AI in accounts payable and receivable: Scope, integration, use cases, challenges and trends

Listen to the article

In the financial operations landscape, significant transformations are occurring in Accounts Payable (AP) and Accounts Receivable (AR). These changes are driven by Artificial Intelligence (AI) and automation. Despite advancements, many companies still rely on outdated AP systems. Nearly half of all invoices received by enterprises are paper documents. Additionally, 38% of payments are processed manually. As businesses anticipate an 80% increase in payment volumes through their AP systems, the reliance on antiquated methods becomes more concerning.

The landscape is further complicated by large enterprises using multiple AP systems, which adds inefficiency. This fragmented approach introduces delays, increases the risk of human error, and underscores the urgent need for streamlined processes to handle over 5,000 invoices monthly.

What are the costs associated with these payment methods? Most businesses report the cost to process a check is $10 or less, while electronic methods like ACH and card payments are generally less than $5. These costs highlight the potential savings from more efficient payment technologies. This situation presents a compelling case for adopting AI-driven automation in AP processes for cost reduction and scaled accuracy and efficiency in handling the growing volume of transactions.

To address these inefficiencies and prepare for future growth, 78% of CFOs recognize the importance of integrating AI into AP processes. This shift is seen as key to improving efficiency and scalability. The push towards automation is gaining momentum, with 73% of executives from mid-sized businesses acknowledging that automation enhances cash flow and drives overall savings and growth. However, the journey towards full automation is still in its early stages, with only 17% of enterprise firms achieving minimal human intervention in their source-to-pay cycles.

This article explores AI’s transformative role in accounts payable and receivable, examining impactful use cases, adoption strategies, and integration challenges. We’ll also highlight emerging trends, offering a comprehensive overview that provides insights into best practices and the scope of AI advancements in financial operations.

- Introduction to Accounts Payable and Accounts Receivable

- The Role of AI in Transforming Accounts Payable and Accounts Receivable

- Approaches to Integrating AI into Accounts Payable and Accounts Receivable

- AI Applications in Accounts Payable

- AI Applications in Accounts Receivable

- Benefits of AI in Accounts Payable and Accounts Receivable

- Challenges of AI Integration in AP and AR

- Best Practices for Implementing AI in Accounts Payable and Accounts Receivable

- Future Trends of AI in AP and AR Automation

- Transforming Accounts Payable and Accounts Receivable with ZBrain: A Full-Stack Agentic AI Orchestration Platform

Introduction to Accounts Payable and Accounts Receivable

Accounts payable and accounts receivable are crucial components of a company’s financial operations, directly impacting cash flow and overall financial health. AP involves managing the obligations to pay off short-term debts to suppliers or vendors, while AR entails managing money that customers owe the company. Efficient handling of AP and AR is essential for maintaining smooth operational continuity and financial stability.

Deep dive into accounts payable

Accounts payable is essential to a company’s financial operations, handling the debts owed to suppliers for goods and services received. It begins with procurement and ends with payment, encapsulating several critical stages:

-

Purchase requisition and order creation: The process starts with a formal request for goods or services, which turns into a Purchase Order (PO) upon approval. This PO is a legal document that details the items needed, their quantities, prices, and delivery terms.

-

Receipt of goods or services: The company receives the goods or services ordered, documented by a receiving report that verifies the quantities and condition of the items received, which is crucial for later stages.

-

Invoice receipt: Vendors submit invoices detailing the amount owed. These can be in various formats, including paper, electronic documents, or EDI files, posing challenges in data extraction.

-

Invoice processing: Invoices undergo data entry, coding, and verification against POs and receiving reports. This manual process is prone to errors and inefficiencies.

-

Invoice matching (Three-way match): Invoices are matched with the corresponding PO and receiving report to check for discrepancies, a step that often requires manual resolution.

-

Approval workflow: Post-verification, invoices are routed through an approval workflow, requiring authorization based on company policies before making payments.

-

Payment processing: Payments are made via preferred methods such as checks, ACH, or wire transfers, necessitating accurate banking information.

-

Payment reconciliation and reporting: Payments are reconciled with invoices and recorded in the accounting system to ensure all financial data is accurate and ready for reporting.

Challenges in AP include manual data entry, varied invoice formats, discrepancies in documents, data silos, compliance demands, lack of audit trails, delayed payments, and fraud risks. These inefficiencies can lead to strained vendor relationships, increased costs, and reduced financial visibility, underscoring the need for transformative solutions like AI.

Deep dive into accounts receivable

Accounts receivable manages incoming customer payments for goods or services sold on credit. The AR process is vital for maintaining cash flow and includes several key steps:

-

Credit approval: Before extending credit, a customer’s creditworthiness is assessed to determine appropriate credit limits.

-

Order processing: Customer orders are verified and processed, ensuring inventory availability and order accuracy.

-

Invoice generation: After order fulfillment, an invoice is generated detailing the products or services provided, the amount due, and the payment terms.

-

Invoice delivery: The invoice is sent to the customer via their preferred method, which can affect the speed of payment receipt.

-

Payment collection: Incoming payments are tracked, and overdue amounts are followed up to ensure timely payment.

-

Payment application: Payments are recorded and matched against outstanding invoices to update customer balances accurately.

-

Reconciliation: This step ensures all payments are accounted for and properly recorded against the right invoices.

-

Debt collection: The AR team may initiate collection efforts for overdue payments, including sending reminders or working with collection agencies.

AR challenges include customer disputes, delayed payments, bad debts, high Days Sales Outstanding (DSO), inaccurate forecasting, inefficient credit management, manual reconciliation, poor communication, and lack of visibility. These issues can disrupt cash flow, complicate financial planning, and damage customer relationships, highlighting the importance of efficient AR management.

The following table summarizes the current pain points of AP and AR processes and their business impact.

|

Pain Point |

Description |

Example |

Impact on Business |

|---|---|---|---|

|

Manual workflows and inefficiencies |

Manual verification rely on physical checks, leading to inefficiencies and potential for error. |

A misfiled document leads to a duplicated payment of $15,000, causing an accounting discrepancy and audit issue. |

Delays in financial reporting and increased risk of audit complications. |

|

Prolonged dispute resolution |

Time-consuming resolution processes for discrepancies in invoices, delaying the entire payment cycle. |

Discrepancy over quantity delivered holds up payment for a month, impacting supplier trust and future collaborations. |

Extended payment cycles and weakened supplier relations. |

|

Exposure to payment fraud |

Increased vulnerability to fraud in manual systems due to a lack of sophisticated checks. |

Fraudulent redirection of payment due to compromised email instructions results in a loss of $20,000. |

Direct financial losses and increased security risk. |

|

Data integration issues |

Challenges in integrating data across different financial systems and platforms. |

Inconsistent data entries between the procurement and finance systems delay monthly financial closings. |

Inefficiencies in financial operations and reporting. |

|

Inadequate cash flow management |

Difficulty in managing liquidity due to unclear visibility of incoming and outgoing funds. |

An unexpected delay in payment from a major client forces a company to dip into its credit line unexpectedly. |

Liquidity issues that can affect daily operations. |

|

Escalating processing costs |

High costs associated with manual handling of invoices and payments due to inefficient processes. |

Hiring temporary staff during peak billing periods significantly raises operational costs. |

Increased administrative expenses, reducing profitability. |

|

Inconsistent payment enforcement |

Challenges in enforcing payment discipline across different customers and suppliers. |

Variations in payment terms with clients lead to cash inflow issues, complicating financial planning. |

Disruptions in cash flow and financial planning difficulties. |

Efficiently managing accounts payable and accounts receivable is essential for maintaining robust financial health and ensuring smooth cash flow in any organization. However, the manual complexities and challenges inherent in traditional AP and AR processes call for innovative solutions. By adopting advanced technologies such as AI, businesses can significantly enhance these financial operations’ accuracy, speed, and efficiency, leading to improved operational continuity and financial stability.

Streamline your operational workflows with ZBrain AI agents designed to address enterprise challenges.

The Role of AI in Transforming Accounts Payable and Accounts Receivable

Artificial Intelligence (AI) emerges as a transformative force in reshaping the landscapes of accounts payable and accounts receivable. With its unparalleled ability to automate complex tasks, analyze extensive datasets, and facilitate intelligent decision-making, AI stands as a potent solution to the multifaceted challenges faced by modern finance departments.

For instance, in accounts payable processes, AI automates the entire invoice processing cycle—from receipt to payment—enhancing data accuracy, reducing processing times, and mitigating fraud risks. In accounts receivable, AI transforms the management of incoming payments by automating billing processes, refining credit assessments, and optimizing cash flow management.

AI-powered systems transcend mere automation; they are crafted to perform tasks with greater speed, accuracy, and efficiency than traditional manual processes. The integration of AI in AP and AR operations extends beyond routine automation, offering strategic insights that empower finance professionals to evolve from reactive problem-solvers into proactive strategists.

Key subfields and techniques of AI in accounts payable and accounts receivable

AI incorporates a broad spectrum of technologies, including machine learning, deep learning, and rule-based systems, aiming to create intelligent systems that emulate human cognitive functions such as problem-solving, decision-making, and understanding language. It is extensively used for predictive analytics, AR and AP automation, and business process optimization.

Below is an overview of the main AI technologies relevant to transforming AP and AR:

Machine Learning (ML): ML is a subset of AI focused on building systems that learn from data without being explicitly programmed. By identifying patterns and relationships in data, ML algorithms can drive insights, classify data, and support decision-making.

Types of machine learning include:

-

Supervised learning: Algorithms learn from labeled data sets to predict outcomes for new inputs. For example, predicting payment delays in AR based on historical payment behaviors.

-

Unsupervised learning: Algorithms learn from unlabeled data to identify hidden patterns or intrinsic structures. For example, segmenting suppliers in accounts payable based on their invoicing patterns to optimize payment terms.

-

Reinforcement learning: Algorithms learn strategies through trial and error, using feedback from their actions to make decisions. For example, dynamically adjusting discount offers in real-time to optimize cash flow in AR.

Deep Learning (DL): This advanced form of ML uses neural networks with multiple layers to analyze data, making it particularly useful in recognizing complex patterns in large datasets, such as identifying anomalies in invoices or customer payment patterns.

Natural Language Processing (NLP): NLP enables the understanding and generation of human language, allowing for the automated extraction of key data from unstructured documents such as contracts, which is essential in both AP and AR for enhancing transaction processing and customer interactions.

Applications of NLP in AP and AR include:

-

Text analytics: Analyzing text data from invoices or customer communications to extract key information.

-

Chatbots: Providing automated customer support and query resolution in AR.

-

Language translation: Assisting multinational companies by translating invoices and financial documents.

-

Sentiment analysis: Assessing the tone and sentiment of customer communications in AR to better understand client satisfaction.

Computer vision: Essential for tasks that require the system to ‘see’ and interpret visual data, computer vision is used in accounts payable to digitize and process images of invoices and receipts and in AR to manage documentation related to billing and customer agreements.

Generative AI: Enhances creative problem-solving and data synthesis by generating realistic and contextually relevant text, images, or data based on learned information. It is used in AP and AR to drive accurate financial insights, automate content generation for financial reports, and innovate new ways to handle transaction discrepancies.

These AI technologies fundamentally enhance the efficiency and accuracy of AP and AR processes. AI transforms traditional financial operations into more strategic, efficient, and error-resistant activities by automating routine tasks, enabling advanced analysis, and improving decision-making processes. This shift streamlines workflows and frees up human resources to focus on more critical and complex tasks, driving significant business efficiency and financial health improvements.

Approaches to Integrating AI into Accounts Payable and Accounts Receivable

AI is transforming the financial management landscape, particularly in accounts payable and receivable, by automating repetitive tasks, enhancing transaction accuracy, and providing strategic insights for better financial decision-making. Here’s an overview of the primary approaches for integrating AI into AP and AR processes:

Custom, in-house AI development

Companies might opt to develop customized AI solutions tailored to their AP and AR needs, such as invoice processing, payment matching, and financial reporting. This method involves designing or modifying AI models that align closely with the organization’s unique data and operational workflows.

Advantages:

-

Customization: Tailors AI solutions to address specific challenges in AP and AR, enhancing process relevance and effectiveness.

-

Control: Enables control over data privacy, model training, and compliance with internal and regulatory standards.

-

Scalability: Ensures the AI system can evolve with the organization, adapting to changing needs and expanding operational capacities.

Using AI point solutions

Organizations can employ pre-built, off-the-shelf AI tools that target specific tasks within the AP and AR processes. These tools are designed for automated reconciliations, payment processing, or complex financial analytics.

Advantages:

-

Quick deployment: Ready-to-use solutions offer rapid improvements and are particularly effective in streamlining specific functions like automated invoice matching or customer payment tracking.

-

Cost-effectiveness: Generally requires less investment in terms of time and resources compared to fully custom solutions.

-

User-friendly: Helpful for non-technical users, these tools are often easy to integrate into existing financial systems and workflows.

Adopting a comprehensive AI platform

Adopting an integrated AI platform like ZBrain can offer a holistic approach to transforming AP and AR processes. Such platforms provide a suite of AI tools and technologies that support various functions, from transaction processing to compliance monitoring and financial analysis.

Advantages:

-

Centralized data and governance: Ensures consistent management of financial data and compliance with regulatory standards, crucial for maintaining data security in AP and AR processes.

-

End-to-end optimization: Supports comprehensive automation from invoice processing to payment reconciliation, enhancing the entire workflow within AP and AR.

-

Scalability and flexibility: Designed to accommodate increasing transaction volumes and adapt to evolving financial technologies, making it suitable for dynamic business environments.

-

Efficiency: Minimizes the need for manual intervention in AP and AR by automating routine tasks, thereby increasing processing speed and improving accuracy.

Choosing the right approach for AI integration in AP and AR

Selecting the optimal AI integration strategy for accounts payable and accounts receivable involves several critical considerations:

-

Specific business needs: Determine which aspects of the AP and AR processes can benefit from AI, such as invoice automation, payment matching, or risk assessment.

-

Resources and expertise: Assess the available internal expertise, budget, and technical infrastructure necessary to support AI deployment in financial operations.

-

Compliance and security requirements: Ensure that the AI solution complies with industry regulations and meets stringent data security standards to protect sensitive financial information.

-

Scalability and long-term goals: Opt for an AI strategy that accommodates current needs and is scalable to support future business growth and adapt to evolving market demands.

By carefully aligning your AI strategy with these factors, you can effectively enhance operational efficiency, improve compliance, and gain deeper financial insights in AP and AR, driving significant value for your organization.

AI Applications in Accounts Payable

AI has transformed the landscape of accounts payable, evolving from basic task automation to deploying advanced applications that enhance efficiency, accuracy, and strategic impact across financial operations.

Intelligent Document Processing (IDP)

| Use Case | Description | How AI Helps |

|---|---|---|

| Advanced OCR and Intelligent Character Recognition (ICR) | AI-driven OCR and ICR technologies extract data from various document formats. | AI enhances the accuracy of extracting data from semi-structured and unstructured documents, including handwritten texts. E.g., ZBrain’s content extractor agent can extract content from PDFs, Docx, txt, and PPT files using multimodal LLM and OCR capabilities, ensuring accessibility to financial data. |

| Handling semi-structured and unstructured data | Processing documents without standardized formats like PDFs and scanned images. | AI adapts to diverse invoice formats, automating the processing and reducing the need for manual data entry. This includes PDFs, scanned images and email attachments. |

| Document classification and routing | Classification and routing documents to appropriate workflows. | AI streamlines the document classification process by reducing manual sorting and routing, ensuring documents are processed more swiftly and accurately. |

Dynamic discounting and early payment programs

| Use Case | Description | How AI Helps |

|---|---|---|

| Instant adjustment to discount strategies | Adjusting discount offerings instantly based on various parameters. | AI helps adjust discount offers based on current financial conditions and vendor participation for better financial decisions. ZBrain’s discount verification agent can validate applied discounts on invoices, ensuring alignment with company policies and eligibility. |

| Vendor participation tracking | Monitoring and managing vendor participation in early payment programs. | AI streamlines the tracking process for vendor participation, ensuring efficient processing of payments qualifying for discounts. |

| Automated compliance verification | Ensuring that transactions comply with the terms of early payment discount programs. | AI automates the compliance verification process, reducing manual checks and increasing operational efficiency. |

Spend analysis and optimization

| Use Case | Description | How AI Helps |

|---|---|---|

| Categorization of spending | Automatic categorization of expenses aiding in a detailed analysis of spending patterns and budget management. | AI facilitates the efficient and accurate grouping of expenses, reducing manual effort and improving financial analysis accuracy. |

| Detection of spending trends | Anomaly detection and pattern recognition in spending indicating potential inefficiencies or opportunities for cost reduction. | AI enhances financial oversight by providing actionable insights into spending behaviors. For example, ZBrain’s procurement spend analysis agent can analyze spending patterns to identify cost-saving opportunities and improve efficiency across vendors and categories. |

| Vendor performance analysis | Comprehensive evaluation of vendor performance focusing on delivery, quality, and compliance metrics. | AI aids in effective vendor management by offering objective assessments of vendor reliability and performance. E.g., ZBrain’s vendor performance improvement agent can monitor vendor performance, analyze key metrics and provide actionable insights to improve service quality and contract compliance. |

| Identification of cost-saving opportunities | Analysis of spending patterns to identify potential savings and negotiation points. | AI supports the analysis of spending patterns, transaction histories, and vendor relationships to identify potential savings and negotiation points. It strengthens the company’s negotiating position by pinpointing areas where cost reductions are feasible. |

Supplier risk management

| Use Case | Description | How AI Helps |

|---|---|---|

| Assessment of supplier financial health | Evaluation of financial stability of suppliers through AI analysis. | AI enhances supply chain stability by identifying financial risks and preventing disruptions through the analysis of financial statements, market trends, and risk factors. For example, ZBrain’s vendor qualification assessment agent can automate vendor qualification, ensuring compliance and flagging risks to optimize procurement efficiency. |

| Monitoring of supplier performance | Assessment of supplier reliability and performance, focusing on various performance metrics. | AI enables proactive management of supply chain risks by offering real-time insights into supplier performance. |

| Compliance checks and regulatory monitoring | Automation of compliance verification with regulatory standards and company policies. | AI reduces legal and compliance risks by ensuring suppliers adhere to regulations and standards. ZBrain’s regulatory compliance monitoring agent can monitor government regulation pages, maintain a knowledge base of regulations, and send summaries of regulatory changes to stakeholders. |

Automated audit trail and compliance

| Use Case | Description | How AI Helps |

|---|---|---|

| Generation of audit trails | Automatic documentation of every transaction in accounts payable. | AI creates tamper-evident audit trails, enhancing transparency and accountability in financial reporting. |

| Automated compliance checks | Routine verification of compliance with regulations and policies. | AI ensures all accounts payable processes meet regulatory standards, automatically identifying and addressing any deviations. |

| Anomaly detection for audit requirements | Automated monitoring for unusual transactions within accounts payable. | AI helps detect potential fraud, errors, or compliance lapses, supporting robust audit and compliance practices. |

| Automated customer reminder | Streamlining audit prep by automating financial document gathering. | ZBrain’s automated customer reminder agent can streamline audit preparation by automating financial document gathering, ensuring compliance with minimal manual effort. |

Chatbots for AP support

| Use Case | Description | How AI Helps |

|---|---|---|

| AI-driven chatbots for inquiries | Instant responses to user queries via AI-powered chatbots. | AI helps AP teams and improves relationships by providing quick and accurate responses. |

| Automated responses to common queries | Chatbots handle routine accounts payable inquiries efficiently. | AI helps manage routine queries about invoices and payments, allowing teams to focus on more pressing issues. |

| Ticket routing for complex queries | Intelligent routing of complex inquiries to appropriate staff. | AI enhances issue resolution by directing complex queries to the right personnel for timely intervention. For example, ZBrain’s inquiry routing agent can route client inquiries to the right team, enhancing support via real-time analysis. |

Enhanced transaction management

| Use Case | Description | How AI Helps |

|---|---|---|

| Three-way matching | Automating matching invoices, purchase orders, and delivery receipts. | AI enhances transaction accuracy and speed to align documents and flag discrepancies. ZBrain’s purchase order-invoice matching agent can match purchase orders and invoices to ensure accuracy in quantities, prices, and delivery terms before payment approval. |

| Duplicate invoice detection | Identifying and flagging duplicate invoices, streamlining the accounts payable process. | ZBrain’s duplicate invoice detection agent can streamline the accounts payable process by identifying and flagging potential duplicate invoices, preventing overpayments. |

| Exception handling | Identifying discrepancies and automating their resolution. | AI leverages anomaly detection techniques to quickly adapt and resolve issues, minimizing manual oversight and speeding up corrections. |

| Automated transaction entries | Automating the recording of transactions into the general ledger. | AI enables data extraction and automation to ensure accurate ledger entries, reducing human error and improving financial data reliability. |

Contract management automation

| Use Case | Description | How AI Helps |

|---|---|---|

| Term extraction and analysis | Scanning contracts to identify and extract key terms and conditions. | Natural Language Processing (NLP) helps parse complex legal language, enhancing accuracy in contract analysis and compliance checks. ZBrain’s contract clause extraction agent can extract and categorize key contract clauses to streamline contract reviews, reducing human oversight. |

| Renewal management | Alerting teams about upcoming contract renewals. | ZBrain’s contract renewal notification agent can monitor contract expirations and send reminders for timely renewals, aiding teams in strategic decision-making. |

| Compliance monitoring | Monitoring contract performance against agreed terms. | ZBrain’s contract compliance check agent can validate contracts against compliance standards, ensuring no critical terms were altered in the data population process. |

AP audit and reporting automation

| Use Case | Description | How AI Helps |

|---|---|---|

| Automated report generation | Generation of comprehensive reports on demand. | AI helps aggregate data from multiple sources, analyze trends, and produce detailed reports that support strategic decision-making. |

| Real-time auditing and automated reminders | Performing real-time audits on transactions and automation of reminders. | ZBrain’s financial audit preparation agent can facilitate automated reminders to optimize customer communication and cash flow by notifying them about upcoming or overdue payments. |

Vendor portal integration

| Use Case | Description | How AI Helps |

|---|---|---|

| Automated data synchronization | Updating and synchronization of vendor data across systems. | AI ensures data accuracy and timeliness, minimizing human error and keeping vendor information current. ZBrain’s vendor data validation agent can validate data to ensure accuracy and compliance, streamlining processes and minimizing risks. |

| Streamlined communications | Facilitating smoother interactions with vendors through automated updates and notifications. | ZBrain’s supplier communication automation agent can automate communications for seamless contract renewals and routine interactions. Also, the AP Insights AI Agent can optimize supplier interactions by automating invoice-related queries with instant, accurate responses. |

| Enhanced transaction tracking | Tracking all transactions through the vendor portal. | AI helps maintain a detailed and transparent audit trail of all transactions, enhancing oversight and compliance. |

AI Applications in Accounts Receivable

AI is transforming accounts receivable, enhancing accuracy and speeding up financial transactions. From automating invoice processing to providing comprehensive analytics, AI enables more efficient and proactive financial management.

Advanced credit scoring and risk assessment

| Use Case | Description | How AI Helps |

|---|---|---|

| Analysis of customer behavior and market data | Analysis of customer payment history, purchasing patterns, and external market data. | AI enhances the accuracy of customer risk assessments by using data-driven insights to evaluate financial behaviors. |

| Dynamic credit scoring models | Adjustment in credit scoring models based on changing customer behavior and other factors. | AI provides more reliable credit assessments by adapting to changes in customer financial behaviors and other factors such as profitability and credit score changes. |

Personalized payment portals and experiences

| Use Case | Description | How AI Helps |

|---|---|---|

| Customization of payment portals | Customization of payment portals to individual customer preferences. | AI helps adapt payment interfaces to match customer preferences and usage patterns, making transactions easier and more intuitive. |

| Personalized payment options and schedules | Customization of payment options and schedules based on customer history and preferences. | AI improves payment efficiency and customer satisfaction by offering tailored solutions for individual needs. ZBrain’s client payment scheduling agent can schedule payments automatically, optimizing cash flows based on payment terms, cash flow needs, and history. |

| AI-powered chatbots for payment queries | AI chatbots offer instant support for customers with payment inquiries. | AI enhances customer service and reduces support workload by providing prompt and accurate responses to inquiries. |

Optimized payment reminders and collections

| Use Case | Description | How AI Helps |

|---|---|---|

| Personalized communication for collection | Facilitating tailored messaging based on customer behavior, enhancing collection rates. | Using customer-specific data, AI customizes communication strategies to approach each customer in the most effective manner, enhancing collections. |

| Automated invoice collection | Automation of overdue invoice collection with personalized reminders. | ZBrain’s automated invoice collection agent can automate overdue invoice collection with personalized reminders, enhancing cash flow and streamlining accounts receivable. |

| Late payment follow-up | Tracking of overdue invoices and sending reminders to clients. | ZBrain’s late payment follow-up agent can automate the tracking of overdue invoices, sending reminders to clients to enhance collections, improve recovery rates and reduce bad debt. |

| Client payment tracking | Monitoring client payments to update statuses in real-time. | ZBrain’s client payment tracking agent can monitor client payments, updating statuses in real-time to improve transparency and accuracy in accounts receivable. |

| Analysis of customer payment behavior | Analysis of payment patterns to determine the optimal timing and method for payment reminders. | By analyzing extensive payment data, AI identifies the best times and methods to engage each customer, thereby improving the likelihood of timely collections. |

| Dynamic reminder scheduling | Optimizing payment reminder schedules by analyzing customer payment patterns. | AI adjusts reminder schedules to more efficiently target times when customers are typically responsive, enhancing communication effectiveness. ZBrain’s automated dunning agent can automatically send reminders for overdue invoices, and customizing follow-ups. |

Dispute management and resolution

| Use Case | Description | How AI Helps |

|---|---|---|

| Identification and categorization of disputes | Categorization of disputes by analyzing transaction data, speeding up the resolution process. | AI facilitates a quicker understanding of the dispute’s nature and urgency, allowing for faster and more appropriate handling. |

| Automated routing of disputes to relevant teams | Routing disputes to the appropriate teams for efficient resolution. | ZBrain’s customer payment dispute resolution agent can resolve customer payment disputes by identifying invoice issues, ensuring speedy resolution and improved cash flow. |

| Dispute data analysis to prevent further occurrences | Analysis of dispute data to identify patterns and prevent potential issues. | AI allows companies to proactively adjust policies or processes to reduce the incidence of similar disputes in the future. |

Revenue optimization and customer value analysis

| Use Case | Description | How AI Helps |

|---|---|---|

| Identification of revenue risks and opportunities | Identifying risks and opportunities within revenue streams. | AI assists in strategic decision-making by identifying key areas that could influence the company’s financial health and growth. |

| Analysis of customer lifetime value | Assessing the long-term revenue potential from customers. | AI supports retention strategies for high-value clients and optimizes resource allocation to maximize customer lifetime value. |

Automated cash application

| Use Case | Description | How AI Helps |

|---|---|---|

| Matching of payments to invoices | Matching incoming payments to the appropriate invoices. | ZBrain’s invoice validation agent can automatically verify invoices by matching them with purchase orders and delivery records to detect discrepancies and prevent payment errors. |

| Handling of partial payments and complex scenarios | Managing intricate payment details like partial payments. | AI ensures precise account reconciliation and reduces accounting errors by effectively managing complex payment scenarios. |

| Automated reconciliation of bank statements | Automating the reconciliation of bank statements. | AI improves financial accuracy and reduces manual efforts by automating the process. ZBrain’s cash application automation agent can automate applying cash receipts, ensuring accurate and faster customer account reconciliation and reducing manual efforts. |

Automated document management

| Use Case | Description | How AI Helps |

|---|---|---|

| Document indexing and retrieving | Automating the indexing, filing, and retrieving of financial documents. | AI ensures documents are easily accessible and well-organized, enhancing document management efficiency. |

| Version control and audit trails | Managing versions of documents and maintaining detailed audit trails of changes. | AI ensures compliance with financial regulations and standards by tracking all modifications. ZBrain’s contract version tracking agent can automate draft revision tracking to ensure current versions are used, and all changes are documented for efficient management. |

| Automated invoice creation | Generation of invoices from purchase orders and service delivery data. | ZBrain’s invoice generation agent can generate invoices based on specific billing parameters and adjustments, with access to customer billing details for accuracy and customization. Also, its client invoice summarization agent can summarize client invoices, highlighting key details for quicker finance reviews. |

| Automated document validation | Validating documents against pre-set rules and criteria. | AI enhances the accuracy and completeness of financial document processing, ensuring regulatory compliance. |

Payment negotiations

| Use Case | Description | How AI Helps |

|---|---|---|

| Automated negotiation bots | AI-powered bots that handle and negotiate payment terms automatically. | AI optimizes payment terms based on customer profiles and past interactions, streamlining negotiations. |

| Dynamic payment plans | Suggesting dynamic payment plans for customers facing financial difficulties. | AI helps maintain customer loyalty and reduce churn by accommodating financial situations flexibly. |

| Real-time adjustment of credit terms | Recommending adjustments to credit terms based on ongoing risk assessments. | AI enhances financial risk management by dynamically adjusting credit terms in real time. |

Enhanced reporting and analytics

| Use Case | Description | How AI Helps |

|---|---|---|

| Real-time reporting | Real-time reporting capabilities for up-to-the-minute financial data. | AI enhances the ability to quickly respond to changes in the financial landscape through its real-time reporting. |

| Custom analytics dashboards | Customizable analytics dashboards for quick decisions. | AI enables stakeholders to make informed decisions rapidly through custom analytics dashboards with powerful visualizations for key metrics and insights. |

| Profitability analysis | Assessing the profitability of different customer segments. | AI helps in strategic decision-making about customer relationships and terms. It analyzes payment timeliness and associated costs to determine the profitability of different customer segments optimizing interactions and tailoring strategies for better financial outcomes. |

AI has transformed accounts payable and accounts receivable, transitioning from basic automation to advanced applications that enhance efficiency, accuracy, and strategic impact. This section explores transformative AI applications that redefine the norms of financial management.

Streamline your operational workflows with ZBrain AI agents designed to address enterprise challenges.

Benefits of AI in Accounts Payable and Accounts Receivable

Adopting artificial intelligence in accounts payable and accounts receivable systems delivers substantial enhancements across various dimensions of financial operations, contributing to improved operational efficiency and robust financial health. These advantages span quantifiable gains and qualitative improvements:

Quantifiable benefits of AI

-

Cost reduction: AI minimizes the operational costs associated with AP and AR by automating routine tasks like data entry, invoice processing, and reconciliations. This leads to decreased manpower costs and less overhead. Additionally, AI optimizes payment schedules to avoid penalties and secure early payment discounts, further trimming expenses.

-

Improved efficiency and processing time: By automating invoice and payment processing, AI significantly cuts down the time required for these activities. This swift processing enables finance teams to manage higher transaction volumes, boosting overall productivity.

-

Enhanced accuracy and reduced errors: AI eliminates common errors associated with manual processes in data handling, ensuring high accuracy in tasks such as data extraction and financial reconciliation. This accuracy results in fewer downstream corrections and adjustments, saving both time and resources.

-

Improved cash flow management: With advanced analytics, AI enhances visibility into cash flows, facilitating more effective management of incoming and outgoing funds. This capability allows businesses to optimize their financial resources for better liquidity management.

-

Reduced Days Sales Outstanding (DSO): AI-powered tools accelerate the collection process in AR, effectively reducing the Days Sales Outstanding and thereby improving the company’s liquidity and cash flow.

Qualitative benefits of AI in AP and AR

-

Stronger vendor relationships: Timely and accurate payments processed via AI-driven systems enhance vendor trust and reliability, fostering stronger business relationships and potentially better terms.

-

Enhanced customer satisfaction: AI enhances customer experience in AR by offering personalized payment solutions and expedited service, leading to higher customer satisfaction and loyalty.

-

Reduced fraud risk: AI’s capability to monitor and analyze real-time transaction patterns helps identify and mitigate fraud risks before they can impact the business significantly.

-

Team productivity and satisfaction: Automating mundane and repetitive tasks allows employees to focus on more strategic and engaging work, boosting both productivity and job satisfaction.

-

Better strategic decision-making: Real-time data and insights provided by AI enable more informed and timely decision-making, allowing finance teams to play a more strategic role in business growth.

Measuring Return on Investment (ROI)

To effectively measure the ROI from AI implementation in AP and AR, organizations should consider the following:

-

Cost savings: Assess reductions in labor and operational costs pre- and post-AI integration.

-

Efficiency gains: Quantify the decrease in time spent on processing invoices and payments.

-

Accuracy improvements: Monitor the reduction in error rates in invoicing and account reconciliations.

-

Cash flow improvements: Evaluate improvements in managing cash flow, particularly through faster collections and optimized payment timings.

-

ROI calculation: Compare these financial benefits against the costs of AI implementation and maintenance to determine the overall return on investment.

Challenges of AI Integration in AP and AR

Let’s discuss the challenges of AI integration in accounts payable and accounts receivable processes.

-

Integration complexity: Integrating AI technologies with existing financial systems like ERPs and accounting software can be challenging due to differing data standards, system architectures, and workflows. The process often reveals unexpected technical and functional mismatches that can disrupt established business processes and delay the realization of AI benefits.

-

Data privacy and security: Implementing AI in financial operations involves handling highly sensitive data, which increases the risk of data breaches and privacy violations. The complexity of securing AI systems against sophisticated cyber threats while ensuring they comply with evolving global data protection regulations adds a significant burden.

-

Cost of implementation and maintenance: The initial and ongoing costs associated with AI can be substantial. Beyond the upfront investment in technology, organizations must consider the expenses related to integrating AI into existing systems, training staff, and potentially increased operational costs due to new data management requirements. Balancing these costs with the expected benefits of AI is crucial for justifying the investment.

-

Change management and user adoption: Resistance to change is common in organizations as employees may fear job displacement or struggle with new workflows incorporating AI. Managing this change requires careful planning, including communication strategies that clearly outline the benefits of AI and training programs that help employees adapt to new technologies.

-

Data quality and availability: AI systems are highly dependent on the availability of large volumes of high-quality data. In many organizations, data may be siloed, outdated, or of poor quality, which can severely limit the effectiveness of AI technologies. Insufficient data can result in AI tools that are ineffective or prone to errors, undermining trust in the system and its outputs.

-

Security and compliance risks: When implementing AI in accounts payable and receivable, companies must navigate complex regulatory landscapes that govern data use and financial transactions. AI systems require stringent security protocols to protect against unauthorized access and ensure compliance with financial regulations. The challenge is to implement these measures without compromising system performance or user accessibility.

-

Algorithmic bias and fairness: There is a risk that AI systems may develop biases based on the data they are trained on. If the underlying data contains biases, the AI’s decisions and processes can perpetuate or even amplify these biases, leading to unfair outcomes for customers or vendors. Ensuring that AI operates fairly involves continuous monitoring and adjustment of algorithms to correct for any biases that may emerge.

-

Lack of internal expertise: Successfully implementing AI requires specific skills and knowledge that may not be present internally within a company. This can create a barrier to the effective deployment and maintenance of AI technologies. Investing in training for current employees or hiring new talent with expertise in AI can be costly and time-consuming but is essential for leveraging AI capabilities effectively.

While integrating AI into AP and AR presents several challenges, strategic planning and investment in proper resources can significantly enhance efficiency and financial operations.

Best Practices for Implementing AI in Accounts Payable and Accounts Receivable

Here are the best practices for successfully implementing AI in accounts payable and accounts receivable:

-

Define clear objectives and KPIs: Start with clear objectives and Key Performance Indicators (KPIs) aligning with your business goals. This approach helps measure the success of AI implementations and ensures AI is applied in areas that significantly impact your organization.

-

Prioritize data quality and governance: Ensure data accuracy, completeness, and proper structure before implementing AI. Good data governance practices, like standardization and cleansing, are crucial for maximizing AI model effectiveness and achieving optimal performance.

-

Choose the right AI solutions and technologies: Select AI solutions and technologies that match your business needs and are compatible with your existing infrastructure. Evaluate different AI platforms and solutions to choose the best fit.

-

Develop a phased implementation approach: Adopt a phased implementation strategy, starting with a pilot project before full-scale deployment. This approach minimizes risk, allows for adjustments, and ensures a smoother transition.

-

Invest in employee training and enablement: Train employees on using new AI-powered tools, address their concerns, and provide ongoing support. Ensuring users understand and are confident in using AI systems is crucial.

-

Implement robust security and compliance measures: Prioritize security and compliance to safeguard sensitive financial data. Implement strong access controls, data encryption, and compliance protocols to minimize risks.

-

Monitor performance and continuously improve: Monitor the performance of AI systems by tracking key metrics and regularly evaluate the system to ensure optimal performance, making adjustments and improvements as needed.

-

Establish a cross-functional project team: Create a project team that includes members from finance, IT, and other relevant departments. A collaborative approach ensures the implementation process is well-coordinated and considers all viewpoints.

-

Develop a robust change management strategy: Effective change management strategies are crucial for a smooth transition to AI-driven processes. These should include detailed training sessions, regular feedback loops, and incentives for early adoption among team members.

-

Maintain open communication and stakeholder engagement: Keep all stakeholders informed of progress, share regular updates, address concerns, and seek feedback to foster a collaborative environment and ensure a smooth transition to AI-powered solutions.

Following these best practices can help you effectively integrate AI into your AP and AR systems, enhancing efficiency and accuracy while ensuring a smooth operational transition.

Future Trends of AI in AP and AR Automation

As we look towards the future, AI’s role in accounts payable and accounts receivable is set to grow exponentially, bringing profound changes to how businesses manage their financial processes:

-

Greater adoption: By 2025, it’s anticipated that AI will automate up to 80% of AP and AR tasks. This massive shift is expected to cut down manual workloads significantly, enhance processing speeds, and allow finance teams to focus on strategic initiatives.

-

Mobile and remote work enhancements: As remote work continues to be prevalent, AI-driven mobile apps for AP and AR will become standard, allowing finance professionals to manage invoices, approvals, and payments from anywhere, at any time. This flexibility is crucial for supporting a distributed workforce and ensuring continuous financial operations outside of traditional office settings.

-

Voice-activated assistants: Voice-activated AI assistants will streamline accounting tasks by allowing professionals to perform queries and approvals through voice commands, enhancing operational efficiency and allowing for multitasking during busy periods.

-

Predictive analytics: AI will increasingly use historical data to forecast future trends, aiding in critical financial decisions. In AP and AR, predictive analytics will help identify potential late payments and optimize cash flow by adjusting credit terms and payment strategies accordingly.

-

Seamless system integrations: AI technologies will increasingly integrate with existing ERP systems and other financial tools to facilitate a more automated and cohesive AP and AR process. This will help eliminate data silos and enable real-time data sharing across departments.

-

Scaled efficiency and decision-making: AI will transform financial management by automating key tasks like invoice processing and payment matching, projected to boost efficiency by 25%. This accelerates workflows and reduces errors. Concurrently, AI’s predictive analytics will empower finance leaders with deep insights into historical data, aiding strategic decisions regarding budgeting, investments, and cash flow management. This synergy enhances both operational speed and financial foresight.

By automating routine tasks and providing strategic insights, AI will transform financial management, enabling businesses to adapt to changing demands quickly and accurately. This shift towards AI-driven processes heralds a new era in financial operations, promising significant gains in productivity and strategic capability.

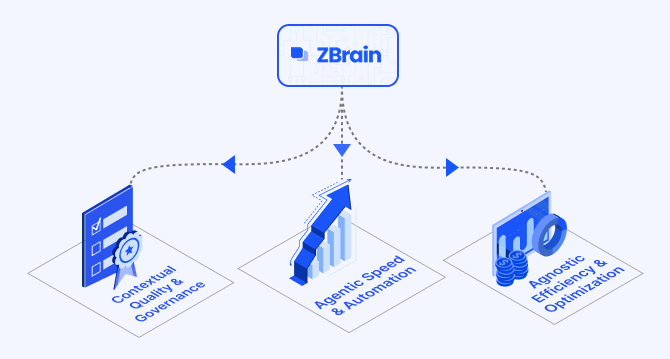

Transforming Accounts Payable and Accounts Receivable with ZBrain: A Full-Stack Agentic AI Orchestration Platform

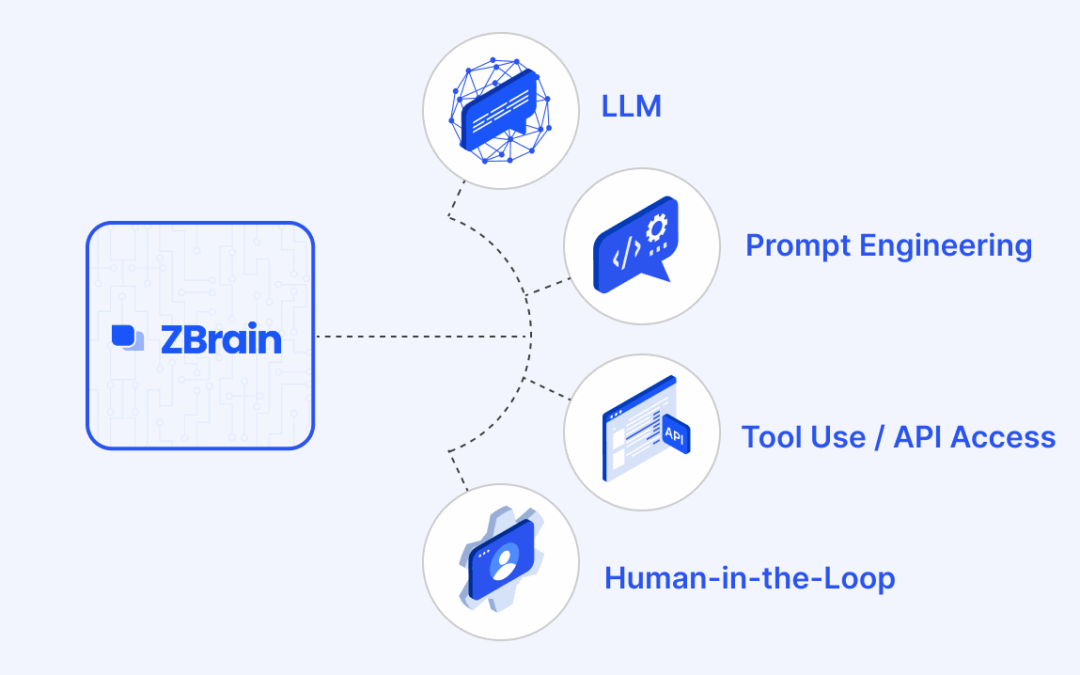

ZBrain’s advanced AI capabilities make it an excellent tool for optimizing Accounts Payable (AP) and Accounts Receivable (AR) processes, enhancing automation, boosting efficiency, and supporting strategic decision-making.

-

AI readiness assessment: ZBrain’s AI readiness assessment framework, ZBrain XPLR, evaluates an organization’s current capabilities and readiness for AI adoption in AP and AR processes. It provides actionable insights, helping businesses identify strengths and areas for improvement to ensure a successful AI integration.

-

Low-code development: The ZBrain Builder low-code platform enables the creation of custom AI solutions tailored to the unique challenges of AP and AR processes, accessible even to users without deep technical skills.

-

Proprietary data utilization: ZBrain allows organizations to effectively use their proprietary data, ensuring AI solutions are customized to meet their financial operations’ specific needs and objectives.

-

Enterprise-ready: Designed for large-scale environments, ZBrain offers robust security, scalability, and integration with existing financial systems, making it ideal for large organizations.

-

End-to-end support: ZBrain provides comprehensive management of AP and AR AI applications—from development through deployment and ongoing maintenance—ensuring continuous optimization and seamless operation.

-

Flexible data ingestion: By integrating data from various sources, ZBrain supports AP and AR processes with real-time financial information, enhancing decision-making, financial reporting, and operational efficiency.

-

Intelligent agent creation: AI agents developed on ZBrain Builder can automate essential tasks in AP and AR, such as invoice processing, payment reconciliation, and financial reporting, significantly reducing manual labor and increasing efficiency.

These features make ZBrain a powerful platform that helps organizations streamline their AP and AR processes, improving overall financial operations’ efficiency, accuracy, and scalability.

Benefits of ZBrain for accounts payable and accounts receivable departments

Key benefits for AP and AR departments include:

-

Tailored solutions: ZBrain Builder helps AP and AR teams create custom solutions tailored to address specific payment and collection processes, allowing them to resolve unique challenges.

-

Automation of complex processes: ZBrain can automate intricate workflows such as invoice processing, payment matching, and credit management, reducing manual work and allowing professionals to focus on strategic financial management.

-

Enhanced decision-making: ZBrain aids in analyzing large volumes of transaction data swiftly, leading to quicker and more informed financial decisions that help optimize cash flow and reduce days sales outstanding (DSO).

-

Increased efficiency: Automating repetitive tasks and streamlining transaction workflows result in faster processing times, enhanced operational efficiency, and reduced costs, helping businesses maintain lean and effective financial operations.

-

Scalability: ZBrain can empower AP and AR teams to develop scalable solutions tailored to their evolving needs, enabling them to expand their operations without sacrificing accuracy or compliance.

By streamlining routine financial operations, enhancing data-driven decision-making, and optimizing overall financial management, ZBrain helps AP and AR departments focus on delivering strategic value and insights. As the landscape of financial management evolves, ZBrain serves as an indispensable tool for any organization aiming to leverage generative AI to refine financial practices and drive business success.

Endnote

The integration of AI in accounts payable and receivable (AP and AR) is transforming how companies manage their financial transactions by automating routine tasks and providing deep analytical insights. This technology reduces the need for manual input, enhances compliance, and accelerates financial processes, aligning perfectly with strategic business objectives. As AI continues to evolve, its capacity to refine AP and AR functions will further assist organizations in staying competitive, nimble, and well-prepared for future financial challenges. Adopting AI-driven solutions equips businesses to excel, fostering enhanced operational efficiency and continuous innovation in financial management.

Ready to transform your financial operations with AI? ZBrain can streamline your processes, boost accuracy, and maximize the financial benefits for your organization. Reach out now to see how our solutions can drive efficiency and boost your bottom line.

Listen to the article

Author’s Bio

An early adopter of emerging technologies, Akash leads innovation in AI, driving transformative solutions that enhance business operations. With his entrepreneurial spirit, technical acumen and passion for AI, Akash continues to explore new horizons, empowering businesses with solutions that enable seamless automation, intelligent decision-making, and next-generation digital experiences.

Table of content

- Introduction to Accounts Payable and Accounts Receivable

- The Role of AI in Transforming Accounts Payable and Accounts Receivable

- Approaches to Integrating AI into Accounts Payable and Accounts Receivable

- AI Applications in Accounts Payable

- AI Applications in Accounts Receivable

- Benefits of AI in Accounts Payable and Accounts Receivable

- Challenges of AI Integration in AP and AR

- Best Practices for Implementing AI in Accounts Payable and Accounts Receivable

- Future Trends of AI in AP and AR Automation

- Transforming Accounts Payable and Accounts Receivable with ZBrain: A Full-Stack Agentic AI Orchestration Platform

What is ZBrain, and how can it optimize AP and AR processes with AI?

ZBrain is a comprehensive AI enablement platform designed to streamline the assessment, development, and deployment of AI solutions for accounts payable and accounts receivable. ZBrain offers comprehensive support for integrating AI across these financial functions.

-

AI readiness assessment with ZBrain XPLR: This tool evaluates your organization’s preparedness for AI, providing insights to adopt AI for AP and AR enhancements strategically.

-

Seamless data integration with ZBrain Builder: Connects with financial systems to enable efficient data ingestion, creating a unified pipeline for real-time financial processing.

-

Low-code development environment: ZBrain Builder’s intuitive interface allows finance teams to develop AI solutions with minimal programming, speeding up the deployment process.

-

Cloud and model flexibility: Supports various AI models and integrates with multiple cloud environments, ensuring optimal infrastructure use for AP and AR processes.

-

Enhanced compliance and governance: ZBrain enhances regulatory compliance and governance, ensuring data security and continuous audit readiness throughout financial operations.

ZBrain’s capabilities streamline critical financial tasks, from invoice processing to payment reconciliation, enhancing efficiency and accuracy in AP and AR operations.

How does ZBrain ensure the security and privacy of data in AP and AR processes?

ZBrain is designed with a strong emphasis on data privacy and security, ensuring that sensitive information involved in AP and AR operations is safeguarded at all stages. Here’s how ZBrain protects sensitive financial data:

-

Private cloud deployments: Allows deployment in a secure private cloud, ensuring that sensitive financial data remains within the organization’s control.

-

Robust security features: Incorporates comprehensive security measures, including:

-

Access controls: Granular role-based access controls ensure that only authorized personnel can view or manage sensitive financial information.

-

Compliance adherence: ZBrain is built to adhere to industry-specific regulations and standards, ISO 27001:2022 and SOC 2 Type II, ensuring that data is handled in a manner that meets compliance requirements for confidentiality, integrity, and accountability.

-

Can ZBrain agents integrate with existing AP and AR systems?

Yes, ZBrain agents are specifically designed to integrate seamlessly with existing AP and AR systems. The platform accommodates various data formats and adheres to organizational standards, ensuring smooth interoperability with legacy financial systems, ERP solutions, and accounts management tools.

This integration facilitates organizations to:

-

Leverage existing infrastructure: Enhance current AP and AR processes without the need for a complete overhaul of existing systems.

-

Enrich data and workflows: Connect ZBrain agents with existing tools to automate workflows and improve the accessibility and utility of financial data.

-

Drive AI-driven insights: Utilize AI capabilities to refine payment processing, risk assessment, and customer credit management while enhancing decision-making capabilities and maintaining compatibility with existing technologies.

By enabling seamless integration, ZBrain ensures that organizations can upgrade their AP and AR processes effectively, aligning with modern AI advancements without disrupting established systems.

What types of AP and AR agents can be built on ZBrain Builder?

ZBrain Builder enables the development of AI agents specifically tailored for accounts payable and accounts receivable processes. These agents are designed to assist in automating invoice matching, optimizing payment schedules, enhancing customer credit assessments, and improving financial transaction accuracy. ZBrain’s advanced AI capabilities enable organizations to streamline data integration, reduce manual tasks, and leverage AI-driven insights for more effective decision-making in financial operations.

How does ZBrain cater to diverse AP and AR needs across finance operations?

ZBrain’s versatility allows it to meet various accounts payable and accounts receivable needs. Organizations can utilize ZBrain Builder to develop customized AI agents that automate invoice processing, optimize payment collections, streamline account reconciliations, and ensure compliance with financial regulations. Its powerful AI agents help businesses enhance operational efficiency, accuracy, and adherence to regulatory standards in their AP and AR processes across various industries.

How can we measure the ROI of ZBrain in our accounts payable and receivable processes?

Evaluating the ROI of ZBrain in AP and AR processes requires examining key performance indicators (KPIs) related to automation, accuracy, and operational efficiency. Here are essential metrics to consider:

-

Reduced manual processing: Automating tasks such as invoice matching, payment scheduling, and account reconciliations can lead to quicker processing times, fewer mistakes, and greater accuracy.

-

Accelerated transaction processing: Automating payment and collection cycles enhances the speed of financial transactions, contributing to more timely financial operations.

-

Enhanced compliance: Automated systems help maintain regulatory compliance by ensuring consistent application of rules and reducing human error, enhancing overall governance.

-

Operational efficiency: Integrating real-time data updates and automating financial processes can reduce operational costs and improve financial management efficiency.

Monitoring these KPIs helps businesses understand the extent to which ZBrain enhances their financial operations, streamlines workflows, and ensures compliance, thereby demonstrating tangible returns on investment.

How can I get started with ZBrain for optimizing AP and AR?

To begin using ZBrain for your AP and AR processes, contact us at hello@zbrain.ai or complete the inquiry form on our website. Our team will assist in integrating ZBrain with your existing systems to streamline and enhance your financial operations.

Insights

A guide to intranet search engine

Effective intranet search is a cornerstone of the modern digital workplace, enabling employees to find trusted information quickly and work with greater confidence.

Enterprise knowledge management guide

Enterprise knowledge management enables organizations to capture, organize, and activate knowledge across systems, teams, and workflows—ensuring the right information reaches the right people at the right time.

Company knowledge base: Why it matters and how it is evolving

A centralized company knowledge base is no longer a “nice-to-have” – it’s essential infrastructure. A knowledge base serves as a single source of truth: a unified repository where documentation, FAQs, manuals, project notes, institutional knowledge, and expert insights can reside and be easily accessed.

How agentic AI and intelligent ITSM are redefining IT operations management

Agentic AI marks the next major evolution in enterprise automation, moving beyond systems that merely respond to commands toward AI that can perceive, reason, act and improve autonomously.

What is an enterprise search engine? A guide to AI-powered information access

An enterprise search engine is a specialized software that enables users to securely search and retrieve information from across an organization’s internal data sources and systems.

A comprehensive guide to AgentOps: Scope, core practices, key challenges, trends, and ZBrain implementation

AgentOps (agent operations) is the emerging discipline that defines how organizations build, observe and manage the lifecycle of autonomous AI agents.

Adaptive RAG in ZBrain: Architecting intelligent, context-aware retrieval for enterprise AI

Adaptive Retrieval-Augmented Generation refers to a class of techniques and systems that dynamically decide whether or not to retrieve external information for a given query.

How ZBrain breaks the trade-offs in the AI iron triangle

ZBrain’s architecture directly challenges the conventional AI trade-off model—the notion that enhancing one aspect inevitably compromises another.

ZBrain Builder’s AI adaptive stack: Built to evolve intelligent systems with accuracy and scale

ZBrain Builder’s AI adaptive stack provides the foundation for a modular, intelligent infrastructure that empowers enterprises to evolve, integrate, and scale AI with confidence.