted using a combination of data sources and assessment techniques, including:

- Credit report: Sarah’s credit report was obtained and analyzed, providing insights into her credit history, outstanding debts, and payment patterns.

- Credit bureaus: Data from major credit bureaus, including Equifax, Experian, and TransUnion, were reviewed to verify credit history and score.

- Payment history: A detailed examination of Sarah’s payment history was conducted to assess the frequency and timeliness of payments on existing credit accounts.

- Credit utilization: Credit utilization ratios were calculated by comparing credit limits to outstanding balances across credit accounts.

- Length of credit: Sarah’s credit history was determined by evaluating the age of her oldest credit account and the average age of all accounts.

- Credit mix: The diversity of credit types, such as credit cards, installment loans, and mortgages, was analyzed to assess the credit mix.

- Recent credit inquiries: Recent credit inquiries were reviewed to evaluate whether Sarah has recently applied for multiple new credit accounts.

Credit Score Summary

The credit score of Sarah Johnson, based on the analysis, is 720.

Credit Score Range: 300-850

Loan Application Recommendation

Based on the credit score and additional assessment factors, the following action is recommended for Sarah Johnson’s loan application:

-

Loan approval: Recommended

-

Loan amount: $15,000

-

Interest rate: 6.2%

-

Loan term: 36 months

Credit Score Factors

The credit score is calculated based on the following key factors:

| Credit Factors | Weight | Score (Out of 100) |

|---|---|---|

| Payment history | 35% | 85 |

| Credit utilization | 30% | 70 |

| Length of credit | 15% | 60 |

| Credit mix | 10% | 75 |

| Recent credit inquiries | 10% | 80 |

Credit Score Breakdown

-

Payment history (35%): Sarah Johnson has an excellent payment history with no late payments or delinquencies.

-

Credit utilization (30%): The credit utilization ratio is reasonable, with 35% of available credit used.

-

Length of credit (15%): Sarah Johnson’s credit history is relatively short, impacting this score component.

-

Credit mix (10%): A diverse mix of credit types contributes positively to the credit score.

-

Recent credit inquiries (10%): Recent credit inquiries are within an acceptable range and do not negatively impact the score.

Recommendation Rationale

Sarah Johnson’s credit score of 720 falls within the “Good” credit category, indicating a reasonable level of creditworthiness. With an impeccable payment history and responsible credit utilization, the applicant demonstrates strong financial discipline.

The recommended loan approval is based on the credit score, which aligns with Apex Bank’s lending guidelines for this loan product. The proposed loan terms are designed to ensure affordability and manageable repayments for the applicant.

Conclusion

Based on the credit score of 720 and the overall creditworthiness assessment, the recommendation is to approve Sarah Johnson’s loan application for a $15,000 loan at an interest rate of 6.2% over a 36-month term. This recommendation considers the applicant’s financial stability and ability to meet the repayment commitments.

This credit scoring and risk assessment report is provided for informational purposes and should be used with other subsidizing criteria and due diligence processes before making a final lending decision.