Smarter Investing: AI-enhanced Portfolio Recommendations

Problem

Drawbacks of Manual Portfolio Recommendations

Portfolio management in the finance and banking industry is a crucial task that directly impacts investment success and client satisfaction. However, the process of creating optimal investment portfolios can be extremely complex, involving various financial instruments, risk assessments, and market data analysis. This complexity often results in a lengthy and error-prone portfolio recommendation process. ZBrain offers a solution to facilitate and improve portfolio recommendation strategies.

Solution

I. How ZBrain Flow Optimizes Portfolio Recommendations

Leveraging advanced analytics and machine learning capabilities, ZBrain transforms the traditional manual portfolio recommendation process. Below is a comparison of the time required for each step with and without ZBrain Flow:

| Steps | Without ZBrain Flow | Time Without ZBrain Flow | With ZBrain Flow |

|---|---|---|---|

| Data gathering and analysis | Manual | ~10 hours | Automated by ZBrain Flow |

| Risk assessment and asset allocation | Manual | ~8 hours | Automated by ZBrain Flow |

| Report generation | Manual | ~6 hours | Automated by ZBrain Flow |

| Report review | Manual | ~3 hours | Manual |

| Total | ~27 hours | ~5 hours |

II. Key Input Data

For ZBrain to perform effectively and produce accurate portfolio recommendations, it requires the following data:

| Information Source | Description | Recency |

|---|---|---|

| Market data providers (e.g., Bloomberg) | Real-time market data, stock prices, and economic indicators | Real-time |

| Client financial information | Information on client goals, risk tolerance, and financial resources | Current |

| Historical investment data | Data on past investments, returns, and risk profiles | Last 5 years |

| Macroeconomic indicators | Economic trends, interest rates, inflation rates, and GDP growth | Real-time |

| Sector-specific analysis | Analysis of specific sectors and industries | Last fiscal year |

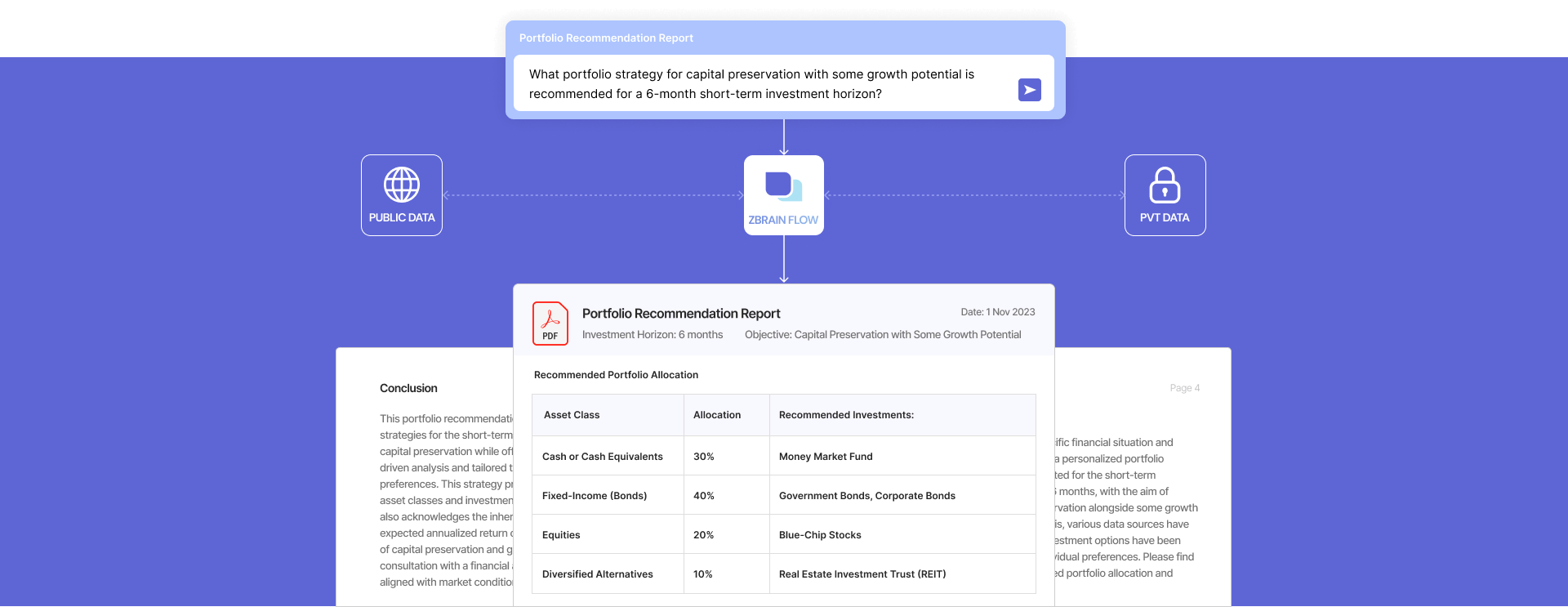

III. ZBrain Flow: How It Works?

Step 1: Data Gathering and Exploratory Data Analysis(EDA)

The first phase of ZBrain starts with data collection, extracting real-time market data, client financial details, historical investment data, macroeconomic indicators, and sector-specific analysis from diverse sources. After data gathering, ZBrain automatically initiates EDA to detect patterns, correlations, and market prospects, offering crucial insights into potential investment choices and prevailing market conditions.

Step 2: Embeddings Generation

In this stage, textual data is converted into numerical representations using embedding techniques, like word embeddings or sentence embeddings. These embeddings capture the semantic meaning and relationships between different data points, facilitating efficient retrieval and analysis. This allows ZBrain to deliver insights with exceptional accuracy, equipping the decision-making process with a wealth of information.

Step 3: Query Execution and Portfolio Analysis and Recommendation

Upon receiving a client’s request for portfolio recommendation, relevant data and the query are fed into the OpenAI Language Model (LLM) to assess the potential risks associated with individual investments. By leveraging historical data, the model computes risk metrics and volatility measures for this evaluation. ZBrain employs risk assessment and market analysis to identify the most suitable asset allocation for the client’s portfolio. In response to the user’s query, a comprehensive report is generated by LLM, presenting information about recommended assets, their risk profiles, expected returns, and the rationale supporting these recommendations.

Step 4: Parsing the Generated Report

Once the LLM generates the report, ZBrain utilizes a parsing method to enhance the report’s quality and extract helpful insights. The parsed data undergoes thorough structuring to ensure that the final portfolio recommendation report aligns precisely with the desired format, sections, and report guidelines.

Through the integration of data collection, analysis, risk assessment, asset allocation, and report generation, ZBrain provides a clear and well-informed portfolio recommendation. This process equips financial advisors with the information needed to make informed investment decisions that are in line with the client’s objectives and risk preferences.

Result

Efficient and Informed Portfolio Recommendations

With ZBrain’s automated, AI-powered process, portfolio recommendations are now more efficient and accurate. The traditional process, which took around 27 hours, has been streamlined to approximately 5 hours, resulting in substantial time and cost savings. Financial advisors can now provide clients with informed investment strategies, ultimately enhancing the success and satisfaction of the clients. Embrace the power of ZBrain to optimize the portfolio recommendation process and elevate your organization’s financial services.

Example Report

Prompt:

What portfolio strategy for capital preservation with some growth potential is recommended for a 6-month short-term investment horizon?

Executive Summary

In response to the specific financial situation and investment objectives, a personalized portfolio strategy has been created for the short-term investment horizon of 6 months, with the aim of achieving capital preservation alongside some growth potential. To achieve this, various data sources have been analyzed, and investment options have been selected based on individual preferences. Please find below the recommended portfolio allocation and investment options:

Recommended Portfolio Allocation

| Asset Class | Allocation |

|---|---|

| Cash or cash equivalents | 30% |

| Fixed-income (Bonds) | 40% |

| Equities (Stocks) | 20% |

| Diversified alternatives | 10% |

The Rationale for the Recommendation

-

Cash or Cash Equivalents (30%): A recommendation is made to allocate 30% of the portfolio to cash or cash equivalents, which provides liquidity and capital preservation. This allocation has been determined utilizing data from the current cash holdings and preferences.

-

Fixed Income (Bonds) (40%): The majority of the portfolio has been allocated to fixed-income securities. A mix of short-term government and corporate bonds has been recommended based on an analysis of risk tolerance, time horizon, and the current bond market conditions.

-

Equities (Stocks) (20%): A portion has been allocated to equities for potential growth, with a focus on carefully selected blue-chip stocks, taking into account the preference for stability and dividends. This recommendation is informed by an analysis of these companies’ historical performance.

-

Diversified Alternatives (10%): To expand the portfolio and add uncorrelated returns, diversified alternatives are recommended. The interest in real estate and data on alternative investments have been taken into account.

Recommended Investments

-

Cash or Cash Equivalents (30%)

Money Market Fund: Investment in SafetyNet Capital with an annual yield of 1.5% is recommended. This data-driven choice ensures liquidity and safety. -

Fixed-income (Bonds) (40%)

Government Bonds: Allocate 20% to StateGuard Assurance Bonds with a 6-month maturity, offering a yield of 2.5%.

Corporate Bonds: A 20% investment in EverGreen Holdings with a 6-month duration, offering a yield of 3.2%, is recommended. These bonds have been chosen based on the analysis of preferences for fixed income and market conditions. -

Equities (Stocks) (20%)

Blue-chip Stocks: Consider investing in Quantum Tech, Global Power, and Premier Health, known for their dividend history and stability. These recommendations have been arrived at through an analysis of their performance and consideration of the preference for dividends. -

Diversified Alternatives (10%)

Real Estate Investment Trust (REIT): Invest in LandMark REIT, providing exposure to a diversified portfolio of income-producing real estate assets. The analysis of this REIT’s performance, driven by data, aligns with diversification goals.

Risk Assessment

This portfolio strategy is prioritized by capital preservation, but it is recognized that all investments carry some level of risk. Based on the analysis of the client’s risk tolerance and investment choices, a relatively conservative risk profile is expected.

Performance Expectations

Considering the individual’s financial situation and the current market conditions, data analysis suggests an estimated annualized return of 3.0% to 4.5% for the portfolio. This considers both capital preservation and growth goals.

Monitoring and Review

To ensure the portfolio remains aligned with short-term goals and market conditions, regular reviews are recommended. Consultation with a financial advisor for updates and necessary adjustments is advised.

Conclusion

This portfolio recommendation report is generated to provide personalized strategies for the short-term investment horizon of 6 months and to achieve capital preservation while offering growth potential. It is backed by data-driven analysis and tailored to the individual’s financial situation and preferences. This strategy provides a well-rounded allocation across various asset classes and investment options. While prioritizing capital preservation, it also acknowledges the inherent risks associated with all investments. With an expected annualized return of 3.0% to 4.5%, the portfolio balances the goals of capital preservation and growth. Regular monitoring and reviews, in consultation with a financial advisor, will help ensure that the portfolio remains aligned with market conditions and short-term objectives.