Boost Retention, Save Time: AI-driven Customer Churn Analysis

Problem

Obstacles in Conventional Customer Churn Analysis

In the banking and finance sector, customer retention is vital for sustained profitability. However, customer churn, where customers switch to competitors or discontinue using financial services, poses a significant challenge. Analyzing churn involves dealing with complex data, leading to challenges like manual data processing, limited predictive accuracy, and delayed responses to customer attrition. ZBrain offers a streamlined solution to enhance customer churn analysis, empowering financial institutions to make data-driven decisions and reduce customer attrition.

Solution

I. How ZBrain Facilitates Customer Churn Analysis

ZBrain Flow transforms the customer churn analysis process by harnessing the power of artificial intelligence and machine learning. Here’s a comparison of time taken for each customer churn analysis with and without ZBrain Flow:

| Steps | Without ZBrain Flow | Time Without ZBrain Flow | With ZBrain Flow |

|---|---|---|---|

| Data Collection | Manual | ~6 hours | Automated by ZBrain Flow |

| Data Cleaning and Preprocessing | Manual | ~8 hours | Automated by ZBrain Flow |

| Data Analysis | Manual | ~10 hours | Automated by ZBrain Flow |

| Report Generation | Manual | ~6 hours | Automated by ZBrain Flow |

| Report Review and Finalization | Manual | ~2 hours | Automated by ZBrain Flow |

| Total | ~32 hours | ~5 hours |

II. Necessary Input Data

For ZBrain Flow to conduct accurate customer churn analysis, it relies on the following data sources and their recency:

| Information Source | Description | Recency |

|---|---|---|

| Internal Customer Data | Customer profiles, transaction history, demographics, and feedback | Always updated |

| External Market Data | Competitor offerings, market trends, and economic indicators | Last 1 year |

| Customer Service Logs | Records of customer interactions, complaints, and inquiries | Last 6 months |

| Social Media and Online Reviews | Publicly available sentiment analysis, customer feedback | Last 1 year |

| Survey Responses | Feedback from customer satisfaction surveys | Current cycle |

III. ZBrain Flow: How It Works?

Step 1: Data Gathering and Exploratory Data Analysis (EDA)

The first step in ZBrain’s process encompasses automated data collection, which gathers relevant information like customer transaction history, account particulars, demographic data, customer interaction logs, and surveys capturing customer feedback. Following the data collection phase, ZBrain commences an EDA to unveil valuable insights. EDA understands the data’s structure and recognizes any missing data, outliers, correlations, and patterns that may impact customer churn.

Step 2: Embedding Generation

In this step, ZBrain transforms textual data, such as customer comments, feedback, and interaction logs, into numerical representations using advanced embedding techniques, including word embeddings and sentence embeddings. These embeddings capture the semantic meaning and relationships between different data points, facilitating efficient retrieval and analysis. Insights are provided with great accuracy through this transformation, and the decision-making process is empowered with a wealth of knowledge.

Step 3: Query Execution and Report Generation

When a user submits a query for the customer churn analysis report, the system retrieves the necessary data according to the query criteria. This retrieved data, along with the query, is subsequently forwarded to the OpenAI Language Model (LLM) for the generation of the report.

Using the obtained embeddings, the OpenAI LLM understands and organizes the data, exploring the provided information thoroughly. By using the dataset, query specifics, and the desired report format, the OpenAI LLM creates a detailed and logical report.

Step 4: Parsing the Generated Report

After the report is created, a careful parsing process starts to fine-tune the report and gather important information. This parsed data is then methodically organized, guaranteeing that the final report precisely follows the desired format, sections, and report criteria. This thorough method ensures the report is driven by data, presented in a professional manner, and easily comprehensible.

By integrating data acquisition, automated EDA, embedding generation, query execution with LLM, report generation, and parsing, ZBrain masterfully produces the final version of the customer churn analysis report. This multifaceted process empowers organizations with valuable insights and equips them to make strategic and well-informed decisions to reduce customer churn and enhance customer retention.

Result

Effective Customer Churn Management

By leveraging ZBrain’s automated customer churn analysis, financial institutions can proactively identify at-risk customers and take timely actions to reduce churn rates. This streamlined process leads to significant time and cost savings and, most importantly, enhances customer retention. The ability to make data-driven decisions and provide personalized solutions strengthens customer relationships and fosters long-term loyalty, ultimately contributing to the success and sustainability of banking and finance businesses. Embrace the power of ZBrain to enhance customer service, retain valuable customers and maintain a competitive edge in the industry.

Example Report

Prompt:

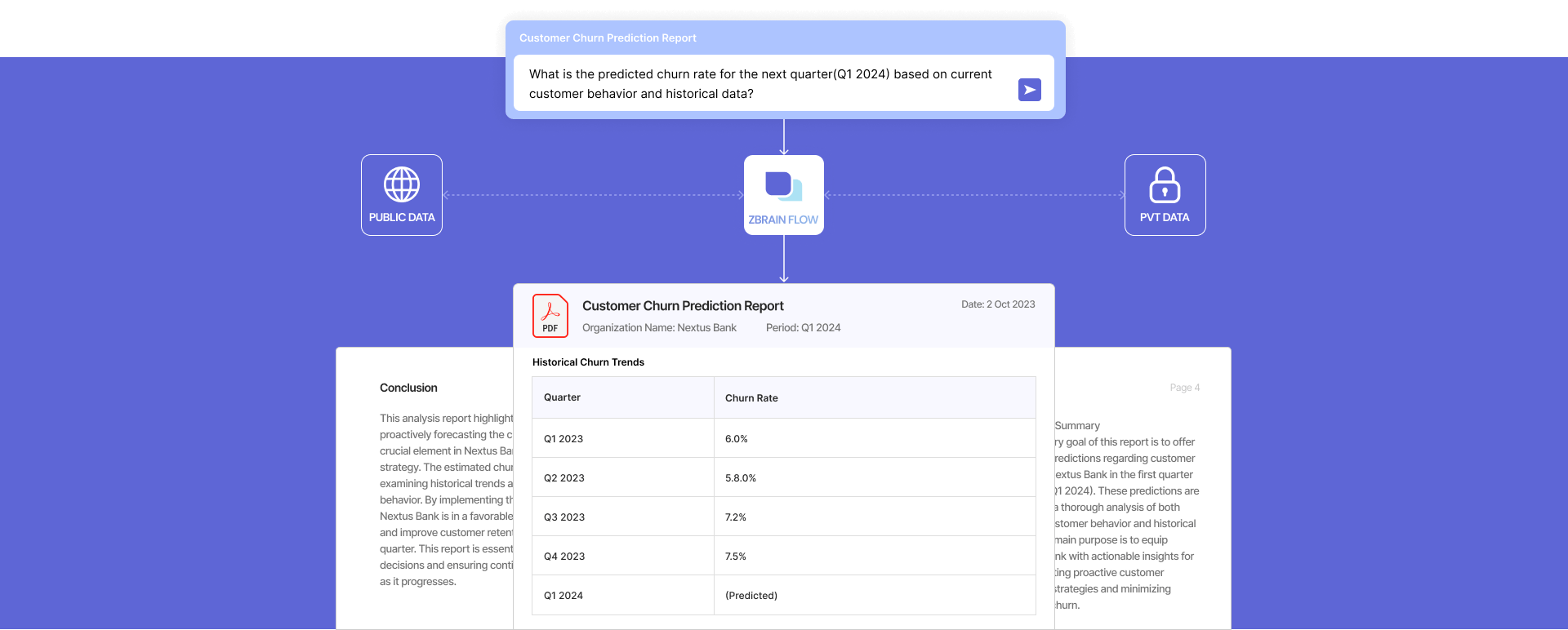

What is the predicted churn rate for the next quarter(Q1 2024) based on current customer behavior and historical data?

Executive Summary

The primary goal of this report is to offer valuable predictions regarding customer churn at Nextus Bank in the first quarter of 2024 (Q1 2024). These predictions are based on a thorough analysis of both current customer behavior and historical data. The main purpose is to equip Nextus Bank with actionable insights for implementing proactive customer retention strategies and minimizing potential churn.

Data Analysis and Methodology

The churn rate prediction for Q1 2024 is based on a robust analysis that leverages a combination of current customer behavior and historical data. This analysis encompasses the following key components:

- Historical Churn Trends: Recurring patterns and trends in customer attrition were identified by diligently examining churn rates for the previous four quarters (from Q1 2023 to Q4 2023). This historical data is used as the foundation for predicting future churn.

- Customer Behavior: Current customer behavior data, which includes transaction history, account activities, interaction logs, and feedback surveys, was meticulously examined to assess the current levels of customer engagement. Early warning signs of churn can be identified by understanding how customers interact with the bank.

- Demographic Information: Demographic data, such as age, income, and location, was considered to explore potential correlations between customer characteristics and churn. Although the initial analysis did not uncover significant correlations, ongoing monitoring is recommended to detect potential influences in the future.

- Economic and Market Factors: The analysis also considered economic indicators and market trends to understand the external factors influencing churn. This broader context helps to provide a more comprehensive churn prediction.

Historical Churn Trends

The historical churn rates for the past five quarters are summarized in the table below:

| Quarter | Churn Rate |

|---|---|

| Q1 2023 | 6.0% |

| Q2 2023 | 5.8% |

| Q3 2023 | 7.2% |

| Q4 2023 | 7.5% |

| Q1 2024 | (Predicted) |

This historical data reveals a gradual increase in the churn rate over the past year, with a predicted rate of 7.5% for Q1 2024. This aligns with the increasing trend observed.

Predicted Churn Rate for Q1 2024

The comprehensive analysis estimates that the churn rate for Nextus Bank in Q1 2024 will be approximately 7.5%. This prediction considers the historical churn trends, current customer behavior, and external economic and market factors.

Key Findings

-

The predicted churn rate for Q1 2024 is estimated to be 7.5%, suggesting a moderate level of churn risk.

-

Individual customer predictions vary widely, with some customers having a higher likelihood of churn while others have a lower likelihood.

Customer Behavior Analysis

The analysis of current customer behavior identified several key indicators that are early warning signs of potential churn. These indicators include:

- Decline in Transaction Frequency: Customers who have shown a significant decline in transaction frequency in the past quarter are at a higher risk of churning.

- Negative Customer Feedback: Customers who provided negative feedback in recent surveys are likelier to churn. Addressing their concerns promptly is critical.

- Low Interaction With Customer Service: Customers with limited recent interaction with customer service may be at risk of churning. Enhancing customer service interactions is essential to mitigating churn.

Recommended Actions

To address the predicted churn rate for Q1 2024, the following actions are recommended:

- Customer Engagement Campaigns: Implement targeted customer engagement campaigns to encourage increased transaction frequency and interaction with customer service. This can help re-engage at-risk customers.

- Customer Feedback Analysis: Pay special attention to customers who provide negative feedback and address their concerns promptly. This proactive approach can help retain customers with concerns.

- Churn Prediction Monitoring: Continuously monitor churn prediction models and refine them based on evolving data. Staying vigilant and adaptable is essential to managing churn effectively.

Conclusion

This analysis report highlights the importance of proactively forecasting the churn rate for Q1 2024 as a crucial element in Nextus Bank’s customer retention strategy. The estimated churn rate of 7.5% results from examining historical trends and current customer behavior. By implementing the recommended strategies, Nextus Bank is in a favorable position to reduce churn and improve customer retention in the upcoming quarter. This report is essential for making well-informed decisions and ensuring continued customer satisfaction as it progresses.