Generative AI for corporate accounting: Scope, integration strategies, use cases, challenges and future outlook

Listen to the article

Generative AI is reshaping corporate accounting, transitioning from manual processes to intelligent automation. Imagine a world where financial insights are not only accurate but also data-driven and actionable, empowering faster and more informed decision-making—this is the promise generative AI makes.

Why is this shift critical in accounting? Traditionally slowed by manual operations, the accounting field is now embracing cutting-edge technology. Generative AI goes beyond mere automation; it fundamentally redefines workflows. By reducing errors and speeding up decision-making, it enables professionals to handle vast datasets with matchless precision and efficiency.

The potential of this technology is broadly recognized. A FreshBooks survey highlighted significant anticipation for change: 52% of businesses see analytics as the most impacted by AI, with accounting and finance not far behind at 42%. According to the same report, 25% of companies are currently using or testing generative AI tools such as ChatGPT and Microsoft Bing and two-thirds of these business owners plan to explore generative AI for work purposes within the next year.

Gartner finding suggests that 66% of finance leaderssee the most immediate benefits of generative AI in enhancing the clarity and accuracy of explanations for forecast and budget variances, underscoring its transformative potential in corporate accounting.

What does this widespread usage suggest about the future of corporate accounting practices?

Generative AI’s impact in accounting transcends simple task automation; it introduces a new paradigm of efficiency and strategic insight. Firms implementing AI-driven workflows are not just adapting—they’re setting new standards in the industry. This evolution promises enhanced operational efficiency and a competitive edge in strategic financial management.

How can your business harness the transformative power of generative AI for corporate accounting? Join us as we explore its pivotal roles, integration approaches, ROI metrics, challenges, and future trends in corporate accounting. Discover how embracing AI technologies represents an upgrade and a strategic revolution—positioning accounting firms for success in an increasingly data-driven world.

- Generative AI in corporate accounting: An overview

- Current landscape of generative AI in corporate accounting

- Different approaches to integrating generative AI into corporate accounting

- Generative AI use cases for corporate accounting

- Measuring the ROI of generative AI in corporate accounting

- Key challenges and factors to consider when adopting generative AI in corporate accounting

- Generative AI in corporate accounting: Future outlook

- Transforming corporate accounting with ZBrain: A full-stack agentic AI orchestration platform

Generative AI in corporate accounting: An overview

Generative AI is an advanced form of AI that creates new content based on user inputs by recognizing patterns in large datasets. It generates text, images, and more using deep learning techniques, offering a higher level of creativity and complexity than traditional machine learning. This can range from drafting complex documents to building sophisticated predictive models. But why is generative AI particularly transformative for corporate accounting? Let’s explore.

Why is generative AI crucial in corporate accounting?

Corporate accounting manages a company’s financial records and transactions, ensuring accuracy and compliance with regulations. The adoption of generative AI (GenAI) in this field has significantly mitigated longstanding challenges by automating routine tasks, increasing data accuracy, and enabling deeper analytical insights for strategic decision-making.

In corporate accounting, GenAI can be leveraged for diverse applications, including automating financial report drafting, generating personalized client communications, and creating custom financial insights. Tools like OpenAI’s ChatGPT and Google’s Gemini are leading examples, offering advanced capabilities that are transforming how accounting professionals approach data-driven tasks and client interactions.

Integrating generative AI into corporate accounting fundamentally reshapes workflow processes, driving efficiency and precision while freeing professionals to focus on more strategic and advisory roles. Such a shift enhances operational capabilities and nurtures deeper client relationships through personalized and high-value services.

Here are a few broader areas where accounting firms leverage generative AI:

- Client communications: GenAI enhances the initial drafting and personalization of client communications, streamlining workflows while retaining a personal touch.

- Customer support: Generative AI-driven chatbots provide continuous, responsive client support, improving overall client engagement.

- AI-driven audit automation: Automates financial data processing and analysis during audits, increasing accuracy and providing deeper insights.

- Compliance and risk management: Helps identify and mitigate compliance and financial risks proactively.

- Research and planning: Generative AI tools enable continuous monitoring of tax laws and scenario planning, ensuring that advice remains current and strategically sound.

Generative AI is emerging as the ultimate solution to modernize the accounting practices. By automating high-volume tasks and synthesizing intricate data, GenAI not only alleviates the burden on resources but also boosts the accuracy and speed of operations.

Streamline your operational workflows with ZBrain AI agents designed to address enterprise challenges.

Current landscape of generative AI in corporate accounting

Generative AI is transforming corporate accounting with powerful tools that enhance data processing and decision-making capabilities. In financial reporting, AI models like GPT-4 are being used to automate the generation of complex financial documents, ensuring accuracy and compliance while significantly reducing manual labor. These systems can analyze vast datasets to identify trends and anomalies, offering insights that were previously unattainable without extensive human intervention.

In customer relations, generative AI is employed to personalize communication with stakeholders. It drafts tailored emails and reports, enhancing the clarity and relevance of financial communications. For internal audits, AI-driven systems streamline processes by automatically verifying transactions and balances, thus improving efficiency and reliability.

In compliance and risk management, generative AI helps identify potential compliance issues before they escalate, allowing firms to maintain higher standards of compliance proactively. GenAI enhances compliance and risk management in corporate accounting by automating policy checks and flagging non-compliant transactions in real time, reducing manual errors. It detects anomalies and patterns that may indicate potential fraud, ensuring adherence to regulatory standards. Additionally, GenAI provides insights into risk factors, enabling proactive management of financial risks. Similarly, in financial planning and analysis, GenAI tools are indispensable for scenario planning and financial analysis, enabling accountants to model various financial outcomes with high precision.

The current landscape of generative AI in corporate accounting showcases a range of applications from basic automation to sophisticated analytics, reflecting a shift towards more strategic, data-driven decision-making processes. This integration marks a significant evolution in how corporate accounting functions operate, setting new standards for efficiency and strategic insight.

These examples highlight just the beginning of generative AI’s impact on corporate accounting. In practice, the potential applications extend far beyond what we have discussed as new use cases are continuously discovered and implemented. This dynamic field is evolving rapidly, driving innovation and offering corporate accountants ever-expanding tools to enhance accuracy, efficiency, and strategic insight within their roles.

Market dynamics

The global generative AI market in accounting is expected to grow from USD 211 million in 2022 to approximately USD 9,098 million by 2032, reflecting a significant CAGR of 47.1%.

Driving factors of generative AI in corporate accounting

- Automation and efficiency: Generative AI significantly enhances operational efficiency in corporate accounting by automating routine tasks and shifting resources toward strategic activities.

- Financial statement generation: By analyzing extensive historical financial data, generative AI facilitates the swift and accurate generation of financial statements, streamlining reporting processes and supporting timely decision-making.

- Fraud detection: Generative AI strengthens financial security within accounting by identifying transactional anomalies, effectively helping to prevent fraud and enhance the integrity of financial management.

Currently, finance teams are exploring how generative AI can augment existing processes by enhancing text generation and conducting preliminary data analysis. As these tools evolve, they are set to transform core accounting practices, streamline business partnering, and enhance risk management protocols. In fact, generative AI is expected to work alongside traditional AI forecasting tools to create comprehensive financial reports and analyses, thus elevating the strategic capabilities of finance functions.

As generative AI technology matures, it is expected to become a staple in financial reporting and analysis, significantly enhancing the efficiency and accuracy of these key accounting functions.

Different approaches to integrating generative AI into corporate accounting

When integrating generative AI into corporate accounting functions, decision-makers can opt for one of three main strategies:

- Developing a custom, in-house AI stack

- Using GenAI point solutions

- Adopting a fully-integrated platform that serves the entire organization

Each approach offers unique benefits. Let’s explore.

1. Developing a custom in-house AI stack

This method involves creating a tailored AI solution from scratch or adapting existing foundation models to meet specific organizational needs.

Advantages

- Enhanced customization: Tailors solutions to specific business requirements and workflows, improving operational efficiency.

- Enhanced security: Ensures tight control over data management and model training, crucial for compliance with financial regulations.

2. Using GenAI point solutions

This strategy involves standalone applications built on top of existing large language models, or AI features added to existing software designed to perform specific tasks.

Advantages

- Task optimization: Efficiently addresses specific operational challenges, ideal for targeted needs.

- User-friendly: Easier to deploy with less technical demand, promoting wider organizational adoption.

- Quick deployment: Allows for rapid configuration and operational use.

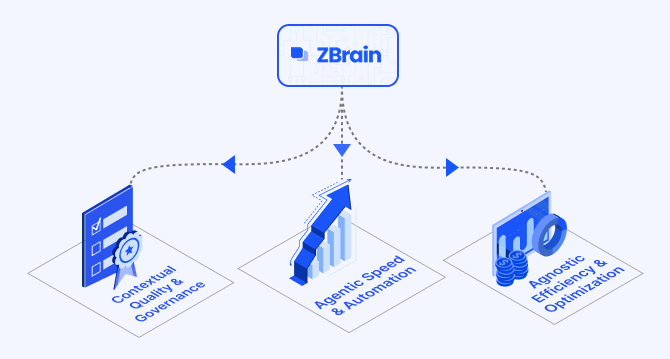

3. Adopting a full-stack platform like ZBrain

Choosing a comprehensive platform like ZBrain provides everything you need, from foundational models for integration to seamless deployment options—all in one place.

Advantages

- End-to-end solution: ZBrain provides a comprehensive suite of tools, allowing enterprises to handle every aspect of their AI projects, from data preparation to model integration, all within a single platform. This eliminates the need for multiple, disconnected tools, improving efficiency and reducing complexity.

- Faster AI implementation: With pre-built tools, advanced orchestration, and streamlined workflows, ZBrain accelerates the AI implementation process, enabling enterprises to deploy AI solutions more quickly.

- Customizability: Enterprises can tailor their solutions to meet their specific needs, ensuring they align with their unique business processes and goals. This flexibility enhances operational efficiency and optimizes AI performance.

- Scalability: ZBrain is built to handle the scale required by large enterprises, making it easy to scale solutions as business needs grow. This scalability allows businesses to evolve their AI strategy without investing in entirely new solutions.

- Security and compliance: ZBrain offers robust security and is designed to meet enterprise-grade compliance standards, ensuring that sensitive data is protected throughout the AI development lifecycle.

- Data integration and management: ZBrain simplifies the integration of proprietary data and data from external data sources. This is crucial for creating accurate, data-driven AI solutions for enterprises with complex data ecosystems.

- Optimized model performance: ZBrain enables the fine-tuning of GenAI models, ensuring that enterprises achieve the best possible performance from their applications with continuous optimization options.

- Reduced costs: ZBrain provides all the necessary tools in one platform, eliminating the need for multiple specialized resources and reducing overall AI development costs. This streamlines the process and cuts expenses associated with hiring diverse expertise.

Choosing the right generative AI solution for corporate accounting operations depends on specific needs, available resources, and strategic goals. Each option offers different levels of control, customization, and complexity, making it crucial to consider how to integrate generative AI in a way that aligns with your business objectives and compliance requirements.

Generative AI use cases for corporate accounting

In today’s fast-evolving business landscape, corporate accounting has grown in complexity, driven by globalization, increased regulations, and a rapidly expanding digital economy. Managing this intricate web of transactions, data, and reporting requirements poses challenges for accounting teams. This section comprehensively discusses the use cases of generative AI in corporate accounting functions and how ZBrain practically implements them:

1. General ledger management

In corporate accounting, general ledger management forms the foundation of financial data and reporting. This task is crucial but traditionally labor-intensive, involving complex processes prone to errors. Generative AI significantly enhances this critical area by automating and improving the accuracy of the entire general ledger process, from entries to reconciliations and closing.

- Automated journal entry creation: Traditionally, journal entries have been a manual process prone to human error. GenAI can transform this by analyzing historical transaction patterns and automatically generating routine journal entries. This not only reduces manual data entry but also ensures higher accuracy in reflecting a company’s financial transactions.

- Reconciliation assistance: Reconciling financial accounts, such as comparing bank statements with the general ledger, is time-consuming. GenAI can automate this process by identifying discrepancies and flagging them for further review, ensuring that all accounts are balanced efficiently.

- Ledger close process: Month-end and year-end closing processes can be stressful for finance teams. GenAI can suggest closing entries, verify account balances, and automate many repetitive tasks in closing the ledger, allowing finance teams to focus on more strategic activities.

The table summarizes key generative AI applications, showcasing ZBrain’s role in enhancing each.

| Generative AI Use Cases | Description | How ZBrain Helps |

|---|---|---|

| Automated journal entry creation | Automates the generation of journal entries from historical transaction data, reducing errors. | ZBrain can automate routine journal entries, ensuring accuracy and efficiency in financial recording. |

| Reconciliation assistance | Streamlines the process of matching bank statements with the general ledger, identifying discrepancies. | ZBrain automates and speeds up the reconciliation process, ensuring all accounts are balanced efficiently. Its transaction matching agent enhances the reconciliation process within corporate accounting departments. |

| Ledger close process | Facilitates month-end and year-end closing by automating tasks like entry suggestions and balance verifications. | ZBrain accelerates closing tasks, allowing finance teams to focus on strategic decisions during critical periods. |

2. Accounts Payable (AP)

Accounts Payable (AP) is a critical component of financial management. It manages outgoing payments and ensures that all financial obligations to suppliers and vendors are met accurately and efficiently. The process can be cumbersome and error-prone when handled manually. GenAI transforms AP processes by automating tasks such as invoice processing, payment reconciliation, expense categorization, and fraud detection, significantly increasing efficiency and reducing the risk of errors.

- Invoice data extraction and processing: Handling hundreds or thousands of invoices manually can be daunting. OCR-powered generative AI tools can extract key data from scanned invoices, categorize them into appropriate accounts, and route them through approval workflows, streamlining the entire process and minimizing errors.

- Vendor payment reconciliation: Matching payments to vendors with corresponding purchase orders and receipts can be complex and error-prone. GenAI helps streamline this by automating data extraction, flagging any discrepancies, and helping avoid costly errors like overpayments or duplicate payments.

- Automated expense categorization: Generative AI can automatically categorize expenses according to specified rules by analyzing historical expense data. This reduces the administrative burden on finance teams and ensures consistency across accounting periods.

- Fraud detection and anomaly monitoring: Generative AI’s advanced capabilities allow it to identify suspicious patterns in vendor payments, such as duplicate invoices or unusually high amounts. By flagging these potential issues, generative AI can reduce fraud and protect company assets.

This table outlines key role of ZBrain in accounts payable:

| Generative AI Use Cases | Description | How ZBrain Helps |

|---|---|---|

| Invoice data extraction and processing | Automates data extraction from invoices, categorizing and routing them efficiently. | ZBrain streamlines invoice handling by automating data capture and processing, reducing errors and saving time. |

| Vendor payment reconciliation | Automates matching vendor payments to purchase orders and receipts, enhancing accuracy. | ZBrain automates reconciliation, flagging discrepancies to prevent overpayments and duplicate payments. Its payment dispute resolution agent resolves disputes between vendors and the company regarding invoice discrepancies or payment terms. |

| Automated expense categorization | Automates expense categorization, ensuring consistency and accuracy. | ZBrain reduces manual workload by automatically categorizing expenses, ensuring consistency. |

| Fraud detection and anomaly monitoring | Scans transaction data for patterns that may indicate fraud, enhancing financial security. | ZBrain enhances security by automatically detecting and alerting on suspicious payment activities. Its duplicate invoice detection agent compares key invoice details such as invoice numbers, vendor information, dates, and amounts to prevent fraudulent payments. |

3. Accounts Receivable (AR)

Accounts Receivable (AR) management is pivotal for maintaining a company’s cash flow and financial stability. It involves critical tasks such as billing, collections, and credit risk assessments, which can be labor-intensive and prone to errors when performed manually. GenAI transforms the AR landscape by automating these processes, enhancing the efficiency and accuracy of invoicing, payment tracking, and customer credit analysis, thus improving overall financial operations.

- Automated billing and invoicing: GenAI can generate invoices based on contract terms and automatically populate necessary financial data, ensuring that customers receive accurate and timely bills and reducing manual invoicing efforts.

- Collections and dunning process: By automating the collections process, GenAI can send personalized reminders to clients based on their payment history, reducing the time finance teams spend following up on overdue payments.

- Cash application: Matching remittances with the corresponding invoices is often labor-intensive. GenAI can automate the cash application process, ensuring real-time payments are accurately applied to customer accounts.

- Customer credit risk assessment: Generative AI can analyze historical payment data and external financial indicators to assess customer credit risk. This helps companies make informed decisions about extending credit and managing receivables more effectively.

Here is a breakdown of GenAI use cases and how ZBrain supports accounts receivable:

| Generative AI Use Cases | Description | How ZBrain Helps |

|---|---|---|

| Automated billing and invoicing | Generates invoices automatically based on contract terms, ensuring accuracy and timeliness. | ZBrain streamlines billing by auto-populating financial data on invoices, reducing manual efforts and errors. With a duplicate invoice detection agent it streamlines the accounts receivable process. |

| Collections and dunning process | Automates sending of personalized reminders for overdue payments based on client payment history. | ZBrain enhances collections efficiency, automating reminder dispatch and reducing time spent on follow-ups. Through ZBrain’s client payment tracking agent and late payment follow-up agent, collection and dunning processes can be streamlined. |

| Cash application | Automates matching payments to invoices, ensuring accurate account updates. | ZBrain’s cash application automation agent automates applying cash receipts to the appropriate customer accounts and invoices, ensuring accurate reconciliation. |

| Customer credit risk assessment | Analyzes payment histories and external data to assess credit risks effectively. | ZBrain aids in credit risk analysis and management and enables better credit decision-making. |

4. Financial reporting

Financial reporting is essential for corporate governance, offering insights into a company’s financial health. Traditionally, this process is meticulous and prone to errors. GenAI transforms financial reporting by automating financial statements, variance analysis, and narrative creation, significantly enhancing accuracy, timeliness, and detail in financial disclosures.

- Automated financial statement generation: GenAI can gather data from various ledgers and compile it into standardized financial reports, such as income statements, balance sheets, and cash flow management statements, saving time and reducing errors in financial reporting.

- Variance analysis reports: By comparing actual performance to budgeted expectations, GenAI can generate variance reports that identify patterns and anomalies, helping finance teams focus on areas that require attention.

- Narrative creation for reports: Creating explanatory notes and narratives for financial reports can be tedious. GenAI can assist teams by analyzing underlying data and generating clear narratives for key metrics and variances, though the creative interpretation and final adjustments are primarily managed by the teams.

The table below details ZBrain’s roles across various GenAI use cases in financial reporting:

| Generative AI Use Cases | Description | How ZBrain Helps |

|---|---|---|

| Automated financial statement generation | Gathers data from multiple ledgers to compile accurate financial reports quickly, reducing manual errors. | ZBrain automates the compilation of financial statements, ensuring efficient financial reporting. |

| Variance analysis reports | Compares actual financial performance to budgeted expectations, highlighting variances. | ZBrain’s variance analysis agent streamlines the financial planning process by automatically analyzing discrepancies between budgeted and actual spending. |

| Narrative creation for reports | Analyzes financial data to generate explanatory narratives for reports, simplifying the reporting process. | ZBrain supports the creation of narratives, making financial reports more comprehensible and informative. |

5. Regulatory compliance and auditing

Regulatory compliance and auditing are vital for ensuring that a company adheres to legal standards and financial regulations. Traditionally, these processes are complex and labor-intensive. GenAI streamlines compliance by automating audit trails, regulatory filings, internal controls, and tax reporting, greatly reducing the risk of errors and enhancing compliance efficiency.

- Automated audit trail generation: A key element of compliance, GenAI can automatically generate detailed audit trails for transactions, ensuring that they meet both internal and external auditing standards.

- Automated regulatory filings: From Security and Exchange Committee’s (SEC’s) filings to local government regulations, GenAI can help automate the preparation of regulatory reports by generating them according to specific guidelines and reducing the burden of regulatory compliance.

- Internal controls and compliance checks: By continuously monitoring financial transactions, GenAI can ensure adherence to internal controls and flag potential compliance risks, helping maintain the integrity and accuracy of financial reporting

- Generative AI for tax compliance automation: Automating tax compliance is another area where GenAI excels. It can calculate taxes based on financial data and ensure that reports are filed according to jurisdictional requirements, minimizing the risk of penalties.

The table illustrates how ZBrain enhances regulatory compliance and auditing:

| Generative AI Use Cases | Description | How ZBrain Helps |

|---|---|---|

| Automated audit trail generation | Automatically generates detailed audit trails for transactions, ensuring compliance with auditing standards. | ZBrain streamlines the creation of audit trails, enhancing compliance and audit readiness. Its audit preparation agent automates the gathering and preparation of financial documents and reports for internal or external audits. |

| Automated regulatory filings | Assists in preparing and filing regulatory reports according to specific guidelines. | ZBrain’s regulatory filing automation agent automates the generation of regulatory filings, simplifying compliance with regulations. |

| Internal controls and compliance checks | Monitors financial transactions to ensure adherence to internal controls and flags compliance risks. | ZBrain enhances oversight by continuously checking transactions against compliance requirements. |

| Tax compliance automation | Calculates and files taxes automatically as per jurisdictional tax laws. | ZBrain automates tax processes, reducing the risk of errors and penalties in tax reporting. |

6. Financial planning

Financial planning is essential for strategic management, allowing companies to plan for future financial scenarios. Generative AI simplifies these processes by providing predictive insights, automating budgeting, and enabling scenario analysis. This automation leads to more accurate planning, efficiency, and enhanced decision-making capabilities

- Budgeting automation: Budgeting can be labor-intensive and prone to inaccuracies. GenAI can automate this process by generating budget suggestions based on historical spending and revenue patterns, helping organizations manage their financial resources more efficiently.

- AI-powered cash flow management: Generative AI helps optimize cash liquidity planning by analyzing cash reserves and upcoming obligations, ensuring optimal cash flow management.

The table below summarizes GenAI use cases and corresponding ZBrain’s capabilities:

| Generative AI Use Cases | Description | How ZBrain Helps |

|---|---|---|

| Budgeting automation | Aids in the budgeting process, generating suggestions based on historical financial patterns. | ZBrain streamlines budgeting, reducing manual efforts and improving budget accuracy by learning from past data. |

| AI-powered cash flow management | Optimizes liquidity planning by analyzing past financial inflows and outflows. | ZBrain’s liquidity planning optimization agent automates liquidity planning by analyzing cash reserves and upcoming obligations, ensuring optimal cash flow management. |

7. Tax accounting

Tax accounting is crucial for meeting legal obligations and optimizing financial outcomes. Manually managing these tasks can be complex and error-prone. GenAI transforms tax accounting by automating tax calculations, filing preparations, and identifying tax credits and deductions, ensuring accuracy and compliance while reducing manual labor.

- Tax calculation automation: Manually calculating corporate taxes can be complex and time-consuming. GenAI can pull financial data, apply relevant tax rules, and aid in tax calculations across different jurisdictions, ensuring accuracy.

- Automated tax filing preparation: GenAI can prepare tax filing documents automatically, ensuring they adhere to the latest tax regulations and minimizing the administrative burden on finance teams.

- Tax credit and deduction identification: Generative AI can analyze company financials to identify potential tax credits and deductions, helping them reduce their tax liabilities.

- Transfer pricing documentation: GenAI can help companies automate the transfer pricing documentation process, ensuring compliance with international tax laws and reducing the risk of audits. Although in its initial stages, this application of GenAI promises significant improvements in managing complex tax compliance efficiently.

Let’s explore key GenAI use cases in tax accounting with corresponding capabilities offered by ZBrain:

| Generative AI Use Cases | Description | How ZBrain Helps |

|---|---|---|

| Tax calculation automation | Automates complex corporate tax calculations across jurisdictions, enhancing accuracy and compliance. | ZBrain processes financial data and accurately applies tax rules, reducing errors and saving time. |

| Automated tax filing preparation | Prepares tax filing documents automatically, adhering to current tax regulations. | ZBrain automates the generation of compliant tax documents, streamlining the filing process. |

| Tax credit and deduction identification | Analyzes financial records to identify potential tax credits and deductions, aiding companies in minimizing tax liabilities. | ZBrain’s withholding tax monitoring agent monitors withholding tax obligations, ensuring that all necessary deductions are made and reported accurately. |

| Transfer pricing documentation | Automates the documentation process for transfer pricing, ensuring compliance with international tax laws. | Ensures compliance with global tax regulations by automating the creation and maintenance of transfer pricing documents. |

8. Expense management

Expense management is fundamental for controlling corporate spending and ensuring policy compliance. GenAI transforms this area by automating the processing of employee expense reports, performing compliance checks, and analyzing expenses. This results in reduced administrative efforts, enhanced compliance with spending policies, and better budget management.

- Employee expense report automation: GenAI can automatically process employee expense reports by extracting data from receipts and matching it with corporate policies. This reduces administrative workload and ensures compliance with company policies.

- Expense policy compliance checks: GenAI automatically reviews submitted expenses to ensure alignment with company policies, flagging any discrepancies or potential issues for further review.

- Travel and expense analysis: GenAI streamlines travel and expense analysis in corporate accounting by automating expense categorization and policy compliance checks, reducing processing time and errors. It identifies out-of-policy claims and detects unusual spending patterns, helping to prevent fraud. Additionally, GenAI provides insights into spending trends, supporting cost optimization and budgeting.

Here’s a table detailing key GenAI use cases in expense management with corresponding capabilities offered by ZBrain:

| Generative AI Use Cases | Description | How ZBrain Helps |

|---|---|---|

| Employee expense report automation | Automates the processing of employee expense reports, extracting data from receipts and ensuring policy compliance. | ZBrain can offer deep insights into spending trends, empowering organizations to make informed budgeting decisions. |

| Expense policy compliance checks | Reviews submitted expenses against company policies, flagging discrepancies for review. | ZBrain automates the review of expense submissions, ensuring they adhere to set policies and flagging outliers. |

| Travel and expense analysis | Streamlining travel and expense analysis by automating expense categorization and policy compliance checks. | ZBrain streamlines travel and expense analysis by automating expense categorization and policy compliance checks. It identifies out-of-policy claims and detects unusual spending patterns, helping to prevent fraud. Its travel expense compliance agent automates the review of travel-related expenses, ensuring compliance with corporate travel policies and flagging any out-of-policy claims. |

Streamline your operational workflows with ZBrain AI agents designed to address enterprise challenges.

9. Fixed asset management

Fixed asset management involves tracking and managing company assets’ valuation, depreciation, and disposal. GenAI streamlines this complex process by automating depreciation calculations, asset tracking, and accounting for asset disposal. This automation ensures accuracy, compliance with accounting standards, and real-time valuation updates, simplifying asset management tasks.

- Automated depreciation calculations: Depreciation calculations can be complex and time-consuming. Generative AI can automate these calculations based on asset life and accounting rules, ensuring accuracy and compliance.

- Asset tracking and valuation: Generative AI can track the value of assets, helping finance teams reevaluate their worth based on changes in market value or the asset’s useful life.

- Disposal and retirement accounting: When assets are disposed of or retired, generative AI can automate the accounting entries, ensuring proper treatment of gains or losses and compliance with accounting standards.

Explore key GenAI use cases in fixed asset management with corresponding capabilities offered by ZBrain:

| Generative AI Use Cases | Description | How ZBrain Helps |

|---|---|---|

| Automated depreciation calculations | Automates complex depreciation calculations for assets based on their life and relevant accounting standards. | ZBrain simplifies asset management by automating depreciation calculations, ensuring compliance. |

| Asset tracking and valuation | Tracks and reevaluates the worth of assets as market value or their estimated useful life changes | ZBrain facilitates real-time asset tracking and valuation, providing up-to-date financial data. Its asset lifecycle management agent tracks company assets, ensuring proper depreciation schedules and providing alerts for asset maintenance or replacement. |

| Disposal and retirement accounting | Automates accounting entries for asset disposal or retirement, managing gains or losses and maintaining compliance. | ZBrain streamlines the disposal and retirement processes, automating entries and ensuring compliance. |

10. Intercompany accounting

Intercompany accounting is critical for businesses with multiple subsidiaries, involving complex transactions that must be accurately reconciled and reported. GenAI automates the management of these transactions and the calculation of transfer pricing, ensuring accuracy and compliance with international tax laws. This reduces the administrative burden and enhances financial reporting efficiency across subsidiaries.

- Intercompany transactions automation: Handling intercompany transactions across global subsidiaries can be challenging. GenAI can automate transaction reconciliation and ensure accurate recording across business units, streamlining the preparation for settlement.

- Transfer pricing adjustments: Generative AI can automate the calculation and adjustment of transfer pricing between subsidiaries, ensuring compliance with international tax regulations and reducing administrative burden.

Explore GenAI’s intercompany accounting use cases with corresponding capabilities offered by ZBrain:

| Generative AI Use Cases | Description | How ZBrain Helps |

|---|---|---|

| Intercompany transactions automation | Automates reconciliation of transactions across subsidiaries, ensuring accurate recording and preparation. | ZBrain streamlines intercompany transactions, automating reconciliation and accuracy across units. |

| Transfer pricing adjustments | Automates the calculations and adjustments of transfer pricing between subsidiaries, complying with international tax laws. | ZBrain reduces administrative efforts by automating transfer pricing adjustments, ensuring compliance and efficiency. |

11. Payroll accounting

Payroll accounting ensures accurate and timely employee payments and tax reporting. Generative AI-driven payroll management automates payroll data reconciliation and tax calculations, minimizing errors and ensuring compliance across various jurisdictions. This enhances efficiency and reduces the risk of financial penalties associated with payroll errors.

- Payroll data reconciliation: GenAI can automatically reconcile payroll data with general ledger records, ensuring payroll entries are accurate and taxes are properly calculated.

- Automated payroll tax calculations: Payroll taxes vary by region, and GenAI can ensure that payroll taxes are calculated accurately for employees across different jurisdictions, minimizing errors and compliance risks.

Check GenAI use cases in payroll accounting and corresponding agents offered by ZBrain:

| Generative AI Use Cases | Description | How ZBrain Helps |

|---|---|---|

| Payroll data reconciliation | Automates reconciliation of payroll data with general ledger records to ensure accuracy and proper tax calculations. | ZBrain’s payroll processing efficiency agent optimizes payroll processing workflows, ensuring timely payments and flagging any discrepancies in tax withholdings or benefits. |

| Automated payroll tax calculations | Ensures accurate payroll tax calculations across various regions to minimize errors and ensure compliance. | ZBrain automates complex payroll tax calculations, reducing errors and ensuring compliance across jurisdictions. |

12. Cost accounting

Cost accounting is fundamental for effective financial management, requiring accurate cost allocation and monitoring. GenAI automates cost allocation and variance analysis, providing real-time insights into financial performance and potential inefficiencies. This supports strategic decision-making by allowing finance teams to focus on cost control and optimization strategies.

- Automated cost allocation: GenAI can automate the allocation of overhead costs to various departments, products, or services based on predefined rules, improving the accuracy of cost accounting.

- Standard cost variance analysis: By analyzing variances between standard and actual costs, GenAI can help identify inefficiencies in production and provide insights for cost-saving opportunities.

- Cost center reporting: GenAI can automatically generate cost center reports comparing planned versus actual expenditures, allowing finance teams to monitor costs more effectively.

This table summarizes key GenAI use cases in cost accounting and corresponding AI agents offered by ZBrain:

| Generative AI Use Cases | Description | How ZBrain Helps |

|---|---|---|

| Automated cost allocation | Automates the distribution of overhead costs to different departments, products, or services enhancing accuracy. | ZBrain streamlines cost allocation processes, ensuring precision and reducing manual workload. |

| Standard cost variance analysis | Analyzes discrepancies between standard and actual costs to pinpoint inefficiencies and suggest potential savings. | ZBrain facilitates deep analysis of cost variances, providing actionable insights for cost management. |

| Cost center reporting | Generates detailed reports comparing budgeted expenses against actual expenditures, enhancing financial oversight. | ZBrain automates cost center reporting, enabling finance teams to track and manage costs efficiently. |

13. Banking and cash management

Banking and cash management are crucial for maintaining liquidity and ensuring timely financial transactions. GenAI enhances this area by automating bank reconciliations, and payment runs. This automation streamlines processes, reduces errors, and ensures optimal liquidity management and timely financial transactions.

- Bank reconciliation automation: GenAI can automate reconciling bank statements with the general ledger, identifying discrepancies and ensuring that bank records match accounting entries.

- Automated payment runs: GenAI can automate the scheduling of vendor and employee payments, manage invoice matching and approval processes, ensure compliance with regulations, and generate timely notifications and reports. This reduces the time finance teams spend managing payment runs and ensures that payments are executed accurately and on time.

Key GenAI use cases in banking and cash management and corresponding ZBrain’s capabilities:

| Generative AI Use Cases | Description | How ZBrain Helps |

|---|---|---|

| Bank reconciliation automation | Automates the reconciliation of bank statements with the general ledger, identifying discrepancies to ensure accuracy in records. | ZBrain streamlines the reconciliation process, reducing errors and saving time by automating comparisons and adjustments. |

| Automated payment runs | Automates the scheduling and execution of payments, ensuring invoices are matched and approved in compliance with financial regulations. | ZBrain automates payment processes, ensuring timely and accurate transactions while reducing manual oversight. Its payroll audit compliance agent automates the audit of payroll records, ensuring compliance and flagging discrepancies. |

14. Financial data quality and integrity

Maintaining the quality and integrity of financial data is essential for accurate reporting and decision-making. GenAI improves financial data management by automating data cleansing, error detection, and consistency checks across systems. This ensures that financial data is accurate, reliable, and consistent, enhancing the overall quality of financial reporting.

- Data cleansing and validation: GenAI can automatically cleanse and validate financial data before it’s recorded in the general ledger, reducing errors and ensuring data integrity.

- Error detection in financial entries: Generative AI ensures that financial records remain accurate and reliable by identifying potential errors, such as duplicate or inconsistent data.

- Data consistency checks across systems: GenAI ensures that financial data is consistent across multiple systems, such as ERP and CRM platforms, reducing discrepancies and improving data integrity.

This table summarizes key GenAI use cases in financial data quality and integrity and ZBrain’s capabilities in implementing them:

| Generative AI Use Cases | Description | How ZBrain Helps |

|---|---|---|

| Data cleansing and validation | Automates the cleansing and validation of financial data before recording, enhancing accuracy and data integrity. | ZBrain’s automated systems cleanse and validate data in real-time, ensuring that only accurate data is recorded. |

| Error detection in financial entries | Identifies and corrects errors in financial records, such as duplicates or inconsistencies, to maintain reliable data. | ZBrain can proactively detect and correct errors, maintaining the accuracy of financial records. |

| Data consistency checks across systems | Ensures that financial data remains consistent across various systems, like ERP and CRM, to reduce discrepancies. | ZBrain synchronizes data across platforms, ensuring consistency and reliability in financial reporting. |

15. External reporting and investor relations support

External reporting and investor relations are key to maintaining trust and transparency with stakeholders. GenAI automates the preparation of earnings reports and SEC filings, ensuring they are accurate and comply with regulatory requirements. This reduces the manual workload and enhances the speed and accuracy of public disclosures.

- Earnings report automation: GenAI can automate the preparation of earnings reports by compiling relevant financial data and drafting initial narratives, making the process faster and more accurate.

- SEC filing assistance: For companies that need to file reports with the Securities and Exchange Commission, such as 10-Ks (annual report) and 10-Qs (quarterly report), GenAI can help prepare these filings in accordance with regulatory requirements, ensuring compliance and reducing the workload for finance teams. While understanding complex SEC regulations is an evolving capability, significant scope exists for improvement.

Here is a detailed table summarising key GenAI use cases in external reporting and investor relations support and ZBrain’s capabilities:

| Generative AI Use Cases | Description | How ZBrain Helps |

|---|---|---|

| Earnings report automation | Automates the preparation of earnings reports. | ZBrain streamlines the drafting and data compilation process, significantly speeding up report generation. |

| SEC filing assistance | Assists with the preparation of SEC filings like 10-Ks and 10-Qs, ensuring they meet all regulatory requirements for compliance. | ZBrain ensures accurate, compliant filings, reducing manual effort and compliance risk for finance teams. |

16. Transactional accounting automation

Transactional accounting involves the immediate processing of financial transactions. GenAI automates real-time transaction processing and data entry for minor transactions, ensuring that financial records are up-to-date and accurate. This automation enhances the efficiency of financial operations and allows finance teams to focus on more strategic activities.

- Real-time transaction processing: With GenAI, real-time transactions can be processed immediately, ensuring they are accurately recorded in the general ledger without human intervention.

- Automated data entry for minor transactions: Small, repetitive transactions can be logged and categorized by GenAI, freeing finance teams to focus on more strategic tasks.

Let’s explore the detailed GenAI use cases and ZBrain’s capabilities:

| Generative AI Use Cases | Description | How ZBrain Helps |

|---|---|---|

| Real-time transaction processing | Processes transactions in real-time, ensuring accurate entries in the general ledger without human intervention. | ZBrain automates the processing of transactions, enhancing the accuracy and efficiency of entries. Its transaction matching agent automatically matches transactions between the general ledger and bank statements. |

| Automated data entry for minor transactions | Automates the logging and categorization of small, repetitive transactions, freeing up time for strategic financial analysis. | ZBrain handles routine data entry tasks, allowing finance teams to focus on more complex and strategic activities. |

17. Consolidation and financial close process

The consolidation and financial close process is critical for accurate financial reporting across multiple business units or subsidiaries. GenAI automates data consolidation and close calendar management, ensuring timely and accurate financial reporting. This reduces the time and effort required for financial closes and minimizes the risk of errors or delays.

- Automated consolidation of financial data: GenAI can automate consolidating financial data from different business units or subsidiaries, ensuring accurate reporting and faster close processes.

- Close calendar management: GenAI can manage the close calendar, ensuring that all necessary tasks are completed on time for monthly, quarterly, and annual closes, reducing the risk of delays or missed deadlines.

Key GenAI use cases in consolidation and financial close process and corresponding ZBrain capabilities:

| Generative AI Use Cases | Description | How ZBrain Helps |

|---|---|---|

| Automated consolidation of financial data | Automates the consolidation of financial data from various business units or subsidiaries, ensuring accurate and timely reporting. | ZBrain streamlines data consolidation across multiple platforms, ensuring accuracy and reducing close times. |

| Close calendar management | Manages and schedules all necessary tasks for monthly, quarterly, and annual financial closes, ensuring timely completion. | ZBrain automates the scheduling and tracking of closing tasks, minimizing delays and ensuring adherence to deadlines. |

Although human oversight remains critical in navigating these intricate processes, GenAI significantly enhances efficiency and accuracy across various corporate accounting tasks. Its ongoing development promises to bolster these capabilities further, offering substantial value in streamlining complex financial operations.

Why is ZBrain essential for modern corporate accounting?

In the dynamic world of corporate accounting, where precision and efficiency are critical, ZBrain stands out as a highly valuable generative AI solution. It is transforming corporate accounting by embedding advanced generative AI capabilities into financial operations, streamlining processes, enhancing decision-making, and ensuring rigorous compliance.

The platform automates mundane tasks like data entry, invoice processing, and complex reconciliations, freeing up finance professionals to concentrate on strategic activities that add significant value. With its deep analytical capabilities, ZBrain not only accelerates data processing but also provides actionable insights for strategic planning, supporting informed decision-making across financial landscapes.

Robust security features are integral to ZBrain, safeguarding sensitive financial data and ensuring adherence to the strictest compliance standards. This makes it a reliable platform for building applications for corporate accounting, where data integrity and security are paramount. Moreover, ZBrain’s flexible API integration enables a seamless fit into existing technological ecosystems, enhancing productivity and ensuring that all financial operations are interconnected and efficiently managed.

Furthermore, ZBrain’s adaptability makes it suitable for businesses of all sizes, scaling as a company grows or as its needs become more complex. This scalability ensures that ZBrain is not only a solution for today but also a strategic investment for the future, capable of evolving with the rapid changes in the global financial environment. Thus, ZBrain is not just a platform but an essential partner for modern corporate accounting, driving efficiency, ensuring security, and enabling innovation in financial management.

Measuring the ROI of generative AI in corporate accounting

Calculating the Return on Investment (ROI) for generative AI in corporate accounting involves an analysis of both direct financial gains and indirect benefits, such as enhanced operational efficiency and decision-making capabilities. The ROI is assessed by weighing the cost reductions and productivity enhancements attributed to AI against the investments made in the technology. This measurement typically includes both quantitative assessments, like reductions in operational costs and increases in processing speed, and qualitative benefits, such as improvements in accuracy and stakeholder satisfaction.

ZBrain Integration: Key ROI metrics for the corporate accounting sector

Let’s delve into some examples from key application areas in corporate accounting:

- Transactional processing:

- Use case: Automation of invoice processing

- ROI metrics: Reduction in processing time, decrease in errors

- Example: By using ZBrain to automate invoice processing, firms can significantly reduce manual entry time and error rates. This streamline accounts payable tasks, resulting in faster cycle times and fewer corrections, enhancing the bottom line.

- Financial reporting:

- Use case: Automated generation of financial reports

- ROI metrics: Time savings, increased reporting accuracy

- Example: ZBrain can automate the aggregation and analysis of financial data to produce accurate reports swiftly. This capability reduces the hours finance teams spend on report generation and increases the reliability of financial statements used for strategic decision-making.

- Compliance and risk management:

- Use case: Enhanced compliance monitoring

- ROI metrics: Reduction in compliance violations, decrease in risk exposure

- Example: Using ZBrain to monitor and analyze real-time transactions helps firms ensure compliance with financial regulations and reduce risk exposure. This proactive approach can prevent costly penalties and enhance the firm’s reputation with regulators and stakeholders.

ZBrain integration offers measurable ROI metrics across key areas of corporate accounting, such as transactional processing, financial reporting, and compliance monitoring. By automating invoice processing, generating accurate financial reports, and enhancing compliance oversight, ZBrain enables firms to reduce processing time, minimize errors, increase reporting accuracy, and mitigate risk. These efficiencies not only streamline operations but also deliver significant financial and operational benefits, positioning firms for long-term success in a competitive landscape.

Key challenges and factors to consider when adopting generative AI in corporate accounting

Integrating generative AI into corporate accounting processes comes with its specific challenges and considerations. These hurdles must be carefully managed to leverage the capabilities of GenAI in this field. Here’s what companies need to consider:

- Data privacy and security: As generative AI systems process extensive amounts of financial data, maintaining the privacy and security of this information is paramount. Corporate accounting teams must ensure compliance with strict data protection laws and establish robust security measures to prevent data breaches.

- Integration with legacy systems: Many accounting departments operate on legacy systems that may not seamlessly integrate with cutting-edge AI technologies. Upgrading these systems or developing custom integration solutions can be costly and time-consuming, but it is essential for harnessing AI’s full potential.

- Bias and fairness: GenAI systems are only as unbiased as the data they are trained on. In accounting, data biases can lead to skewed financial reporting or unfair financial practices. Monitoring and adjusting GenAI models continuously is crucialIt’s to ensure fairness and accuracy in all accounting tasks.

- Regulatory compliance: The accounting sector is heavily regulated, and AI implementations must comply with financial reporting standards and regulations. Adapting AI solutions to keep pace with regulatory changes is a significant challenge that requires ongoing attention.

- Skill gaps and training: There is often a significant skill gap within accounting teams regarding AI technologies. Investing in training for existing staff and potentially hiring new talent with GenAI expertise is vital for successful generative AI integration.

- Explainability and transparency: Financial statements and reports must be transparent and explainable to meet audit and compliance requirements. This poses a challenge with GenAI models, which are often complex and not inherently transparent. Developing GenAI solutions that provide clear, interpretable outputs is essential.

- Cost implications: The initial setup and integration of AI in corporate accounting can be expensive, involving costs related to technology procurement, system modifications, personnel training, and ongoing maintenance.

- Managing stakeholder expectations: Stakeholders may have concerns about AI managing financial data and making autonomous decisions. Transparent communication about the benefits, limitations, and measures put in place to ensure accuracy and compliance is essential to manage these expectations effectively.

ZBrain simplifies the integration of generative AI into corporate accounting by providing robust data security, seamless compatibility with existing systems, and enhanced transparency for compliance. The platform facilitates continuous learning and sophisticated data management, allowing firms to optimize workflows while ensuring ethical and regulatory adherence.

Adopting generative AI in corporate accounting offers transformative potential but requires a thoughtful approach to overcome inherent challenges. By addressing these key considerations—from technical and operational to ethical and regulatory—corporate accounting can adapt to AI technology and thrive with it, achieving greater accuracy, efficiency, and strategic insight.

Streamline your operational workflows with ZBrain AI agents designed to address enterprise challenges.

Generative AI in corporate accounting: Future outlook

The corporate accounting functions of global companies are engaging in discussions about the transformative potential of various generative AI tools. CFOs and accounting leaders now recognize the importance of understanding how these tools will reshape the function of the future. These points detail the evolving role of generative AI in corporate accounting, tracing its current journey from enhancing basic operational tasks to enabling transformative capabilities for the future.

- Initial adoption: Currently, teams are utilizing generative AI to augment existing processes by generating text and conducting basic research. This includes automating repetitive tasks such as drafting financial statements, producing narrative reports, and performing initial data analysis, setting the stage for broader applications within the finance sector.

- Transformative integration: Looking ahead, generative AI is expected to modernize core accounting processes, redefine business partnering, and enhance risk management. It will augment traditional financial forecasting tools by generating intelligent reports, providing detailed variance explanations, and suggesting strategic recommendations. This will empower accounting teams to shift from reactive to proactive decision-making, using AI-generated insights to inform long-term strategies. GenAI will likely work in tandem with traditional AI tools to produce financial reports, analyze variances, and provide strategic recommendations, enhancing the finance function’s ability to deliver actionable insights.

- Empowering decision-making: This evolution will enable finance professionals to make more informed strategic decisions, thus improving operational efficiency and effectiveness. As generative AI becomes more advanced, its ability to produce real-time, nuanced insights will allow professionals to optimize cash flow management, identify emerging financial risks, and fine-tune business strategies.

Key generative AI future trends in corporate accounting include:

- Improved collaboration across functions: Generative AI will enable more seamless collaboration between finance and other departments. From automated report generation to detailed variance analysis, generative AI will help departments share insights quickly, improving overall business alignment.

- Advanced knowledge management: Generative AI will support the centralization of accounting data and knowledge management, improving the accuracy and accessibility of information across the organization.

- Enhancing business partnering: Generative AI will enable teams to offer more valuable insights during cross-department collaborations, such as budgeting, forecasting, and variance analysis, improving overall alignment between finance and other business functions.

- Predictive analytics and financial modeling: Generative AI will enhance predictive financial modeling for corporate accounting teams. It will offer deep insights into financial performance, helping organizations forecast revenue, expenses, and cash flow more accurately. This extends beyond traditional accounting practices, allowing businesses to anticipate financial outcomes and plan for future scenarios, improving budgeting, risk management, and decision-making.

The future of generative AI in corporate accounting looks promising, with platforms like ZBrain leading the charge. This genAI shift promises to empower accounting professionals to make strategic decisions more effectively, increasing both operational efficiency and overall business impact. These advanced tools will enable continuous process improvement and deeper analytical engagement across all finance functions, ushering in an era of profoundly data-driven and insight-rich strategic financial management.

Transforming corporate accounting with ZBrain: A full-stack agentic AI orchestration platform

ZBrain, with its AI capabilities, helps organizations streamline corporate accounting by automating financial data processing, ensuring compliance, and enhancing decision-making accuracy. It provides a range of features designed to improve efficiency, reduce errors, and support regulatory adherence.

-

AI readiness assessment: ZBrain’s AI readiness assessment framework, ZBrain XPLR, evaluates an organization’s preparedness for AI adoption in corporate accounting. It provides actionable insights to identify areas for automation, ensuring a seamless AI-driven transformation.

-

Low-code development: ZBrain’s low-code platform, ZBrain Builder, enables accounting teams to create custom AI solutions for financial reconciliation, expense tracking, and tax compliance without requiring extensive technical expertise.

-

Proprietary data utilization: The platform allows organizations to leverage their proprietary financial data effectively, ensuring AI models align with specific accounting policies, financial reporting standards, and audit requirements.

-

Enterprise-ready: Designed for large-scale corporate accounting operations, ZBrain Builder offers security, scalability, and seamless integration with enterprise resource planning (ERP) and accounting systems to optimize financial workflows.

-

End-to-end support: ZBrain Builder manages the entire accounting lifecycle—from transaction processing to financial statement generation and compliance verification—ensuring efficiency, accuracy, and regulatory adherence.

-

Flexible data ingestion: ZBrain integrates financial data from multiple sources, including general ledgers, invoices, and tax records, to provide real-time insights that enhance financial reporting, budgeting, and audit preparation.

-

Intelligent agent creation: AI agents built on ZBrain Builder can automate key accounting tasks, such as invoice validation, fraud detection, and variance analysis, reducing manual effort and improving financial accuracy.

These capabilities position ZBrain as a powerful tool for organizations looking to optimize and automate their corporate accounting processes, ensuring compliance, accuracy, and operational efficiency.

Endnote

Generative AI in corporate accounting is transforming traditional practices with powerful automation and strategic innovation. By automating routine tasks and employing deep data analysis, GenAI not only enhances efficiency but also scales accuracy and decision-making capabilities. This technology allows accountants to shift from number-crunching to strategic advisors, unlocking insights that drive business success with precision.

As we look to the future, integrating generative AI into corporate accounting practices promises to redefine industry standards, offering matchless opportunities for growth and innovation. For businesses, adopting GenAI means not just keeping pace with technological advancements but leading the charge in a data-driven world, where strategic financial management becomes a key competitive advantage.

Discover how ZBrain can streamline your financial processes. Contact us today and take the first step towards enhanced accounting efficiency!

Listen to the article

Table of content

- Generative AI in corporate accounting: An overview

- Current landscape of generative AI in corporate accounting

- Different approaches to integrating generative AI into corporate accounting

- Generative AI use cases for corporate accounting

- Measuring the ROI of generative AI in corporate accounting

- Key challenges and factors to consider when adopting generative AI in corporate accounting

- Generative AI in corporate accounting: Future outlook

- Transforming corporate accounting with ZBrain: A full-stack agentic AI orchestration platform

Frequently Asked Questions

What is ZBrain, and how can it optimize corporate accounting with generative AI?

ZBrain is an end-to-end AI enablement platform that assists businesses in seamlessly integrating AI into their corporate accounting functions, enhancing financial reporting, compliance, and decision-making. From assessing AI readiness to deploying intelligent solutions, ZBrain empowers accounting teams to improve efficiency, ensure accuracy, and align financial strategies with business goals.

Here’s how ZBrain enhances corporate accounting:

-

AI readiness assessment with ZBrain XPLR: ZBrain XPLR provides a detailed AI readiness assessment, helping accounting teams evaluate their current processes and identify areas for AI-driven optimization. This ensures a strategic approach to AI adoption, improving financial analysis, risk management, and regulatory compliance.

-

Seamless data ingestion and integration: ZBrain Builder integrates with enterprise resource planning (ERP) systems, financial databases, and accounting software to unify financial data from multiple sources. This enables real-time financial analytics, assisting teams in making data-driven decisions on financial planning, variance analysis, and cash flow management.

-

Low-code development environment: ZBrain Builder’s intuitive, low-code interface allows accounting professionals to create and deploy gen AI-driven solutions with minimal technical expertise. This accelerates automation in key accounting processes, such as transaction processing, audit trails, and compliance monitoring.

-

Cloud and model flexibility: ZBrain Builder supports advanced AI models like GPT-4 and LLaMA and integrates with cloud platforms like AWS, Azure, and GCP. This flexibility allows accounting teams to deploy scalable AI solutions tailored to their organization’s unique needs.

-

Enhanced compliance and governance: ZBrain’s AI-driven analytics assist accounting teams in ensuring compliance with financial regulations, internal policies, and industry standards. By continuously monitoring financial data, ZBrain identifies potential risks related to reporting inaccuracies, fraud, and policy violations.

By combining powerful gen AI capabilities with seamless data integration, ZBrain enables organizations to optimize accounting strategies, improve financial accuracy, and create a more agile, future-ready accounting function.

How does ZBrain ensure the security and privacy of sensitive data in corporate accounting?

ZBrain focuses on data privacy and security, ensuring that sensitive accounting information—such as financial records, transaction details, and compliance data—is protected at all stages. Here’s how ZBrain safeguards accounting data throughout the financial management lifecycle:

Private cloud deployments: ZBrain agents can be deployed in a private cloud environment, ensuring that critical accounting data, including general ledger entries, financial statements, and audit trails, remains securely stored within the organization’s infrastructure.

Robust security features: ZBrain incorporates multiple layers of security to protect sensitive accounting data, including:

-

Access controls: Granular role-based access controls ensure only authorized accounting personnel can view or manage confidential financial data, such as revenue reports, expense accounts, and tax filings.

-

Anonymization and compliance monitoring: AI-driven compliance tools help accounting teams anonymize sensitive data where necessary and ensure alignment with financial regulations and data privacy laws.

Compliance and governance: ZBrain is built to meet global compliance standards ISO 27001:2022 and SOC 2 Type II, ensuring that financial data is managed with confidentiality, integrity, and accountability. It also supports adherence to accounting standards, tax regulations, and corporate governance policies.

By integrating these security and compliance measures, ZBrain enables accounting teams to leverage AI-driven financial management strategies while ensuring that sensitive data remains protected and regulatory requirements are met.

Can ZBrain AI agents be integrated with existing corporate accounting systems?

Yes, ZBrain AI agents are designed to integrate seamlessly with existing corporate accounting systems, including enterprise resource planning (ERP) platforms, financial reporting tools, and compliance management software. The platform supports various data formats and standards, ensuring smooth interoperability with both modern and legacy accounting technologies.

This integration enables organizations to:

-

Leverage existing infrastructure: Enhance current accounting processes without the need for a complete overhaul of existing systems.

-

Enrich data and workflows: Connect ZBrain AI agents with existing tools to automate financial data entry, reconciliation, reporting, and compliance monitoring.

-

Drive AI-driven insights: Utilize gen AI capabilities to analyze financial data, detect anomalies, and improve decision-making while maintaining compatibility with current technologies.

By enabling seamless integration, ZBrain ensures that accounting teams can modernize their financial operations without disrupting existing ecosystems, leading to improved efficiency, data-driven decision-making, and strategic agility.

What AI agents can be built on ZBrain for corporate accounting operations?

ZBrain enables organizations to build generative AI-powered agents that enhance decision-making, automate critical accounting processes, and optimize financial strategies. With ZBrain Builder, businesses can develop AI agents tailored to various accounting functions, ensuring seamless integration with existing financial systems and data sources.

Key AI agents that can be built on ZBrain:

-

Financial data processing agent: Automates data entry, reconciliations, and transaction categorization, reducing manual effort and errors.

-

Expense management agent: Streamlines expense reporting and approval workflows, ensuring policy compliance and timely reimbursements.

-

Fraud detection agent: Analyzes financial transactions to identify anomalies and potential fraudulent activities, enhancing security measures.

-

Financial analysis agent: Utilizes gen AI to examine historical financial data and identify patterns, assisting in budgeting and strategic planning.

-

Audit assistance agent: Automates the collection and analysis of audit evidence, facilitating more efficient and accurate auditing processes.

By leveraging ZBrain’s AI-driven automation and analytics, organizations can streamline accounting operations, enhance financial accuracy, and build more responsive, data-driven financial strategies.

How does ZBrain cater to diverse corporate accounting needs across business operations?

ZBrain’s flexibility enables organizations to build gen AI-driven solutions tailored to various corporate accounting needs, from financial data processing and compliance to reporting and analysis. With custom AI agents, accounting teams can automate transaction recording, ensure regulatory compliance, generate financial reports, and analyze financial data. By leveraging ZBrain’s intelligent automation and data-driven insights, businesses can create more strategic, agile, and efficient accounting operations, driving better decision-making and financial outcomes.

How can we measure the ROI of ZBrain in our corporate accounting operations?

Measuring the return on investment (ROI) of ZBrain in corporate accounting involves assessing key performance indicators (KPIs) related to automation, accuracy, efficiency, and strategic decision-making. Key metrics include:

-

Reduced manual effort: AI-driven automation in tasks such as transaction recording, reconciliation, and data entry leads to faster processing and fewer errors, minimizing the need for manual intervention.

-

Improved accuracy and compliance: By automating data processing and analysis, ZBrain helps ensure adherence to accounting standards and regulatory requirements, reducing the risk of non-compliance and associated penalties.

-

Enhanced decision-making: Data-driven insights into financial performance, cash flow management, and cost optimization enable more informed strategic decisions, contributing to better financial outcomes.

-

Operational efficiency: AI-powered automation streamlines accounting workflows, reduces processing times, and allows staff to focus on higher-value tasks, leading to increased productivity.

By tracking these KPIs, organizations can quantify ZBrain’s impact on streamlining accounting processes, enhancing financial strategy, and driving better business outcomes.

How can I get started with ZBrain for corporate accounting?

To leverage ZBrain for optimizing your corporate accounting processes, contact us at hello@zbrain.ai or fill out the inquiry form on our website. Our team will connect with you to discuss how ZBrain can integrate with your existing accounting systems, automate key processes, and enhance financial planning, compliance, and reporting strategies.

Insights

Why structured architecture design is the foundation of scalable enterprise systems

Structured architecture design guides enterprises from requirements to build-ready blueprints. Learn key principles, scalability gains, and TechBrain’s approach.

A guide to intranet search engine

Effective intranet search is a cornerstone of the modern digital workplace, enabling employees to find trusted information quickly and work with greater confidence.

Enterprise knowledge management guide

Enterprise knowledge management enables organizations to capture, organize, and activate knowledge across systems, teams, and workflows—ensuring the right information reaches the right people at the right time.

Company knowledge base: Why it matters and how it is evolving

A centralized company knowledge base is no longer a “nice-to-have” – it’s essential infrastructure. A knowledge base serves as a single source of truth: a unified repository where documentation, FAQs, manuals, project notes, institutional knowledge, and expert insights can reside and be easily accessed.

How agentic AI and intelligent ITSM are redefining IT operations management

Agentic AI marks the next major evolution in enterprise automation, moving beyond systems that merely respond to commands toward AI that can perceive, reason, act and improve autonomously.

What is an enterprise search engine? A guide to AI-powered information access

An enterprise search engine is a specialized software that enables users to securely search and retrieve information from across an organization’s internal data sources and systems.

A comprehensive guide to AgentOps: Scope, core practices, key challenges, trends, and ZBrain implementation

AgentOps (agent operations) is the emerging discipline that defines how organizations build, observe and manage the lifecycle of autonomous AI agents.

Adaptive RAG in ZBrain: Architecting intelligent, context-aware retrieval for agentic AI

Adaptive Retrieval-Augmented Generation refers to a class of techniques and systems that dynamically decide whether or not to retrieve external information for a given query.

How ZBrain breaks the trade-offs in the AI iron triangle

ZBrain’s architecture directly challenges the conventional AI trade-off model—the notion that enhancing one aspect inevitably compromises another.