AI for control and risk management: Scope, integration, use cases, challenges and future outlook

Listen to the article

Control and risk management are integral to every organization’s health, encompassing financial oversight, regulatory compliance, operational safeguards, and strategic risk assessment. Failure to effectively manage these areas can result in financial misstatements, regulatory penalties, reputational damage, or operational disruptions. Yet, traditional control and risk management often involve time-consuming manual processes, disparate data sources, and reactive measures—leaving businesses vulnerable to undetected risks and slow to adapt in a rapidly evolving environment.

AI is increasingly revolutionizing control and risk management by automating labor-intensive tasks, monitoring compliance in real-time, and enhancing predictive analytics. A recent Deloitte survey confirms that AI, particularly generative AI, is becoming a critical enabler for fraud detection and broader enterprise risk management strategies. Detecting fraud and managing risk are among the top benefits organizations expect from generative AI, with approximately 25%–30% of respondents indicating its impact. Businesses can proactively address issues before they escalate by incorporating AI across processes like anomaly detection, regulatory reporting, and strategic scenario modeling.

As AI adoption accelerates, platforms like ZBrain are pivotal in embedding intelligent automation into control and risk management workflows. Whether augmenting audit activities, streamlining capital allocation decisions, or continuously scanning for policy breaches, ZBrain helps teams harness AI-driven analytics for faster, more accurate decision-making. Beyond automation, ZBrain’s assessments identify process bottlenecks and recommend targeted AI solutions that enhance operational resilience, strengthen compliance, and safeguard an organization’s reputation.

This article explores how AI is transforming control and risk management, driving efficiency, and creating a forward-thinking approach to organizational risk. It also highlights how platforms like ZBrain empower enterprises to automate critical tasks, optimize financial and operational controls, and foster a proactive, data-informed decision-making culture in an increasingly complex business landscape.

- What is the control and risk management process?

- Understanding the control and risk management stages

- Transforming control and risk management processes: How AI solves traditional challenges

- Approaches to integrating AI into control and risk management

- AI applications transforming the control and risk management processes

- Why ZBrain is the ideal platform for control and risk management

- Benefits of implementing AI in control and risk management

- Measuring the ROI of AI in control and risk management

- Challenges and considerations in adopting AI for control and risk management

- Best practices for implementing AI in control and risk management

- The future of AI in control and risk management

- Transform control and risk management processes with ZBrain

What is the control and risk management process?

Control and risk management is a structured approach to identifying, assessing, mitigating, and monitoring organizational risks. It ensures financial integrity, regulatory compliance, and operational resilience through governance frameworks, financial controls, and proactive risk mitigation strategies. This process encompasses risk governance, financial exposure management, compliance monitoring, capital and liquidity risk controls, stress testing, and enterprise risk management (ERM) to safeguard business stability and continuity.

The control and risk management process follows a structured framework comprising five key stages. It begins with risk governance, compliance, and financial control, which involves establishing governance structures, regulatory compliance, and financial oversight to embed a risk-aware culture. The next stage focuses on risk identification and financial exposure management, defining the risk universe, categorizing financial risks, and managing tax and cash flow exposures. Risk assessment and stress testing follow, involving risk quantifying risks through advanced financial models, conducting scenario analyses, and prioritizing risk responses. The fourth stage, risk treatment, financial controls, and capital resilience, entails implementing financial controls, liquidity risk measures, and fraud prevention strategies. Finally, continuous risk monitoring, reporting, and optimization ensure real-time risk monitoring, regulatory reporting, independent audits, and process enhancements. By integrating these stages into a cohesive risk management framework, organizations can mitigate financial, operational, and regulatory risks, strengthen decision-making, and ensure long-term business continuity.

While control and risk management is a process-driven discipline, automation significantly enhances its effectiveness. AI-powered platforms and risk management tools enable businesses to automate compliance tracking, detect anomalies in financial transactions, forecast risks, and streamline audit processes. Organizations can enhance fraud detection, optimize internal controls, and improve risk response strategies by leveraging predictive analytics, AI-driven monitoring, and intelligent workflows.

Effective control and risk management enable businesses to minimize financial and operational risks, improve governance, and ensure regulatory compliance. Organizations can manage risks with precision, agility, and scalability by integrating automation, AI-driven risk analytics, and adaptive compliance frameworks, ensuring sustainable business growth and resilience.

Why is control and risk management important?

Control and risk management are crucial in business operations by mitigating financial, operational, and regulatory risks while ensuring compliance with industry standards and governance frameworks. It provides a structured approach to risk identification, assessment, and response, helping organizations proactively manage uncertainties and protect financial assets.

One of the key benefits of effective control and risk management is the standardization of internal controls and risk mitigation practices. By enforcing consistent financial reporting, fraud detection mechanisms, and regulatory compliance protocols, businesses can minimize financial misstatements, prevent fraud, and reduce operational disruptions. This structured approach not only enhances financial accuracy and audit readiness but also strengthens stakeholder confidence and business reputation.

A well-implemented risk management framework ensures adherence to financial regulations and enables businesses to respond effectively to evolving risks. AI-driven risk monitoring tools help organizations identify compliance gaps, forecast financial risks, and automate regulatory reporting, reducing audit risks and enhancing financial transparency. Additionally, data-driven risk insights empower leadership teams to make informed strategic decisions, optimize capital allocation, and strengthen operational resilience.

Control and risk management ultimately safeguard business continuity, enhance compliance, and strengthen financial governance. Organizations can proactively mitigate risks, optimize financial controls, and drive long-term business sustainability by integrating AI-driven risk analytics, predictive modeling, and automation.

Understanding the control and risk management stages

Financial risk management involves identifying, measuring, monitoring, and controlling risks. A structured approach ensures a comprehensive, stepwise process for managing financial risks and controls effectively. It covers everything from establishing a strong governance foundation to continuous monitoring and improvement, with each stage incorporating industry best practices.

Stage 1: Risk governance, compliance and financial control

-

Step 1.1: Establish governance and risk oversight

-

Define board-level risk oversight, including risk committees, CFO leadership, and internal audit (Three Lines of Defense Model).

-

Ensure regulatory compliance with applicable financial regulations, corporate governance requirements, and industry standards governing capital adequacy, financial reporting, and internal controls.

-

Embed a risk-aware culture across finance and operations.

-

-

Step 1.2: Define risk context and business strategy alignment

-

Establish risk appetite frameworks, linking financial risk management to capital allocation, liquidity management, and financial strategy.

-

Consider external market risks, regulatory risks, and economic shifts when setting policies.

-

-

Step 1.3: Finance compliance and internal controls

-

Ensure adherence to corporate governance laws, tax compliance requirements, and financial reporting regulations applicable to the organization’s jurisdiction and industry.

-

Implement financial reporting controls to prevent fraud, misstatements, and non-compliance risks.

-

Stage 2: Risk identification and financial exposure management

-

Step 2.1: Identify risk universe and financial exposures

-

Categorize strategic, financial, operational, and compliance risks across finance functions (credit, market, liquidity, fraud, cyber, tax).

-

Maintain a risk register to document all material risks.

-

-

Step 2.2: Tax and cash flow risk management

-

Develop tax risk strategies, transfer pricing policies, and regulatory tax compliance.

-

Implement cash flow forecasting and liquidity stress testing to mitigate liquidity risk.

-

-

Step 2.3: Capital and investment risk management

-

Assess capital adequacy planning, ensuring alignment with applicable capital requirements and risk-based financial regulations.

-

Implement investment risk management controls to mitigate exposure to credit, interest rate, and foreign exchange risk.

-

Stage 3: Risk assessment and stress testing

-

Step 3.1: Quantify and evaluate risks

-

Apply Value at Risk (VaR), Monte Carlo simulations, Expected Loss (EL) models, and sensitivity analysis.

-

Conduct operational risk impact analysis (e.g., fraud, cyber risk, compliance breaches).

-

-

Step 3.2: Stress testing and scenario analysis

-

Perform macro and micro stress tests for market shocks, recessionary scenarios, or regulatory changes.

-

Assess potential liquidity crises and capital buffer adequacy.

-

-

Step 3.3: Prioritize and allocate risk responses

-

Rank risks based on financial exposure, regulatory impact, and business continuity priorities.

-

Establish KRIs (Key Risk Indicators) to track vulnerabilities in financial controls.

-

Stage 4: Risk treatment, financial controls and capital resilience

-

Step 4.1: Risk mitigation and financial control strategies

-

Implement financial hedging, credit risk mitigation, and fraud prevention controls.

-

Establish financial reporting controls to prevent financial misstatements and compliance risks.

-

-

Step 4.2: Capital and liquidity risk controls

-

Maintain capital buffers, reserve allocations, and funding contingency plans.

-

Ensure compliance with applicable liquidity and funding requirements to maintain financial stability and risk resilience.

-

-

Step 4.3: Financial transaction risk monitoring

-

Automate real-time transaction monitoring, fraud detection, and payment risk mitigation.

-

Stage 5: Continuous risk monitoring, reporting and optimization

-

Step 5.1: Risk and compliance monitoring

-

Implement continuous audit controls, compliance risk tracking, and real-time fraud detection.

-

Monitor Key Risk Indicators (KRIs) for early warning signals.

-

-

Step 5.2: Risk reporting and regulatory compliance

-

Conduct required risk disclosures, financial reporting compliance, and regulatory filings in accordance with applicable standards and jurisdictional requirements.

-

Provide board-level risk reporting and quarterly financial risk assessments.

-

-

Step 5.3: Independent review and process optimization

-

Conduct regular internal audits, stress-test reviews, and continuous improvements to risk management frameworks to ensure compliance and operational resilience.

-

Enhance AI-driven risk analytics for predictive financial risk intelligence.

-

Transforming control and risk management processes: How AI solves traditional challenges

In financial risk management, traditional methods often grapple with inefficiencies and heightened risks due to manual processes and static models. Artificial Intelligence (AI) integration offers transformative solutions across various stages, enhancing accuracy, compliance, and operational resilience. Below is an overview of key challenges, their impacts, and how AI addresses them:

|

Risk management stage |

Challenges with traditional methods |

AI solutions |

|---|---|---|

|

Risk identification |

|

|

|

Risk assessment |

|

|

|

Risk treatment |

|

|

|

Risk monitoring and reporting |

|

|

By leveraging AI in control and risk management, organizations can reduce financial risks, improve regulatory adherence, enhance fraud detection, and optimize risk-informed decision-making—ensuring long-term business stability and resilience.

Streamline your operational workflows with ZBrain AI agents designed to address enterprise challenges.

Approaches to integrating AI into control and risk management

AI is transforming control and risk management by automating compliance processes, enhancing risk assessment, and improving financial governance. Businesses can leverage AI-driven strategies to strengthen tax management, financial compliance, operational risk mitigation, and enterprise risk governance based on their organizational priorities, resources, and long-term risk strategy. Below are key approaches to integrating AI into control and risk management.

Custom, in-house AI development

This approach involves building a tailored AI solution to manage regulatory compliance, fraud detection, financial risk assessment, and internal controls. AI models can automate tax calculations, monitor compliance gaps, and predict financial risks in real-time.

Advantages:

-

Customization: Aligns with specific risk management workflows, such as automated risk scoring, compliance tracking, and fraud detection.

-

Full control: Ensures compliance with industry regulations while maintaining strict data security.

-

Scalability: Adapts to evolving risk landscapes, supporting continuous monitoring and proactive risk mitigation strategies.

Using AI point solutions

Businesses can integrate pre-built AI tools designed for specific risk management functions, such as AI-driven fraud detection, real-time audit monitoring, and tax compliance automation.

Advantages:

-

Quick deployment: Ready-to-use solutions improve efficiency in areas like compliance audits, transaction monitoring, and risk analysis.

-

Cost-effective: Requires fewer development resources compared to custom AI solutions.

-

Ease of use: Integrates seamlessly with ERP, governance risk and compliance (GRC) systems, and financial reporting tools for enhanced control and risk management.

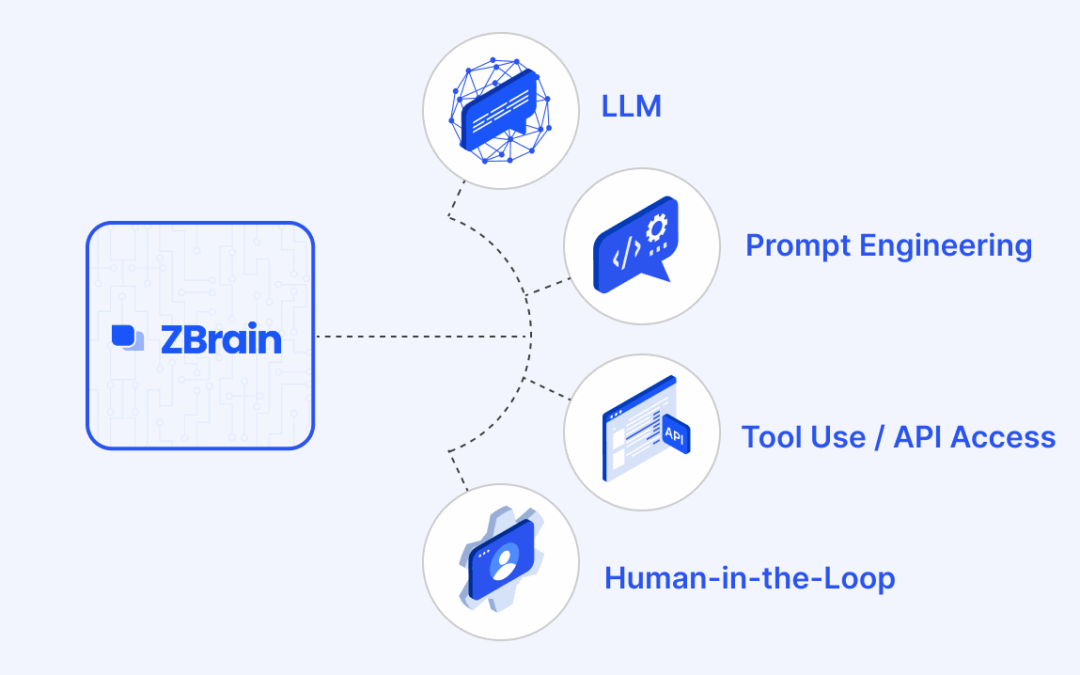

Adopting a comprehensive AI platform

A full-scale AI platform like ZBrain integrates multiple AI capabilities to optimize the entire control and risk management lifecycle—from compliance monitoring to financial risk assessment and enterprise-wide risk governance. It provides real-time insights, automated workflows, and predictive analytics to mitigate financial and operational risks.

Advantages:

-

Centralized risk and compliance management: Ensures adherence to global financial regulations while maintaining data integrity.

-

End-to-end automation: Enhances internal controls, financial risk analysis, tax reporting, and compliance tracking, reducing manual intervention.

-

Scalability and flexibility: Adapts to evolving business risks, supporting enterprise-wide compliance frameworks and financial governance models.

-

Efficiency boost: Improves risk forecasting accuracy, minimizes compliance violations, and strengthens financial decision-making.

Choosing the right AI integration approach

To effectively implement AI in control and risk management, businesses should consider:

-

Regulatory requirements: Identify key compliance areas such as tax compliance, financial reporting, and fraud prevention.

-

Operational needs: Determine which risk processes—audit automation, control testing, or liquidity risk forecasting—require AI-driven enhancements.

-

Resources and expertise: Assess internal capabilities and budget constraints for AI adoption.

-

Data security and governance: Ensure AI solutions comply with financial regulations and cybersecurity standards.

-

Scalability and future risk trends: Select an AI strategy that supports long-term risk mitigation, regulatory adaptability, and business growth.

Organizations can enhance compliance, minimize financial risks, and strengthen enterprise resilience against uncertainties by aligning AI integration with business risk priorities.

AI applications transforming the control and risk management processes

Artificial intelligence (AI) is revolutionizing control and risk management by automating processes, enhancing decision-making, and improving compliance. Organizations can proactively identify and mitigate risks by integrating AI-driven solutions, ensuring operational resilience and regulatory adherence. Below is a structured framework detailing how AI applications are transforming control and risk management across various stages.

Stage 1: Risk governance, compliance, and financial control

Step 1.1: Establish governance and risk oversight

- AI-driven compliance monitoring: AI systems can continuously analyze financial operations, contracts, and regulatory obligations, flagging potential compliance issues for prompt action.

- Automated policy updates: AI monitors regulatory changes and recommends necessary policy revisions, ensuring alignment with current standards.

Step 1.2: Define risk context and business strategy alignment

- Risk appetite frameworks: AI facilitates the development of risk appetite frameworks by analyzing vast datasets and linking financial risk management to capital allocation, liquidity management, and overall financial strategy.

- External risk assessment: AI evaluates external market risks, regulatory changes, and economic shifts, aiding in formulating responsive policies.

Step 1.3: Finance compliance and internal controls

- Automated compliance validation: AI agents perform thorough checks to ensure all operations adhere to necessary standards and regulations, reducing manual effort and enhancing accuracy.

- Fraud detection: AI systems analyze patterns in financial transactions to detect anomalies, prevent fraud and ensure data integrity.

How ZBrain enhances risk governance, compliance, and financial control

| Step | Use case | Description | How ZBrain helps |

|---|---|---|---|

| Step 1.1: Establish governance and risk oversight | AI-driven compliance monitoring | Analyzes financial operations, contracts, and regulatory obligations, flagging potential compliance issues for prompt action. | ZBrain’s Compliance Risk Assessment Agent automates the assessment of compliance risks by reviewing financial operations, contracts, and regulatory obligations, flagging any potential issues for action. |

| Automated policy updates | Monitors regulatory changes and recommends necessary policy revisions, ensuring alignment with current standards. | ZBrain’s Regulatory Filing Automation Agent streamlines regulatory filings by automating data preparation and compliance checks, ensuring timely and accurate submissions. | |

| Step 1.2: Define risk context and business strategy alignment | Risk appetite frameworks development | Facilitates the development of risk appetite frameworks by analyzing vast datasets and linking financial risk management to capital allocation, liquidity management, and overall financial strategy. | ZBrain’s Liquidity Planning Optimization Agent optimizes liquidity planning by analyzing cash reserves and obligations, ensuring efficient cash flow management. |

| External risk assessment | Evaluates external market risks, regulatory changes, and economic shifts, aiding in the formulation of responsive policies. | ZBrain’s Supplier Risk Assessment Agent streamlines supplier onboarding by automating risk assessments based on financial stability and regulatory compliance. | |

| Step 1.3: Finance compliance and internal controls | Automated compliance validation | Performs thorough checks to ensure all operations adhere to necessary standards and regulations, reducing manual effort and enhancing accuracy. | ZBrain’s Corporate Policy Compliance Agent ensures financial compliance by checking transactions against company policies and flags issues for finance team review. |

| Fraud detection | Analyzes patterns in financial transactions to detect anomalies, prevent fraud and ensure data integrity. | ZBrain’s Duplicate Invoice Detection Agent streamlines the accounts payable process by identifying and flagging potential duplicate invoices, preventing overpayments. |

Stage 2: Risk identification and financial exposure management

Step 2.1: Identify risk universe and financial exposures

- Comprehensive risk categorization: AI tools categorize strategic, financial, operational, and compliance risks across finance functions, maintaining an updated risk register.

Step 2.2: Tax and cash flow risk management

- Tax compliance automation: AI assists in developing tax risk strategies, managing transfer pricing policies, and ensuring regulatory tax compliance.

- Cash flow forecasting: AI models predict cash flow trends, enabling proactive liquidity management and stress testing.

Step 2.3: Capital and investment risk management

- Investment risk analysis: AI evaluates investment portfolios to mitigate credit, interest rate, and foreign exchange risk exposure.

How ZBrain enhances risk identification and financial exposure management

| Step | Use case | Description | How ZBrain helps |

|---|---|---|---|

| Step 2.1: Identify risk universe and financial exposures | Comprehensive risk categorization | Categorizes strategic, financial, operational, and compliance risks across finance functions, maintaining an updated risk register. | ZBrain’s Compliance Risk Assessment Agent automates the assessment of compliance risks by reviewing financial operations, contracts, and regulatory obligations, flagging any potential issues for action. |

| Step 2.2: Tax and cash flow risk management | Tax compliance automation | Assists in developing tax risk strategies, managing transfer pricing policies, and ensuring regulatory tax compliance. | ZBrain’s Corporate Tax Review Agent reviews corporate tax filings for compliance, identifying discrepancies to minimize errors and streamline the preparation process |

| Cash flow monitoring | Analyzes cash inflows and outflows to enhance liquidity management and support stress testing | ZBrain’s Cash Flow Monitoring Agent monitors cash inflows and outflows to provide real-time liquidity insights, reducing cash shortage risks and aiding decisions. | |

| Step 2.3: Capital and investment risk management | Investment risk analysis | Evaluates investment portfolios to mitigate exposure to credit, interest rate, and foreign exchange risks. | ZBrain’s Risk Scoring Agent assigns risk scores to identified factors, streamlining legal risk management with consistent, adaptable GenAI-driven assessments. |

Stage 3: Risk assessment and stress testing

Step 3.1: Quantify and evaluate risks

- Advanced risk modeling: AI enhances traditional risk assessment methods by capturing non-linear relationships between macroeconomic factors and financial metrics, leading to more accurate risk evaluations.

- Operational risk analysis: AI algorithms analyze patterns in large datasets to identify potential fraud, cyber threats, and compliance breaches, enabling proactive risk mitigation.

Step 3.2: Stress testing and scenario analysis

- AI-driven stress testing: AI automates the generation of stress test scenarios, allowing financial institutions to respond quickly to emerging risks and regulatory changes.

- Liquidity crisis simulation: AI models simulate potential liquidity crises by analyzing market conditions and transaction patterns in real-time, providing insights for maintaining adequate capital buffers.

Step 3.3: Prioritize and allocate risk responses

- Risk ranking and resource allocation: AI systems rank risks based on financial exposure and regulatory impact, aiding in strategically allocating resources for effective risk mitigation.

- Key risk indicators (KRIs) development: AI establishes KRIs by analyzing data to monitor vulnerabilities in financial controls, providing early warning signals for potential issues.

How ZBrain enhances risk assessment and stress testing

| Step | Use case | Description | How ZBrain helps |

|---|---|---|---|

| Step 3.1: Quantify and evaluate risks | AI-driven risk quantification | Utilizes AI models for precise risk measurement. | ZBrain’s Risk Assessment Agent automates the quantification of risks, enabling accurate and efficient risk measurement and facilitating informed decision-making. |

| Operational risk impact analysis | Conducts AI-driven analysis of operational risks such as fraud, cyber threats, and compliance breaches. | ZBrain’s AI agents can employ gen AI to analyze patterns and detect anomalies indicative of fraudulent activities, enhancing the organization’s ability to mitigate operational risks. | |

| Step 3.2: Stress testing and scenario analysis | Liquidity crisis assessment | Uses AI to evaluate potential liquidity crises and the adequacy of capital buffers under different scenarios. | ZBrain’s Liquidity Planning Optimization Agent can analyze liquidity positions and simulate potential crises, ensuring sufficient capital buffers are maintained. |

| Step 3.3: Prioritize and allocate risk responses | AI-driven risk ranking and response allocation | Ranks risks based on financial exposure, regulatory impact, and business continuity priorities using AI algorithms. | ZBrain AI agents can leverage gen AI to rank identified risks according to their potential impact, aiding in strategically allocating resources for risk mitigation. |

| Key Risk Indicators (KRIs) establishment | Establishes AI-generated KRIs to monitor vulnerabilities in financial controls. | ZBrain AI agents like Risk Scoring Agent can utilize gen AI to identify and establish key risk indicators, providing ongoing monitoring and early warning signals for financial control vulnerabilities. |

Stage 4: Risk treatment, financial controls and capital resilience

Step 4.1: Risk mitigation and financial control strategies

- Financial hedging and credit risk mitigation: AI models analyze market trends and credit data to optimize hedging strategies and assess credit risk, thereby reducing potential losses.

- Fraud prevention controls: AI systems detect anomalies in transaction patterns, enabling early identification and prevention of fraudulent activities.

Step 4.2: Capital and liquidity risk controls

- Capital buffer optimization: AI algorithms forecast potential capital needs under various economic scenarios, helping institutions maintain adequate capital buffers.

- Liquidity risk management: AI assesses liquidity positions and simulates potential crises, ensuring compliance with liquidity requirements and enhancing financial stability.

Step 4.3: Financial transaction risk monitoring

- Real-time transaction monitoring: AI systems analyze transactions in real-time to detect suspicious activities, enhancing fraud detection and payment risk mitigation.

How ZBrain enhances risk treatment, financial controls and capital resilience

| Step | Use case | Description | How ZBrain helps |

|---|---|---|---|

| Step 4.1: Risk mitigation and financial control strategies | Fraud prevention controls | Implements measures to detect and prevent fraudulent activities within financial operations. | ZBrain AI agents can analyze transaction patterns to identify anomalies indicative of fraudulent activities, enhancing the organization’s ability to mitigate operational risks. |

| Step 4.2: Capital and liquidity risk controls | Maintain capital buffers and reserve allocations | Ensures sufficient capital reserves are maintained to absorb potential losses and meet regulatory requirements. | ZBrain’s Liquidity Planning Optimization Agent analyzes cash reserves and obligations to optimize resource allocation, ensuring efficient cash flow management and adequate capital buffers. |

| Funding contingency plans | Develops strategies to secure funding in unforeseen circumstances to maintain financial stability. | ZBrain’s AI agents can automatically classify financial activities to ensure compliance and reduce risks in treasury operations, supporting the development of effective funding contingency plans. | |

| Step 4.3: Financial transaction risk monitoring | Automate real-time transaction monitoring | Monitors financial transactions to detect and address potential risks promptly. | ZBrain’s Cash Flow Monitoring Agent tracks cash inflows and outflows to provide real-time liquidity insights, reducing cash shortage risks and aiding in decision-making. |

| Fraud detection | Identifies fraudulent activities within financial transactions to prevent financial losses. | ZBrain’s AI agents can analyze transaction patterns to identify anomalies indicative of fraudulent activities, enhancing the organization’s ability to mitigate operational risks. |

Stage 5: Continuous risk monitoring, reporting, and optimization

Step 5.1: Risk and compliance monitoring

- Continuous audit controls: AI automates routine and repetitive audit tasks, allowing auditors to focus on more complex activities, thereby enhancing the efficiency and effectiveness of audits.

- Compliance risk tracking: AI-powered tools manage document reviews, audit trails, and regulatory reporting with enhanced accuracy and efficiency, ensuring consistent adherence to regulatory requirements.

- Real-time fraud detection: AI systems monitor real-time transactions, providing alerts on suspicious activities that may indicate non-compliance or fraud, enabling quick decision-making to prevent compliance breaches.

- Monitoring key risk indicators (KRIs): AI technologies analyze vast amounts of data to identify trends, anomalies, and risks, allowing organizations to monitor KRIs effectively and gain actionable insights.

Step 5.2: Risk reporting and regulatory compliance

- Automated risk disclosures: AI enhances compliance monitoring by identifying anomalies, forecasting potential risks, automating audit processes, and analyzing extensive datasets to detect compliance breaches, thereby ensuring timely and precise risk disclosures.

- Financial reporting compliance: AI-powered automation tools manage document reviews, audit trails, and regulatory reporting with enhanced accuracy and efficiency, ensuring consistent adherence to regulatory requirements.

- Regulatory filings: AI systems can monitor real-time transactions, providing alerts on suspicious activities that may indicate non-compliance or fraud, aiding in maintaining accurate regulatory filings.

- Board-level risk reporting: AI allows compliance professionals to set customized thresholds for acceptable behavior, flag anomalies, and generate tailored reports that provide actionable insights to stakeholders, strengthening the compliance function.

Step 5.3: Independent review and process optimization

- Automated internal audits: AI plays a significant role in optimizing internal audit processes by automating data analysis, identifying patterns, and assessing risks, allowing auditors to focus on more critical tasks.

- Stress-test reviews: AI technologies enable auditors to analyze vast amounts of data more efficiently and effectively, identifying trends, anomalies, and risks, thereby enhancing the effectiveness of stress-test reviews.

- Risk management framework optimization: AI offers a transformative tool to enhance program efficiency, improve risk detection, and create a more resilient corporate compliance framework, contributing to the continuous improvement of risk management frameworks.

- Predictive financial risk intelligence: AI-powered risk assessment tools scrutinize transactions for anomalies, blending AI, statistical methods, and traditional business rules to identify both known and unknown risks, ensuring a thorough audit process.

How ZBrain enhances continuous risk monitoring, reporting, and optimization

| Step | Use case | Description | How ZBrain helps |

|---|---|---|---|

| Step 5.1: Risk and compliance monitoring | Continuous audit controls | Implements ongoing audit processes to ensure adherence to regulatory standards and internal policies. | ZBrain’s Compliance Check Agent cross-references organizational processes with regulatory guidelines, flagging non-compliance instances for resolution. |

| Compliance risk tracking | Monitors compliance-related activities to identify and mitigate potential risks. | ZBrain’s Regulatory Compliance Monitoring Chat Agent serves as a chatbot interface for querying the regulatory compliance knowledge base, providing accessible insights to different stakeholders. | |

| Real-time fraud detection | Detects fraudulent activities in real-time to prevent financial losses. | ZBrain AI agents can analyze transaction patterns to identify anomalies indicative of fraudulent activities, enhancing the organization’s ability to mitigate operational risks. | |

| Monitoring Key Risk Indicators (KRIs) | Tracks KRIs to provide early warnings of potential financial control vulnerabilities. | ZBrain’s Risk Scoring Agent assigns risk scores to various factors, streamlining legal risk management with consistent, adaptable GenAI-driven assessments. | |

| Step 5.2: Risk reporting and regulatory compliance | Automated risk disclosures | Automates the process of disclosing risks to ensure transparency and compliance. | ZBrain’s Compliance Improvement Agent provides actionable recommendations for policy updates and automation to improve compliance efficiency. |

| Financial reporting compliance | Ensures that financial reports adhere to regulatory standards and internal policies. | ZBrain’s Compliance Risk Assessment Agent automates the evaluation of compliance risks by reviewing financial operations, contracts, and regulatory obligations, flagging potential issues to ensure adherence to financial requirements. | |

| Regulatory filings | Prepares and submits necessary documents to regulatory bodies in compliance with legal requirements. | ZBrain’s AI agents can generate regular reports and insights on regulatory compliance status, and potential risks to aid decision-making. | |

| Board-level risk reporting | Provides the board with comprehensive reports on risk status and management efforts. | ZBrain’s Risk Assessment Agent analyzes contracts to highlight potential issues, such as ambiguous terms, missing clauses, or unfavorable conditions, supporting informed decision-making. | |

| Step 5.3: Independent review and process optimization | Automated internal audits | Conducts internal audits using automated systems to improve efficiency and accuracy. | ZBrain’s Financial Audit Preparation Agent automates the reminders to optimize customer communication and cash flow by notifying about upcoming or overdue payments. |

| Risk management framework optimization | Continuously improves risk management strategies to enhance effectiveness and adaptability. | ZBrain’s Compliance Improvement Agent provides actionable recommendations for policy updates and automation to improve compliance efficiency. |

By leveraging AI across these stages, organizations enhance efficiency, ensure robust compliance, and gain real-time insights for proactive risk mitigation. ZBrain AI agents accelerate these benefits by providing dynamic reporting, intelligent automation, and guided decision support, ultimately strengthening the organization’s overall control and risk posture.

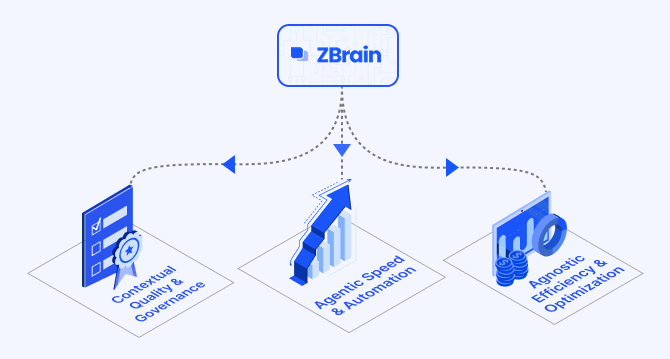

Why ZBrain is the ideal platform for control and risk management

ZBrain’s AI-driven capabilities offer a comprehensive solution for enhancing control and risk management processes. It provides a range of features designed to automate risk detection, strengthen compliance, and support data-driven decision-making across various risk management functions.

AI-powered risk assessment

ZBrain’s AI readiness framework, ZBrain XPLR, enables organizations to evaluate their risk posture and preparedness for AI-driven risk management. It delivers actionable insights to identify vulnerabilities, improve control mechanisms, and enhance compliance strategies, ensuring a proactive risk mitigation approach.

Low-code development for risk management solutions

ZBrain Builder’s low-code interface empowers businesses to create custom AI-driven risk management solutions tailored to their specific needs. This allows non-technical users to develop and deploy AI solutions for risk assessment, fraud detection, and compliance monitoring without requiring extensive programming expertise.

Proprietary data-driven risk insights

ZBrain leverages proprietary business data to design AI-powered risk management solutions that align with an organization’s unique operational risks, compliance requirements, and industry standards. This ensures a highly customized and effective approach to risk mitigation.

Enterprise-ready compliance and security

ZBrain is designed for large-scale enterprise environments, offering robust security, scalability, and seamless integration with existing governance, risk, and compliance (GRC) systems. This makes it an ideal platform for enhancing regulatory compliance, internal controls, and risk monitoring at scale.

End-to-end support for risk lifecycle management

ZBrain Builder supports the entire lifecycle of AI-driven risk management solutions—from development and deployment to continuous monitoring and refinement. This ensures seamless risk detection, compliance tracking, fraud prevention, and audit readiness across the organization.

Flexible data ingestion for real-time risk monitoring

ZBrain Builder integrates data from diverse sources in real-time, enabling organizations to monitor risks dynamically, detect anomalies, and improve decision-making. This real-time visibility enhances the organization’s ability to proactively address financial, operational, and regulatory risks.

Intelligent AI agents for automation

ZBrain Builder enables the creation of AI-powered intelligent agents that can automate key risk management tasks, such as regulatory compliance tracking, fraud detection, internal control validation, and audit preparation. By reducing manual effort, these AI agents enhance operational efficiency while ensuring accuracy and compliance.

These capabilities position ZBrain as a powerful AI-driven platform for optimizing and automating control and risk management processes, helping organizations minimize risks, strengthen compliance, and improve operational resilience.

Streamline your operational workflows with ZBrain AI agents designed to address enterprise challenges.

Benefits of implementing AI in control and risk management

Integrating AI into control and risk management processes provides significant advantages for organizations, employees, and other stakeholders. Below is a breakdown of how AI enhances risk management and internal controls:

For organizations

-

Proactive risk identification – AI continuously monitors internal controls, financial transactions, and operational processes to detect potential risks and compliance violations before they escalate.

-

Fraud detection and prevention – Machine learning models analyze patterns to identify anomalies, reducing the risk of financial fraud, cyber threats, and policy violations.

-

Enhanced compliance management – AI automates regulatory tracking, audit preparation, and policy enforcement, ensuring adherence to industry standards and reducing compliance risks.

-

Improved decision-making – AI-driven risk analytics provide real-time insights into operational vulnerabilities, financial exposure, and regulatory risks, helping organizations make informed strategic decisions.

-

Cost efficiency in risk management – Automation reduces manual risk assessment efforts, regulatory reporting costs, and fraud investigation expenses, improving overall cost-effectiveness.

-

Data integration and governance – AI seamlessly integrates risk data from multiple sources, ensuring accurate, real-time risk assessment and compliance tracking across departments.

For employees

-

Reduced manual workload – AI automates risk monitoring, compliance reporting, and fraud detection, allowing employees to focus on high-value tasks like risk strategy and mitigation planning.

-

Improved accuracy and efficiency – AI-driven systems eliminate human errors in risk analysis, ensuring more precise risk scoring, anomaly detection, and compliance checks.

-

Skill enhancement and strategic roles – Employees gain exposure to AI-driven analytics, cybersecurity risk assessment, and predictive modeling, enhancing their expertise in modern risk management practices.

-

Better risk response times – AI enables faster identification, escalation, and resolution of risks, ensuring timely action and minimizing business disruptions.

For customers and stakeholders

-

Stronger data security and fraud protection – AI-powered threat detection and real-time transaction monitoring help prevent identity theft, fraud, and data breaches, enhancing trust.

-

Increased transparency and compliance assurance – AI-driven reporting ensures accurate, real-time insights into compliance adherence, reinforcing stakeholder confidence in risk governance.

-

Minimized disruptions and enhanced service reliability – AI-driven risk management prevents financial losses, operational downtime, and compliance penalties, ensuring consistent service delivery.

By implementing AI in control and risk management, organizations can enhance regulatory compliance, strengthen risk mitigation strategies, and drive operational resilience, leading to long-term sustainability and security.

Measuring the ROI of AI in control and risk management

Implementing AI in control and risk management enhances risk detection, compliance enforcement, and operational resilience, allowing organizations to manage threats and maintain regulatory adherence proactively. ZBrain’s AI solutions automate risk assessment, fraud detection, and compliance monitoring, ensuring greater accuracy, efficiency, and decision-making. Businesses can measure the ROI of these AI-driven capabilities by evaluating factors such as risk reduction, cost savings, regulatory compliance, and operational improvements. Below are examples of how ZBrain’s AI applications drive ROI in control and risk management workflows.

ZBrain implementation in control and risk management: Key ROI indicators

AI-powered control and risk management solutions using ZBrain provide measurable ROI by automating critical risk processes, minimizing financial exposure, and improving governance. Here’s how AI drives ROI in key control and risk management use cases:

Fraud detection and prevention

-

Use case: Identifying fraudulent transactions, anomalies in financial data, and suspicious activity patterns in real-time.

-

ROI metrics:

-

Reduced fraud-related losses

-

Faster fraud detection and response times

-

Improved compliance with anti-fraud regulations

-

-

Example: ZBrain AI agents can analyze financial transactions, expense claims, and procurement data to detect irregular patterns and flag fraudulent activities before they escalate.

Regulatory compliance automation

-

Use case: Ensuring continuous compliance with evolving regulatory standards by automating compliance tracking and reporting.

-

ROI metrics:

-

Lower compliance-related penalties and fines

-

Reduced time spent on manual regulatory reporting

-

Improved audit readiness and regulatory adherence

-

-

Example: ZBrain AI agents monitor policy updates, analyze compliance reports, and automatically flag non-compliant activities, reducing regulatory risks and ensuring adherence to industry mandates.

Risk assessment and mitigation

-

Use case: Automating risk assessment models to identify potential financial, operational, or cybersecurity risks before they become critical.

-

ROI metrics:

-

Early identification of high-risk areas

-

Reduced financial exposure from unmitigated risks

-

Faster risk response and mitigation planning

-

-

Example: ZBrain AI agents can continuously scan operational workflows and financial transactions to detect vulnerabilities, helping risk teams take preventive action before issues escalate.

Anomaly detection in financial transactions

-

Use case: Detecting inconsistencies and anomalies in financial records to prevent errors, fraud, and reporting discrepancies.

-

ROI metrics:

-

Improved financial data accuracy

-

Reduction in financial reporting errors

-

Early detection of revenue misstatements

-

-

Example: ZBrain AI agents can analyze financial ledgers, transactional records, and revenue flows to flag suspicious anomalies that could indicate potential errors or fraudulent activities.

Contract compliance and risk monitoring

-

Use case: Monitoring contract terms, identifying non-compliance, and ensuring proper execution of obligations.

-

ROI metrics:

-

Increased contract compliance rates

-

Reduction in contract disputes and penalties

-

Improved visibility into contractual risks

-

-

Example: ZBrain AI agents can extract and analyze contractual obligations, payment terms, and service-level agreements (SLAs) to ensure compliance and mitigate contract-related risks.

Automated incident response and risk reporting

-

Use case: Enabling AI-driven risk alerts and real-time incident response for security breaches and compliance violations.

-

ROI metrics:

-

Faster resolution of risk incidents

-

Enhanced real-time risk visibility

-

Reduced manual workload in incident investigations

-

-

Example: ZBrain AI agents can automate incident escalation, root-cause analysis, and response workflows, allowing risk teams to contain and resolve threats efficiently.

These examples showcase how ZBrain enhances control and risk management by automating risk detection, fraud prevention, and compliance enforcement. Organizations can measure AI’s effectiveness by tracking key ROI metrics, such as reduced fraud losses, improved regulatory compliance, and enhanced financial accuracy.

With AI-driven automation, real-time insights, and continuous risk monitoring, ZBrain enables risk management teams to focus on strategic risk mitigation and proactive governance, ultimately strengthening organizational resilience and security.

Challenges and considerations in adopting AI for control and risk management

While AI significantly enhances risk detection, compliance enforcement, and operational resilience, organizations must address several challenges for smooth AI adoption. These include ensuring data integrity, integrating with legacy systems, managing regulatory compliance, addressing security risks, and overcoming resistance to AI-driven decision-making. Understanding these factors allows businesses to prepare effectively for AI-driven control and risk management.

Key challenges and ZBrain solutions

|

Aspect |

Challenge |

How ZBrain addresses these challenges |

|---|---|---|

|

Data integration |

Managing risk-related data across various platforms (ERP, GRC, financial systems) can be complex due to differing formats and data silos. |

ZBrain Builder enables seamless integration across multiple platforms, ensuring real-time risk analysis and compliance monitoring. |

|

Legacy system compatibility |

Existing governance, risk, and compliance (GRC) systems may lack AI compatibility, requiring costly upgrades. |

ZBrain XPLR evaluates system compatibility, offering phased AI integration without disrupting existing compliance workflows. |

|

High initial investment |

Implementing AI-driven risk management solutions may involve significant upfront costs. |

ZBrain offers phased implementation, allowing businesses to assess ROI and optimize costs while gradually scaling AI-driven risk management. |

|

Data security risks |

AI systems handling sensitive risk and compliance data are vulnerable to breaches and unauthorized access. |

ZBrain enforces strict security controls, including role-based access and compliance audits to mitigate risks. |

|

Regulatory compliance |

Adapting to evolving global regulations and industry-specific compliance mandates can be challenging. |

ZBrain ensures adherence to global standards (ISO 27001:2022, SOC 2 Type II), continuously updating AI models to align with regulatory changes. |

|

Lack of AI expertise |

A shortage of skilled personnel may slow AI implementation and impact risk analytics capabilities. |

ZBrain Builder’s low-code platform allows non-technical users to deploy AI solutions, accelerating adoption and enhancing team capabilities. |

|

Employee resistance |

Teams may resist AI-driven risk management due to concerns about automation replacing decision-making roles. |

ZBrain’s intuitive AI-driven dashboards facilitate seamless integration, promoting collaborative decision-making and user adoption. |

|

Inaccurate or incomplete data |

Poor data quality can lead to false risk alerts and ineffective compliance monitoring. |

ZBrain Builder’s data normalization tools improve data accuracy, ensuring that AI-driven risk assessments are based on reliable insights. |

|

Scalability issues |

Expanding AI-based risk management across multiple business units or geographic regions can be complex. |

ZBrain’s cloud-native architecture and modular AI solutions support scalable and adaptable risk management deployments. |

By addressing these challenges with ZBrain’s AI-driven solutions, organizations can strengthen governance, enhance compliance, and proactively manage risks. AI enables real-time monitoring, anomaly detection, and predictive risk assessment, ensuring businesses can adapt to evolving regulatory landscapes while maintaining operational resilience.

Best practices for implementing AI in control and risk management

Implementing AI in control and risk management enhances risk detection, compliance monitoring, and decision-making. However, a successful AI adoption requires strategic planning, stakeholder engagement, and continuous evaluation. Below are key best practices to ensure effective AI-driven control and risk management.

Assess process readiness for AI integration

Before adopting AI, evaluate existing risk management frameworks to identify areas for automation and optimization.

-

Map risk and compliance workflows: Identify bottlenecks in risk assessment, compliance tracking, fraud detection, and audit processes to determine where AI can add value.

-

Assess data quality and infrastructure: Ensure access to structured, high-quality data and a secure AI-ready infrastructure to support risk analysis, anomaly detection, and regulatory compliance.

-

Gauge organizational readiness: Engage stakeholders early to align expectations and address concerns about AI adoption in risk management.

-

Define measurable goals: Set clear objectives, such as reducing compliance violations, improving fraud detection accuracy, or minimizing financial risks.

Leverage the right AI technologies

Choosing the right AI tools ensures effective risk management and compliance enforcement.

-

Machine learning for risk prediction: Utilize ML models to detect emerging risks, analyze past incidents, and enhance proactive risk mitigation.

-

Natural language processing (NLP) for compliance monitoring: Automate contract and policy analysis to ensure adherence to regulatory requirements and flag non-compliance.

-

AI-driven dashboards for real-time risk insights: Implement AI-powered dashboards to monitor key risk indicators (KRIs), compliance metrics, and financial anomalies, supporting informed decision-making.

-

Automated anomaly detection: Use AI to identify unusual transactions, operational risks, and compliance deviations in real-time.

Engage stakeholders and manage change effectively

AI adoption success depends on strong stakeholder collaboration and change management.

-

Communicate AI’s role in risk management: Highlight how AI improves risk oversight, compliance efficiency, and fraud prevention while reducing manual effort.

-

Provide training and upskilling: Equip risk and compliance teams with AI literacy and analytical skills to use AI-driven risk assessment tools effectively.

-

Involve key stakeholders early: Secure buy-in from risk management, compliance, finance, and IT teams to ensure seamless AI integration.

-

Pilot and phased rollouts: Start with small-scale AI implementations in fraud detection, regulatory reporting, or internal audit processes before expanding to enterprise-wide risk management.

Ensure scalability and flexibility

AI solutions should be scalable and adaptable to evolving risks, regulations, and business needs.

-

Scalability: Choose AI systems capable of handling large volumes of risk data and adapting to growing compliance demands.

-

Continuous improvement: Regularly evaluate AI models to ensure they remain accurate, relevant, and aligned with emerging risks.

-

Interoperability: Select AI tools that integrate seamlessly with existing GRC (governance, risk, and compliance) platforms, financial systems, and security frameworks for a unified risk management approach.

By following these best practices, organizations can leverage AI to enhance risk control, strengthen regulatory compliance, and proactively mitigate financial and operational risks. A well-executed AI strategy fosters resilience, transparency, and agility, empowering businesses to confidently adapt to an evolving risk landscape.

The future of AI in control and risk management

The future of control and risk management will be shaped by AI-powered automation, predictive analytics, and emerging technologies such as blockchain, federated learning, and explainable AI. These innovations will enhance risk detection, compliance enforcement, and fraud prevention, enabling organizations to proactively mitigate threats, strengthen governance, and adapt to regulatory changes. Key trends influencing AI-driven control and risk management include:

AI and blockchain for secure and transparent risk management

Integrating AI and blockchain will improve data integrity, automate compliance, and enhance security.

-

Immutable risk records: Blockchain ensures tamper-proof records of risk assessments, audit trails, and compliance documentation, reducing fraud and data manipulation.

-

AI-driven fraud detection: AI analyzes blockchain transaction patterns in real-time to identify anomalies, flag suspicious activities, and prevent financial fraud.

-

Automated compliance enforcement: Smart contracts will self-execute compliance protocols, automatically detecting and addressing violations based on predefined risk policies.

Predictive analytics for proactive risk mitigation

AI-driven predictive analytics will enable organizations to anticipate risks, assess vulnerabilities, and implement preventive controls.

-

Dynamic risk scoring: Machine learning models will analyze historical incidents, market trends, and operational data to generate real-time risk scores, allowing for early intervention.

-

Regulatory risk forecasting: AI will track evolving compliance requirements and assess the potential impact of regulatory changes, enabling businesses to stay ahead of compliance obligations.

-

Operational risk monitoring: AI-powered surveillance systems will continuously scan business processes, IT infrastructure, and financial transactions to detect unusual patterns and emerging threats.

Explainable AI for transparent decision-making

As AI adoption in risk management grows, explainability and accountability will be critical to ensuring trust and regulatory acceptance.

-

Interpretable AI models: AI-driven risk assessments will provide clear justifications for flagged risks, ensuring compliance teams can understand and audit AI-generated insights.

-

Bias detection and mitigation: Organizations will implement bias-aware AI models to prevent discriminatory risk scoring in areas such as credit risk assessment, fraud detection, and regulatory compliance.

-

AI governance frameworks: Businesses will establish governance policies to define ethical AI usage, ensuring compliance with global risk management standards like ISO 31000 and COSO ERM.

AI-powered automation for compliance and internal audits

AI will streamline regulatory compliance, automate audits, and enhance governance controls.

-

Automated audit trails: AI will generate real-time audit logs, ensuring that all risk-related decisions, policy changes, and compliance updates are documented and traceable.

-

Natural language processing (NLP) for policy compliance: AI-powered NLP tools will analyze contracts, policies, and regulatory documents, ensuring compliance with industry standards and legal requirements.

-

Continuous control monitoring (CCM): AI will provide real-time oversight of financial transactions, operational processes, and cybersecurity frameworks, automatically detecting control failures.

Federated learning for secure risk analysis

Federated learning will revolutionize AI-driven risk management by enabling decentralized data processing while preserving data privacy.

-

Collaborative risk intelligence: Organizations will securely share risk insights across industries without exposing sensitive data, improving fraud detection and cybersecurity intelligence.

-

Privacy-preserving compliance analytics: AI will assess compliance risks without directly accessing customer or financial data, ensuring data protection in highly regulated sectors.

-

Decentralized threat detection: Federated AI models will detect cybersecurity threats across multiple organizations, strengthening collective resilience against fraud, breaches, and insider threats.

Cyber risk management and AI-driven security

As cyber threats evolve, AI-powered security solutions will play a crucial role in protecting digital assets and mitigating cybersecurity risks.

-

Threat intelligence automation: AI will continuously analyze cyber threats, detecting anomalies in network traffic, unauthorized access attempts, and malware patterns.

-

Adaptive security frameworks: AI-driven security systems will self-adjust defenses based on real-time risk assessments, ensuring proactive protection against cyberattacks.

-

Behavioral biometrics for fraud prevention: AI will analyze user behavior, keystroke patterns, and transaction histories to detect identity fraud and prevent unauthorized system access.

Ethical AI and responsible risk management

As AI becomes a core component of risk management, organizations must ensure ethical AI usage, data security, and regulatory compliance.

-

AI bias audits: Businesses will regularly audit AI models to detect bias in risk assessments, fraud detection, and compliance decisions, ensuring fairness and transparency.

-

Privacy-first AI frameworks: AI systems will align with global data privacy regulations, enforcing strict data protection protocols.

-

Human-AI collaboration: AI will enhance, not replace, human decision-making, ensuring that risk management teams maintain oversight and accountability in critical risk assessments.

The evolution of AI in control and risk management will redefine risk assessment, strengthen compliance, and enhance operational resilience. Organizations that embrace AI-driven automation, predictive analytics, and secure, explainable AI frameworks will be well-positioned to proactively manage risks, optimize controls, and navigate regulatory challenges.

Platforms like ZBrain will play a pivotal role in integrating AI into enterprise risk management strategies, enabling businesses to detect threats faster, enforce compliance efficiently, and build a risk-aware culture for the future.

Transform control and risk management processes with ZBrain

ZBrain empowers businesses to enhance control and risk management by identifying automation opportunities, improving risk detection, and strengthening compliance frameworks. As a generative AI platform, ZBrain helps organizations optimize risk assessment, regulatory compliance, and fraud prevention, enabling proactive decision-making through advanced AI-driven insights and automation.

ZBrain XPLR assists businesses in evaluating their AI readiness for risk management by assessing existing workflows, identifying gaps in control mechanisms, and ensuring AI strategies align with compliance and governance objectives. This structured approach helps organizations minimize implementation risks and transition smoothly to AI-powered risk mitigation solutions.

With ZBrain Builder’s low-code platform, businesses can design custom AI-driven risk management solutions to automate critical tasks such as fraud detection, policy compliance monitoring, and anomaly detection in financial transactions and operations.

By seamlessly integrating with existing governance, risk, and compliance (GRC) systems, ZBrain provides scalability, robust security, and adaptive risk intelligence, enabling organizations to streamline risk controls, strengthen regulatory adherence, and mitigate threats more effectively.

Endnote

The integration of AI into control and risk management is transforming how organizations strengthen governance, mitigate risks, and ensure regulatory compliance. By automating risk assessments, anomaly detection, and policy enforcement, AI enhances efficiency, accuracy, and proactive decision-making in managing operational and financial risks. As AI technologies continue to advance, their ability to provide real-time insights, predictive risk analytics, and adaptive compliance measures will enable businesses to stay resilient and agile in an evolving regulatory landscape. Embracing AI-driven risk management solutions ensures organizations can enhance control frameworks, minimize vulnerabilities, and drive sustainable, risk-aware growth.

Ready to strengthen your control and risk management with AI? Leverage ZBrain’s intelligent automation to enhance risk detection, ensure regulatory compliance, and streamline decision-making—empowering your organization with proactive risk mitigation and operational resilience.

Listen to the article

Author’s Bio

An early adopter of emerging technologies, Akash leads innovation in AI, driving transformative solutions that enhance business operations. With his entrepreneurial spirit, technical acumen and passion for AI, Akash continues to explore new horizons, empowering businesses with solutions that enable seamless automation, intelligent decision-making, and next-generation digital experiences.

Table of content

- What is the control and risk management process?

- Understanding the control and risk management stages

- Transforming control and risk management processes: How AI solves traditional challenges

- Approaches to integrating AI into control and risk management

- AI applications transforming the control and risk management processes

- Why ZBrain is the ideal platform for control and risk management

- Benefits of implementing AI in control and risk management

- Measuring the ROI of AI in control and risk management

- Challenges and considerations in adopting AI for control and risk management

- Best practices for implementing AI in control and risk management

- The future of AI in control and risk management

- Transform control and risk management processes with ZBrain

What is ZBrain, and how can it enhance control and risk management with AI?

ZBrain is an end-to-end AI enablement platform designed to help businesses strengthen control and risk management by streamlining AI adoption across key operational areas. From assessing AI readiness to deploying intelligent automation, ZBrain empowers organizations to enhance compliance, mitigate risks, and optimize decision-making processes.

How ZBrain supports control and risk management:

-

AI readiness assessment with ZBrain XPLR:

ZBrain XPLR evaluates existing risk management frameworks, identifying gaps where AI can enhance compliance monitoring, fraud detection, and regulatory adherence. This ensures a strategic, data-driven approach to AI adoption for risk mitigation. -

Seamless data ingestion and integration:

ZBrain Builder integrates with governance, risk, and compliance (GRC) systems, financial platforms, and security tools to centralize data processing. This enables real-time monitoring of risk factors, anomaly detection, and automated compliance reporting. -

Low-code development for risk automation:

ZBrain Builder’s intuitive, low-code interface allows organizations to rapidly deploy AI-driven solutions for fraud detection, policy enforcement, and automated risk assessments—reducing manual workload while improving accuracy. -

Cloud and model flexibility:

With support for leading AI models like GPT-4 and LLaMA and integration with cloud platforms such as AWS, Azure, and GCP, ZBrain provides a scalable and cost-effective approach to managing control and risk processes. -

Enhanced compliance and governance:

ZBrain continuously monitors transactions, policies, and compliance frameworks to flag potential violations in real-time. Its AI-driven insights help businesses proactively address risks, ensuring alignment with regulatory standards ISO 27001:2022 and SOC 2 Type II.

By leveraging ZBrain’s AI capabilities, organizations can automate risk assessments, improve compliance accuracy, and strengthen governance frameworks—enhancing operational resilience while minimizing financial and reputational risks.

How does ZBrain ensure the security and privacy of sensitive data in control and risk management?

ZBrain is designed with a strong focus on data privacy, security, and compliance, ensuring that sensitive information related to control and risk management is safeguarded throughout its lifecycle. Here’s how ZBrain protects critical data and mitigates security risks:

Secure deployment options

-

Private cloud deployments: ZBrain agents can be deployed in a private cloud or on-premises environment, ensuring that confidential risk management data—such as audit reports, compliance records, and financial transactions—remains within the organization’s secure infrastructure.

Granular access controls

-

Role-based access: ZBrain enforces strict role-based access controls (RBAC) to ensure that only authorized personnel can view or manage sensitive data related to compliance, financial governance, and risk assessment.

-

Audit logging: Comprehensive logging and tracking of user actions enhance accountability and support regulatory compliance.

Compliance and governance alignment

-

Regulatory compliance: ZBrain adheres to industry standards ISO 27001:2022 and SOC 2 Type II, ensuring that risk management processes align with global security and governance requirements.

-

Automated policy enforcement: AI-driven compliance monitoring helps organizations maintain adherence to internal policies and external regulatory frameworks.

By integrating these security measures, ZBrain provides organizations with a resilient, AI-powered approach to control and risk management—ensuring data integrity, regulatory compliance, and protection against emerging threats.

Can ZBrain AI agents be integrated with existing control and risk management systems?

Yes, ZBrain AI agents are built to integrate seamlessly with existing control and risk management systems. The platform supports various data formats, security protocols, and industry standards, ensuring smooth interoperability with governance, risk, and compliance (GRC) platforms, financial management tools, and audit systems.

This integration enables organizations to:

-

Enhance existing risk frameworks: Strengthen current control and risk management processes without the need to replace legacy systems.

-

Improve risk monitoring and compliance: Connect ZBrain AI agents with internal control mechanisms to automate regulatory compliance checks, financial risk assessments, and policy enforcement.

-

Leverage AI-driven insights: Use AI to detect anomalies, predict potential risks, and generate data-driven recommendations for proactive risk mitigation.

By enabling seamless integration, ZBrain ensures that organizations can modernize their control and risk management strategies while maintaining operational stability and regulatory alignment.

What kind of control and risk management agents can be built on ZBrain Builder?

ZBrain Builder enables the development of AI agents tailored to various control and risk management use cases. These agents enhance governance, automate compliance tracking, monitor financial risks, and strengthen internal controls.

Organizations can leverage ZBrain to build AI agents for:

-

Regulatory compliance monitoring: Automate policy enforcement, track regulatory changes, and ensure adherence to industry standards.

-

Risk assessment and anomaly detection: Identify financial risks, detect fraudulent transactions, and flag irregularities in operational processes.

-

Audit and control automation: Streamline internal audits by automating data validation, control testing, and compliance reporting.

-

Policy and contract analysis: Use AI to review contracts, identify non-compliance risks, and ensure alignment with internal governance frameworks.

ZBrain enables businesses to enhance operational resilience, reduce compliance risks, and maintain stronger control over financial and regulatory obligations by automating key risk management processes and providing AI-driven insights.

How does ZBrain cater to diverse control and risk management needs across business operations?

ZBrain’s flexibility allows it to address a wide range of control and risk management challenges. Organizations can develop AI-driven agents to automate compliance tracking, strengthen internal controls, monitor financial risks, and enhance governance.

With ZBrain, businesses can:

-

Automate compliance monitoring – Ensure adherence to regulatory frameworks, industry standards, and internal policies with AI-driven rule enforcement.

-

Strengthen risk detection – Identify anomalies, flag potential fraud, and mitigate financial and operational risks through advanced analytics.

-

Enhance internal controls – Automate audit trails, track policy adherence, and enforce governance best practices across departments.

-

Improve decision-making – Leverage AI-powered insights for proactive risk mitigation and strategic planning.

ZBrain’s AI agents can enable organizations to enhance operational resilience, reduce compliance risks, and maintain stronger oversight across diverse business functions.

How can we measure the ROI of ZBrain in our control and risk management processes?

Measuring the return on investment (ROI) of ZBrain in control and risk management involves evaluating key performance indicators (KPIs) related to automation, compliance, and risk mitigation. Here are some important metrics to consider:

-

Reduction in compliance risks – Automated monitoring of policies and regulations helps prevent violations, minimizing legal and financial penalties.

-

Efficiency in risk detection – AI-driven anomaly detection reduces fraud, enhances oversight, and improves financial controls.

-

Lower operational costs – Automating audit trails, reporting, and control assessments decreases manual effort and resource allocation.

-

Improved data accuracy and governance – AI-powered validation processes ensure accurate risk assessments, internal audits, and regulatory reporting.

-

Faster issue resolution – Real-time insights enable proactive risk mitigation, reducing delays in compliance-related decision-making.

By tracking these KPIs, businesses can quantify how ZBrain enhances governance, strengthens risk management, and improves overall operational resilience.

How can I get started with ZBrain for my control and risk management processes?

To leverage ZBrain to enhance your control and risk management processes, contact us at hello@zbrain.ai or fill out the inquiry form on our website. Our team will connect with you to assess your specific risk management needs, discuss integration with your existing systems, and demonstrate how ZBrain can automate compliance monitoring, strengthen internal controls, and mitigate operational risks.

Insights

A guide to intranet search engine

Effective intranet search is a cornerstone of the modern digital workplace, enabling employees to find trusted information quickly and work with greater confidence.

Enterprise knowledge management guide

Enterprise knowledge management enables organizations to capture, organize, and activate knowledge across systems, teams, and workflows—ensuring the right information reaches the right people at the right time.

Company knowledge base: Why it matters and how it is evolving

A centralized company knowledge base is no longer a “nice-to-have” – it’s essential infrastructure. A knowledge base serves as a single source of truth: a unified repository where documentation, FAQs, manuals, project notes, institutional knowledge, and expert insights can reside and be easily accessed.

How agentic AI and intelligent ITSM are redefining IT operations management

Agentic AI marks the next major evolution in enterprise automation, moving beyond systems that merely respond to commands toward AI that can perceive, reason, act and improve autonomously.

What is an enterprise search engine? A guide to AI-powered information access

An enterprise search engine is a specialized software that enables users to securely search and retrieve information from across an organization’s internal data sources and systems.

A comprehensive guide to AgentOps: Scope, core practices, key challenges, trends, and ZBrain implementation

AgentOps (agent operations) is the emerging discipline that defines how organizations build, observe and manage the lifecycle of autonomous AI agents.

Adaptive RAG in ZBrain: Architecting intelligent, context-aware retrieval for enterprise AI

Adaptive Retrieval-Augmented Generation refers to a class of techniques and systems that dynamically decide whether or not to retrieve external information for a given query.

How ZBrain breaks the trade-offs in the AI iron triangle

ZBrain’s architecture directly challenges the conventional AI trade-off model—the notion that enhancing one aspect inevitably compromises another.

ZBrain Builder’s AI adaptive stack: Built to evolve intelligent systems with accuracy and scale

ZBrain Builder’s AI adaptive stack provides the foundation for a modular, intelligent infrastructure that empowers enterprises to evolve, integrate, and scale AI with confidence.