Strengthening Financial Regulatory Compliance Using AI

Problem

Challenges in Regulatory Compliance Monitoring

In the finance and banking industry, adhering to ever-evolving regulations is paramount. Regulatory non-compliance can result in severe penalties and reputational damage. Monitoring these regulations and ensuring consistent compliance is both complex and time-consuming. ZBrain offers a state-of-the-art solution to simplify and streamline this daunting task.

Solution

I. How ZBrain Flow Enhances Regulatory Compliance Monitoring

Utilizing advanced AI and ML techniques, ZBrain provides financial organizations with real-time insights and alerts regarding regulatory updates and compliance statuses. Here’s a comparison of the time required for each task with and without ZBrain Flow:

| Steps | Without ZBrain Flow | Time Without ZBrain Flow | With ZBrain Flow |

|---|---|---|---|

| Data acquisition | Manual | ~6 hours | Automated by ZBrain Flow |

| Data cleaning and preparation | Manual | ~6 hours | Automated by ZBrain Flow |

| Data analysis | Manual | ~8 hours | Automated by ZBrain Flow |

| Report generation | Manual | ~6 hours | Automated by ZBrain Flow |

| Report review and finalization | Manual | ~2 hours | Manual |

| Total | ~28 hours | ~3 hours |

II. Necessary Input Data

For ZBrain to function at its best, it necessitates the following data:

| Information Source | Description | Recency |

|---|---|---|

| Bank’s internal compliance database | History of regulatory adherence and past violations | Always updated |

| Regulatory authority databases | Latest regulatory updates and amendments | Real-time |

| Internal policy documents | Institution’s existing policy framework | Continuous updates |

| Audit reports | Insights into previous compliance audits | Last fiscal year |

| Industry webinars & forums | Discussions and insights on upcoming regulations | Monthly updates |

III. ZBrain Flow: How It Works?

Step 1: Data Acquisition and Exploratory Data Analysis (EDA)

ZBrain gathers various data relevant to financial regulatory compliance like the latest regulatory amendments, internal compliance information, policy documents, and audit reports. Following this, an automated EDA is conducted on the gathered database to help assess the organization’s current compliance status and identify potential areas of concern.

Step 2: Embedding Generation

In this phase, ZBrain uses advanced techniques to convert textual data containing regulatory texts, past violations, and audit findings into numerical embeddings. These embeddings capture complex data relationships, equipping ZBrain to retrieve and analyze information efficiently. These generated embeddings form the foundation for in-depth analysis, enhancing ZBrain’s capability to detect regulatory irregularities and provide accurate compliance recommendations.

Step 3: Query Execution and Compliance Analysis

On user demand, ZBrain assesses the organization’s compliance status, using the OpenAI Language Model (LLM) to generate a detailed report outlining any deviations and recommended actions.

Given the embeddings, the OpenAI LLM can provide deep insights, highlighting areas of attention and offering actionable suggestions for adherence.

Step 4: Parsing the Generated Report

Once the LLM generates the compliance report, ZBrain undertakes a rigorous parsing technique to fine-tune the report and generate only relevant insights. This ensures that compliance officers receive precise, actionable, and timely recommendations.

Result

Enhanced Regulatory Compliance

With its AI-driven approach, ZBrain ensures financial organizations remain ahead of the compliance curve. By accelerating traditional processes with the help of ZBrain, risks can be mitigated, penalties can be avoided, and the industry reputation of finance and banking organizations can be safeguarded. Embrace ZBrain to maintain impeccable compliance records and reinforce trust in your organization.

Example Report

Prompt:

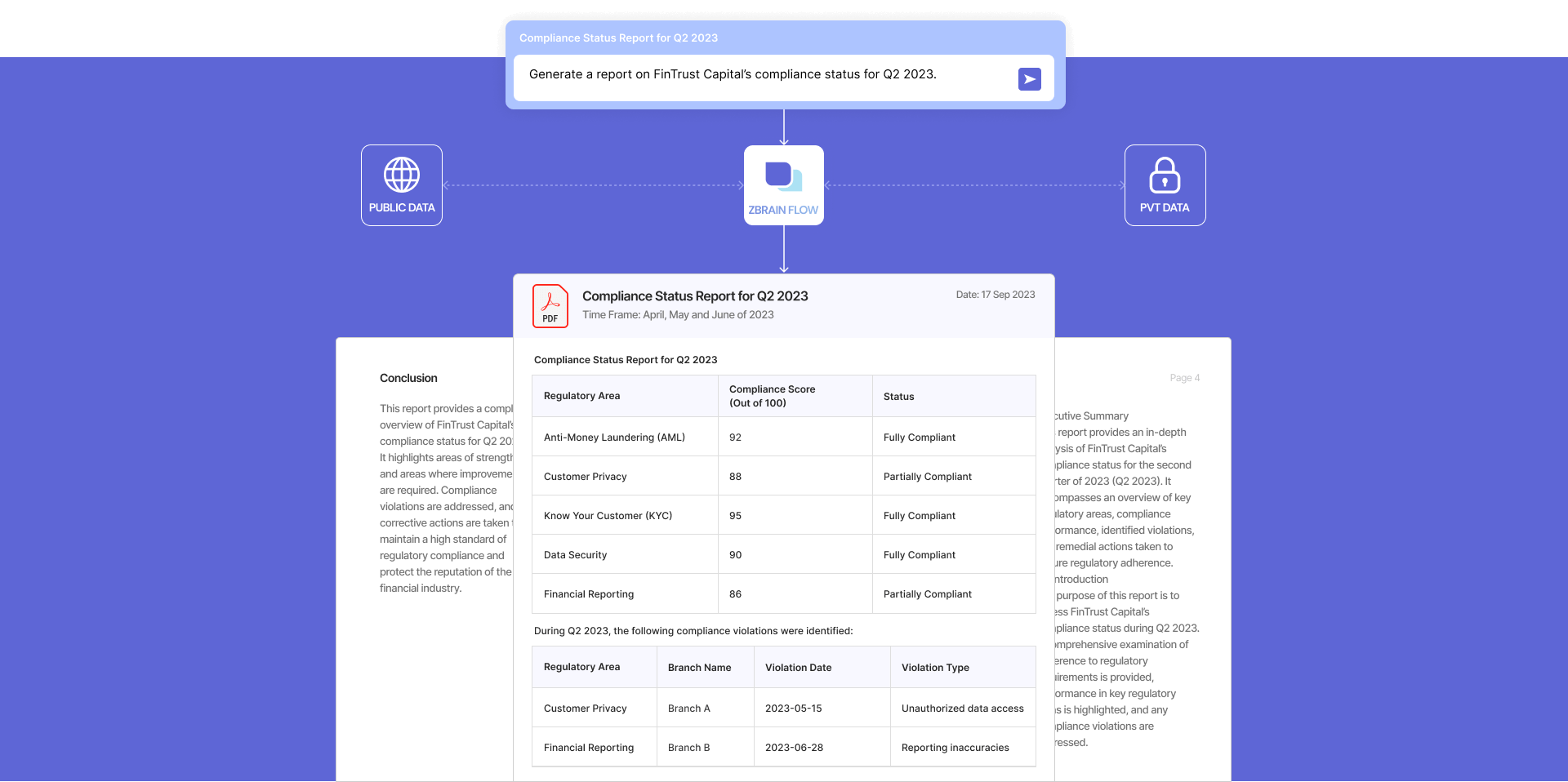

Generate a report on FinTrust Capital’s compliance status for Q2 2023.

Executive Summary

This report provides an in-depth analysis of FinTrust Capital’s compliance status for the second quarter of 2023 (Q2 2023). It encompasses an overview of key regulatory areas, compliance performance, identified violations, and remedial actions taken to ensure regulatory adherence.

- Introduction

The purpose of this report is to assess FinTrust Capital’s compliance status during Q2 2023. A comprehensive examination of adherence to regulatory requirements is provided, performance in key regulatory areas is highlighted, and any compliance violations are addressed.

- Compliance Performance Overview

The compliance performance overview section was compiled based on an analysis of a variety of data sources, including :

- Internal audit reports: Insights into compliance with specific regulatory requirements were provided by internal audit reports conducted at each branch.

- Compliance monitoring tools: Data from compliance monitoring tools and software was utilized to evaluate performance against regulatory benchmarks.

- Regulatory reporting and documentation: Regulatory reports and documentation submitted to authorities during the quarter were reviewed to assess compliance in specific areas.

- Incident reports: Incident reports related to compliance violations were examined to determine areas of concern.

The following table summarizes FinTrust Capital’s compliance performance for Q2 2023:

| Regulatory Area | Compliance Score (Out of 100) | Status |

|---|---|---|

| Anti-money Laundering (AML) | 92 | Fully compliant |

| Customer privacy | 88 | Partially compliant |

| Know Your Customer (KYC) | 95 | Fully compliant |

| Data security | 90 | Fully compliant |

| Financial reporting | 86 | Partially compliant |

- Regulatory Areas Assessment

This section provides a detailed assessment of each key regulatory area.

Anti-money Laundering (AML): The organization maintained a high level of compliance with AML regulations, with a score of 92. In this area, full compliance is achieved, reflecting robust procedures for detecting and preventing money laundering activities.

Customer privacy: The compliance score for customer privacy is 88, indicating partial compliance. While they have made significant strides in protecting customer privacy, some areas require improvement to achieve full compliance.

Know Your Customer (KYC): The organization achieved a compliance score of 95 in the KYC regulatory area, indicating full compliance. Meticulous practices in verifying customer identities and conducting due diligence are commendable.

Data security: Data security compliance stands at 90, signifying full compliance. They have implemented stringent measures to safeguard sensitive data and ensure the confidentiality, integrity, and availability of information.

Financial reporting: The compliance score in financial reporting is 86, indicating partial compliance. While financial reporting practices are strong, some areas necessitate enhancements to achieve full compliance.

- Compliance Violations

During Q2 2023, the following compliance violations were identified:

| Regulatory Area | Branch Name | Violation Date | Violation Type |

|---|---|---|---|

| Customer privacy | Branch A | 2023-05-15 | Unauthorized data access |

| Financial reporting | Branch B | 2023-06-28 | Reporting inaccuracies |

Branch A – Customer privacy violation (Unauthorized data access):

-

Violation date: May 15, 2023

-

Violation description: Unauthorized data access refers to the unauthorized viewing or retrieval of customer data, compromising customer privacy and data security.

Branch B – Financial reporting violation (Reporting inaccuracies):

- Violation date: June 28, 2023

-

Violation description: Reporting inaccuracies indicate errors or discrepancies in financial reporting, potentially impacting financial transparency and compliance with regulatory reporting requirements.

- Corrective Actions Taken

Corrective actions were promptly implemented to address the identified compliance violations.

Branch A – Customer privacy violation:

-

An investigation was conducted, and the employee responsible was terminated.

-

Fortified access controls and data encryption protocols.

Branch B – Financial reporting violation:

-

Thorough review and revision of financial reporting procedures.

-

Additional staff training to enhance accuracy in financial reporting.

Conclusion

This report provides a complete overview of FinTrust Capital’s compliance status for Q2 2023. It highlights areas of strength and areas where improvements are required. Compliance violations are addressed, and corrective actions are taken to maintain a high standard of regulatory compliance and protect the reputation of the financial industry.